Around the time of B2B International’s inception in the 1990s, a key challenge we faced was explaining to potential customers that our skills as business-to-business market researchers and marketers were unique. There was a frequent dismissal of the idea that B2B marketing – and therefore the techniques used to explore these markets – were in any meaningful way distinct from consumer marketing.

Over the past 30 years, however, B2B marketing has emerged as a discipline in its own right and divergences in marketing practice have been accentuated. We feel it is worth reiterating the many differences between the two disciplines and, above all, pointing out the implications of these differences when it comes to implementing a business-to-business marketing strategy.

Navigate this guide: What Is B2B Marketing? | 2022 B2B Marketing Trends | 10 Key Principles That Make B2B Marketing Unique

What Is B2B Marketing?

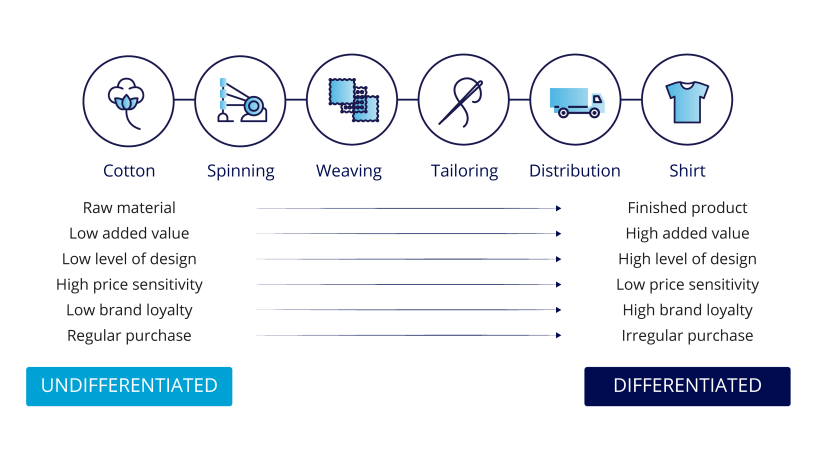

As always, we must be clear about our definitions. What are business-to-business markets and what is B2B marketing? To answer these questions it is useful to consider the value chain that starts with a consumer demand and from which dozens of business products or services are required. Take the example of the simple shirts that we buy. They do not arrive in the shops by accident. There is a value chain of enormous complexity that begins with cotton or some other fibre that must then be woven into cloth, which in turn is machined into a garment, packed and distributed through various levels until finally we pick it from the shelf. This is illustrated in the diagram below. We call this the chain of derived demand since everything to the left hand of the shirt is pulled through as a result of the demand for the product. Businesses sell cotton to merchants who sell it to spinners who sell it to weavers who sell it to garment makers and so on. None of the businesses buy the products for pure indulgence. They buy them with the ultimate aim of adding value in order that they can move the products down the chain until they finally reach us, the general public.

Figure 1 – The Chain Of Derived Demand

Business marketers meet the needs of other businesses, though ultimately the demand for the products made by these businesses is likely to be driven by consumers in their homes.

Businesses buy products with the aim of adding value in order to move the products down the chain until they finally reach the general public.

Businesses buy products with the aim of adding value in order to move the products down the chain until they finally reach the general public.

2022 B2B Marketing Trends

Top Strategic Focuses for Business-to-Business Marketers

-

Brand building / positioning and improving the customer experience are the top strategic focuses for B2B marketers in 2022.

Source: Connecting You With Today’s B2B Buyer.

The B2B Buyer Journey

-

Internal circumstances and change such as cost reduction, new requirements and organization growth are the primary triggers to look for a new supplier (48%), followed by external triggers such as increasing customer expectations and keeping up with competitors (21%), previous supplier issues (16%) and being made aware of new possibilities via supplier communications (16%).

-

The B2B buyer journey is split into three distinct stages: the initial research, rationalizing the list down to just a favored few, and gathering competitive quotes and making the final decision. Each stage of the journey takes 2.5 months on average, with enterprises and Millennial decision-makers taking even longer.

-

On average, B2B decision-makers are using 10 different sources of information across the journey, ranging from content from suppliers (supplier websites, in-depth reports / guides and short-form infographics / interactive tools), through to content in the public domain (online reviews, news articles, social media, general business communities) and industry-specific sources (industry analysts, industry-specific communities and industry publications)

-

Winning brands interact across a greater number of channels and also have more personal contact with B2B buyers than losing brands.

Source: Connecting You With Today’s B2B Buyer.

The Growing Importance of Social Media in B2B Marketing

-

85% of B2B decision-makers make use of at least one form of social media for work, with over 59% doing so at least once a week. This is much higher for Millennials, with over 94% using social media for work and over 75% doing so at least weekly.

-

Winning brands were 65% more likely to have communicated to the buyer via social media during the decision-making process than the losing brand.

Source: Connecting You With Today’s B2B Buyer.

The Growing Importance of Messaging Platforms in B2B Marketing

-

29% of B2B decision-makers now use messaging platforms such as WhatsApp and Facebook Messenger for work purposes at least once a week.

-

83% stated that they felt more valued when using messaging platforms and the experience was better than any other method of interaction.

Source: Connecting You With Today’s B2B Buyer.

The Role of Emotions in B2B Marketing

-

35% of businesses with 1,000+ employees state that making a final choice of B2B supplier is difficult.

-

A majority of low and mid-value purchases made by B2B buyers across all sizes of business are either “detractors” or “passive” in their likelihood to recommend a brand.

-

To stand out from the crowd and deliver the ultimate B2B experience, brands need to focus on honing 4 ‘Superpowers’:

- At company level: Reliability – “A brand we can trust to deliver”

- At company level: Understanding – “Gets my company’s needs”

- At buyer level: Enrichment – “Makes my work life better”

- At buyer level: Pre-eminence – “A brand people are proud to work with”

Source: Architecting The Ultimate B2B Customer Experience (Superpowers 1.0) / The New Shape Of B2B Customer Experiences (Superpowers 2.0).

10 Key Principles That Make B2B Marketing Unique

As expert business-to-business marketers, we believe that there are ten key factors that make B2B markets special and different to consumer markets. These are described below:

1. Brands Are Important But Sub-Brands Are Less Effective

We have frequently argued that the most neglected B2B marketing opportunity is the building of a strong brand. In a world where it is becoming increasingly difficult to distinguish one product from another, it is even more important to have the support of a powerful brand.

The role of brand in the B2B buying decision has increased significantly over the past decade. While it used to be said that its influence was 5% of the B2B buying decision against 30-40% of the consumer buying decision, our 2019 ‘State of B2B’ study found that having a strong emotional connection with a brand accounts for 56% of the final B2B purchase decision. More recently, a study into B2B decision-making by WSJ Intelligence and B2B International found that winning brands are more than 2x as likely to be well-known to decision-makers prior to the decision journey.

It must be said, however, that B2B companies are generally far worse at both developing and implementing branding strategies than are B2C companies. B2B companies tend to be bad at recognizing that branding strategy should envelop every customer touchpoint and aspect of the business – an unknowledgeable technical sales-team can undo the work of a branding communications campaign instantly.

Again, this view is supported by our own research into what B2B decision-makers think of the brands they use. While basic requirements such as trust and prestige are largely met, many B2B brands still fail to engage at a more emotional level.

One of our latest research studies, ‘The New Shape of Superpowered B2B Customer Experiences‘, found that 35% of businesses with 1,000+ employees state that making a final choice of B2B supplier is difficult, and a majority of low and mid-value purchases made by B2B buyers are either “detractors” or “passive” in their likelihood to recommend a brand. It is of no surprise, therefore, that brand building and positioning is the number one strategic focus for B2B marketers in 2022 as they strive to effectively differentiate their brand and stand out from the crowd.

In their rush to embrace branding strategy, many B2B companies have over-compensated and developed huge numbers of sub-brands for every aspect of their product range. This kind of approach can be effective in consumer markets, where diversified companies such as Unilever recognize the need to build relationships with segments and sub-segments of numerous target audiences. In business-to-business markets, however, target audiences are smaller and, most importantly, business-to-business buyers are generally more informed than consumers and tend to regard multiple brands and sub-brands as pointless and confusing, perhaps even insulting.

What does this mean for the business-to-business marketer?

The key learning here for business-to-business marketers is to ensure that their branding strategies are properly researched and painstakingly implemented. Brand research should encompass every customer touchpoint within the business, and beyond, acting as a framework through which the company’s values are transmitted. Above all, business-to-business marketers should recognize that ‘less is more’ when it comes to branding – far better to have one coherent brand which customers, stakeholders and employees alike can relate to, rather than a confusing raft of sub-brands, which hinder rather than promote meaningful choice and amount to little more than product identifiers.

2. B2B Markets Have A More Complex Decision-Making Unit

In most households, even the most complex of decisions is confined to the small family unit while items such as clothes and food usually involve just one person. The decision making unit (DMU) in business-to-business markets is highly complex or at least it has the potential to be so.

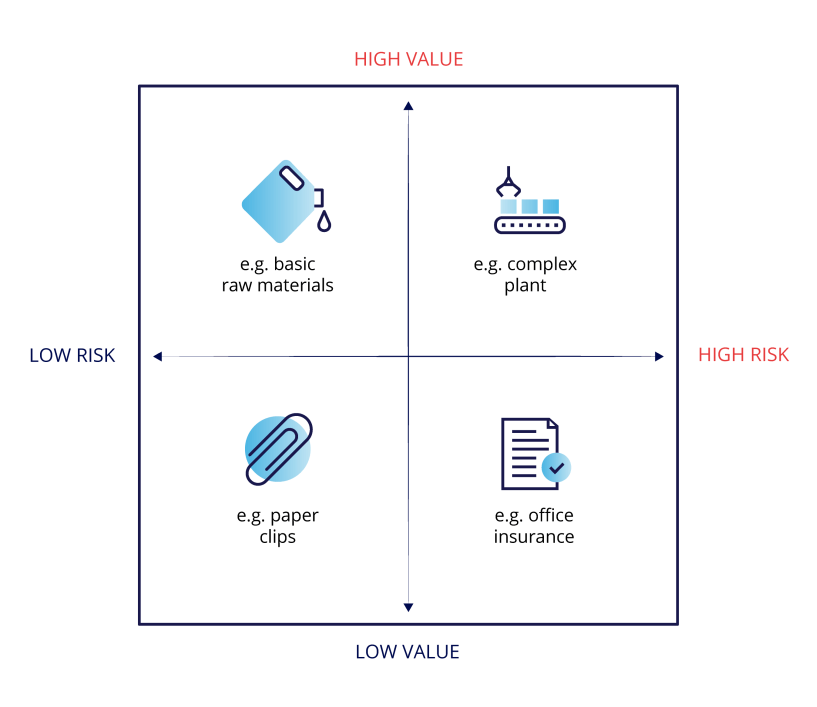

Ordering products of low value and low risk (such as the ubiquitous paper clip) may well be the responsibility of the office junior. However, the purchase of a new plant that is vital to a business may involve a large team who makes their decision over a protracted period. The DMU at any one time is often ephemeral – specialists enter and leave to make their different contributions and, of course, over time people leave the company or change jobs far more frequently than they change family unit.

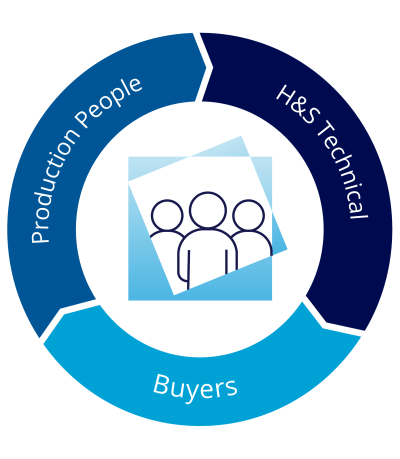

This complexity and dynamism have implications for business-to-business marketers and markets alike. The target audiences for B2B communications are amorphous, made up of groups of constantly changing individuals with different interests and motivations. Buyers seek a good financial deal. Production managers want high throughput. Health and safety executives want low risk. And those are just their simple, functional needs. Each person who is party to the DMU will also bring their psychological and cultural baggage to the decision and this can create interesting variations to the selection of products and suppliers.

Figure 2 – The Risk-Value Purchasing Decision Matrix In Business-to-business Marketing

Figure 2 above divides business-to-business purchases into four categories according to their financial value and the level of business risk associated with the purchase. Each of these categories gives rise to different purchasing behavior and different complexities.

- Low-risk, low-value purchases are the least distinct from consumer purchases. They often involve just one, frequently junior person. There is little financial or business risk involved on getting the decision wrong, meaning that relatively little thought goes into the decision.

- Low-risk, high-value items such as raw materials typically involve a mixture of technical and purchasing personnel, and often very senior people such as board members. This complexity is necessary to ensure that price is minimized without impacting upon quality. Purchasing personnel would usually be the key decision makers on a transaction-by-transaction basis, under the general guidance of more technical employees, who would review suppliers periodically.

- Low-value, high-risk items such as office insurance would similarly involve a mixture of specialists and purchasers. As the ‘risk’ is in the product rather than the price, and as each transaction is likely to be unique, an expert (in this case perhaps an in-house legal expert) would tend to be the key decision maker every time a purchase takes place.

- High-value, high-risk purchases are the most distinct from consumer purchases, with a large number of senior decision makers evaluating a large range of purchase criteria. In the case of plant equipment, we might expect a CFO, R&D Director, Production Director, Purchasing Director, Head of Legal Department, CEO and a number of upper-management department heads to be involved.

The complexities of B2B decision-making also means that the path-to-purchase is often long and consisting of numerous stages. Our latest report, ‘Connecting You With Today’s B2B Buyer‘, found that the B2B buyer journey is split into three distinct stages: the initial research, rationalizing the list down to just a favored few, and gathering competitive quotes and making the final decision. Each stage of the journey takes 2.5 months on average, with enterprises and Millennial decision-makers taking even longer.

Figure 3 – A Typical Decision Making Unit In A B2B Environment

What does this mean for the business-to-business marketer?

Faced with a multifaceted and knowledgeable buyer, it is critical that the B2B marketer demonstrates a high level of expertise in all of its interactions with the target audience. This refers not only to product knowledge, but also to the technical and other back-up that the buyer will receive throughout the life of the purchase.

Business-to-business marketers need to fully understand the different needs of decision makers – often within the same customer.

Business-to-business marketers need to fully understand the different needs of decision makers – often within the same customer.

The marketer must also show diligence and patience when negotiating the decision making unit and assuaging the fears of finance, production, technical and other decision-makers.

3. B2B Buyers Have Different Rational and Emotional Needs

Business-to-business marketers describing B2B buyers as more ‘rational’ than their consumer counterparts is perhaps controversial, but still rings true in part. We may not leave our emotions at home when we go to work, but most of us attach them to a tight leash and try to keep them away from our colleagues.

Would the consumer who pays $3,000 for a leather jacket that is less warm and durable than its $200 counterpart in the shop next door make a similar decision in the workplace? What about the person who spends $1,000 for a season ticket at a football club that has just been relegated and frustrates them every Saturday, or $6.50 on a packet of cigarettes that excludes them from indoor public places and puts them at risk of serious disease – would the same person choose to buy, for example, a computer that consistently infuriated them or an asbestos roof that risked their own health and that of their colleagues?

The truth is that as consumers we are often less well-informed, less accountable to others and far more susceptible to whims, indulgences, recklessness and showing off than is the case when we are in the workplace. We therefore have a tendency to make purchasing decisions that a rational observer (a business-to-business buyer that has to make a profit each month) would regard as ludicrous. As consumers we are far less likely to ask whether the product we are buying has an ROI (return on investment). We buy what we want, not what we need.

What does this mean for the business-to-business marketer?

To some extent the fact that business-to-business buyers are relatively rational makes our job as B2B marketers easier – all we need to do is design and manufacture good products, and deliver them on time and at a good price.

Not quite. It would be disingenuous to claim that business-to-business buyers are entirely rational. Due to the accountability that constrains most B2B buyers, trust in the supplier’s credibility and confidence in the supplier’s ability to deliver are key issues. No B2B buyer wants to risk his or her livelihood or reputation buying an unreliable product and service. This makes emotional issues such as trust and confidence absolutely critical. This in turn places great emphasis on brand, reputation, case studies and other factors which convey reliability and consistency over the life of the product or service being purchased.

Furthermore, our 2019 ‘State of B2B: Winning With Emotion‘ research into B2B decision-making revealed that emotions such as optimism about what the supplier could do for the buyer’s organization and pride in the prospect of partnering with the supplier also play a major role in the decision-making process.

More recently, our ‘Architecting the Ultimate B2B Customer Experience‘ research identified four B2B brand ‘Superpowers’ that together drive superior B2B customer experiences. Of the four ‘Superpowers’, two add meaningful value at the company level and, importantly, two add meaningful value at the individual level.

The ‘Superpowers’ which add value at the company level:

- Reliability – “A brand we can trust to deliver”

- Understanding – “Gets my company’s needs”

The ‘Superpowers’ which add value at the individual buyer level:

- Enrichment – “Makes my work life better”

- Pre-eminence – “A brand people are proud to work with”

4. Personal Relationships Are More Important In B2B Markets

An important distinguishing feature of business-to-business markets is the importance of the personal relationship. A small customer base that buys regularly from the business-to-business supplier is relatively easy to talk to. Sales and technical representatives visit the customers. People are on first-name terms. Personal relationships and trust develop. It is not unusual for a business-to-business supplier to have customers that have been loyal and committed for many years.

The importance of personal relationships is particularly pronounced in emerging markets such as China and Russia, which have little culture of free information, historic quality problems with local suppliers, and – in markets where the concept of branding is still emerging – little other than their trust in the salesperson on which they can judge the provenance of the product or service they are buying.

The importance of the personal touch in B2B decision-making is again highlighted in our latest research – ‘Connecting You With Today’s B2B Buyer‘. For B2B buyers in the Baby Boomer and Gen X categories, personalized engagements with sales and account reps is the number 1 preferred communication channel. Even among the new generation of Millennial decision-makers, personalized engagements made the top 3 preferred channels when communicating with a brand.

It’s also important to note that advances in technology means that the concept of personalized engagements in 2022 and beyond extends beyond face-to-face interactions and phone calls. Messaging platforms such as WhatsApp and Facebook Messenger are regularly used for work purposes, with 29% of B2B decision-makers in our study saying they use it at least once a week. 54% of business decision-makers report using WhatsApp for work while Facebook Messenger is close behind at 46% usage. Furthermore, 83% of business buyers stated that they felt more valued when using messaging platforms and the experience was better than any other method of interaction.

What does this mean for the business-to-business marketer?

For the business-to-business marketer, the consequences of this emphasis on relationships for marketing budgets are a relatively high expenditure on people (sales and technical support) and a more modest expenditure on other forms of promotion. Advertising budgets for business marketers are usually measured in thousands of pounds (or Euros or dollars) and not millions.

The B2B salesperson is also a different animal to the consumer salesperson, in that the focus is on listening and cultivating a limited number of relationships rather than the more quantity-driven and transactional approach seen in consumer markets. As already mentioned, this salesperson must have an in-depth technical understanding of whatever he or she is selling.

In a pre-Covid world, face-to-face rep visits and trade shows ruled supreme in B2B markets. In today’s post-Covid, digital-first world, B2B brands must ensure that they have a seamless digital journey that gives all the information the market is looking for, in both short and long form, and makes it easy for the buyer to get in touch with the company when they do have a question.

5. B2B Products Are Often More Complex

Just as the decision making unit is often complex in business-to-business markets, so too are B2B products themselves.

Where the purchase of a consumer product requires little expertise (perhaps nothing more than a whim), the purchase of an industrial product frequently requires a qualified expert. Where consumer products are largely standardized, industrial products are often bespoke and require high levels of fine-tuning. Even relatively complex consumer products tend to be chosen on fairly simple criteria. A car might be chosen because it goes fast and looks nice, and a stereo might be purchased on the grounds that it is tremendously loud.

Even simpler industrial products, on the other hand, frequently have to be integrated into wider systems and as a result have very specific requirements and need intimate, expert examination and modification. It is difficult to imagine a turbine manufacturer or commercial website design buyer having a look at three or four products and then choosing one simply because it looks nice. The choice of turbine will involve a whole host of technical, productivity and safety issues, whilst the choice of website might be based on its integration into a wider B2B marketing campaign, its interactivity with users and the degree to which it draws potential clients via search engines.

Buyers of consumer products are generally not interested in the technical details of what they are buying. The vast majority of car buyers are far more interested in what speed the car will reach than in how it will reach that speed. Similarly, the buyer of a chocolate bar is likely to be far more interested in the fact that the item stops them feeling hungry and tastes nice than in the technology and ingredients that make it so. As a result, consumer products are frequently marketed in ways that are superficial or even vacuous.

Car manufacturers frequently completely ignore not only how a car performs, but often the fact that the car performs at all, and instead seek to apply non-physical attributes such as sex appeal to their products. Business-to-business campaigns, on the other hand, seek to educate their target audience by providing specific factual information. A corporate vehicle fleet buyer is unlikely to purchase a car for his salesforce on the basis of its color or sex appeal. Many target companies in business-to-business campaigns are already well-informed on the product area, in which case promotional material may have to go as far as offering product specifications.

What does this mean for the business-to-business marketer?

The key for the business-to-business marketer is to be fully informed in relation to the product or service being sold. This understanding must cover not only the ‘technical’ details of the offering, but also the extended offer including aftersales service, problem resolution, client management team, etc. As a result, the B2B sale is often a ‘technical sale’, meaning that salespeople in business-to-business markets are often extremely experienced and originate from a technical discipline within their company. The success or otherwise of an entire business-to-business product line can be largely dependent on the abilities of a small team of salespeople.

6. Limited Number Of Buying Units In B2B Markets

Almost all business-to-business markets exhibit a customer distribution that confirms the Pareto Principle or 80:20 rule. A small number of customers dominate the sales ledger. Nor are we talking thousands and millions of customers. It is not unusual, even in the largest business-to-business companies, to have 100 or fewer customers that really make a difference to sales.

There is also a matter of scale. In consumer markets there are reasonable limits to the amount that a single person can buy and use of any product. Certainly there are heavy users of all consumer products but the difference between the light user and the heavy user is a matter of small degree compared with the scale of differences in business-to-business markets. You can fit most buyers of consumer products into a “typical spend per month” with a few heavy spenders and a few light spenders at the extremes. The range of spend between the largest and smallest buyer in a business-to-business universe is likely to be much, much larger than the range of spend between the largest and smallest buyers in consumer markets. Small numbers of customers of widely different sizes – and the presence of a few key accounts – is a major distinguishing feature of business-to-business markets and this requires a completely different marketing approach to that required for consumer markets.

What does this mean for the B2B marketer?

Because such small numbers of customers dominate the lives of businesses, database management is a crucial part of business-to-business marketing. Customer relationship management systems now allow databases to be kept up-to-date with personal details of members of the DMU together with every transactional and contact record.

It is also critical that the business-to-business marketer be adept at key account management with all the manpower, proactivity and responsiveness that this entails. Key accounts not only require the product delivered to them when and in the quantities they need it; they also routinely require services such as swift problem resolution and technical advice. Indeed, key business-to-business accounts are increasingly moving beyond requiring effective products and services and good prices; they are now looking for partnership. They are looking for suppliers that will hold stock on their behalf, provide technical consultancy, calculate product efficiency and added value, and offer long-term on-site support.

Above all, the limited number of buying units in business-to-business markets, and particularly the concentration of expenditure among a few of those buying units, presents both an opportunity and an expectation that the biggest spenders are provided with dedicated value-added services that reflect their importance to the supplier. If you don’t satisfy this expectation, someone else will!

In addition to a smaller number of B2B customers overall, B2B markets are also unique in that at any given time, research by the Ehrenberg-Bass Institute and Professor John Dawes has shown that only 5% of buyers are in-market. A marketing strategy that successfully drives growth does not do so by persuading in-market buyers to buy today, but influencing the other 95% of the market so that when they go in-market sometime in the future, they think of your brand first.

7. B2B Markets Have Fewer Behavioral And Needs-Based Segments

Our experience of over 4,000 business-to-business studies shows that B2B markets typically have far fewer behavioral or needs-based segments than is the case with consumer markets. Whereas it is not uncommon for an FMCG market to boast 10, 12 or more segments, the average business-to-business study typically produces 3 or 4.

Part of the reason for this is the smaller target audience in business-to-business markets. In a consumer market with tens of thousands of potential customers, it is practical and economical to divide the market into 10 or 12 distinguishable segments, even if several of the segments are only separated by small nuances of behavior or need. This is patently not the case when the target audience consists of a couple of hundred business buyers.

The main reason for the smaller number of segments, however, is simply that a business audience’s behavior or needs vary less than that of a (less rational) consumer audience. Whims, insecurities, indulgences and so on are far less likely to come to the buyer’s mind when the purchase is for a place of work rather than for oneself or a close family member. And the numerous colleagues that get involved in a B2B buying decision, and the workplace norms established over time, filter out many of the extremes of behavior that may otherwise manifest themselves if the decision were left to one person with no accountability to others.

It is noticeable that the behavioral and needs-based segments that emerge in business-to-business markets are frequently similar across different industries. Needs-based segments in a typical business-to business market often resemble the following:

- A price-focused segment, which has a transactional outlook to doing business and does not seek any ‘extras’. Companies in this segment are often small, working to low margins and regard the product/service in question as of low strategic importance to their business.

- A quality and brand-focused segment, which wants the best possible product and is prepared to pay for it. Companies in this segment often work to high margins, are medium-sized or large, and regard the product/service as of high strategic importance.

- A service-focused segment, which has high requirements in terms of product quality and range, but also in terms of aftersales, delivery, etc. These companies tend to work in time-critical industries and can be small, medium or large. They are usually purchasing relatively high volumes.

- A partnership-focused segment, usually consisting of key accounts, which seeks trust and reliability and regards the supplier as a strategic partner. Such companies tend to be large, operate on relatively high margins, and regard the product or service in question as strategically important.

What does this mean for the business-to-business marketer?

The fact that business-to-business markets have relatively few segments makes the job of the B2B marketer easier than it might otherwise be. Nevertheless, skills in recognizing which customers fit which segments, and how to appeal to each of these segments, are not easy to come by. Key challenges in establishing a behavioral or needs-based segmentation are as follows:

- Obtaining a consensus on exactly what the segments are, and what characterizes them, usually requires investment in quantitative market research.

- Once a segmentation has been achieved, identifying which companies are in which segment is extremely difficult. Behavioral and needs-based segments usually transcend ‘firmographic’ segments, meaning that there are often no immediately manifest indicators (such as country, industry sector) of the segment to which a company belongs.

- Training sales teams, marketing teams, customer relationship and other departments must implement the segmentation by adjusting their approach to often intangible criteria. This requires huge effort and investment horizontally and vertically within a business.

Given the limited size of business-to-business target audiences, many marketers find the most simple approach is to tier the target audience by size and split it by geography, with accounts receiving the attention they ‘deserve’ according to their strategic value to the supplier.

8. B2B Buyers Are Longer-Term Buyers

Whilst consumers do buy items such as houses and cars which are long-term purchases, these incidences are relatively rare. Long-term purchases – or at least purchases which are expected to be repeated over a long period of time – are more common in business-to-business markets, where capital machinery, components and continually used consumables are prevalent.

Furthermore, the long-term products and services required by businesses are more likely to require service back-up from the supplier than is the case in consumer markets. A computer network, a new item of machinery, a photocopier or a fleet of vehicles usually require far more extensive aftersales service than a house or the single vehicle purchased by a consumer. Businesses’ repeat purchases (machine parts, office consumables, for example) will also require ongoing expertise and services in terms of delivery, implementation/installation advice, etc that are less likely to be demanded by consumers.

Finally, business customers tend to be regarded as long-term customers more than consumers do for the simple reason that there are fewer business customers about, and the ones that do exist are more valuable! The benefits of retaining a B2B customer are often enormous, and the consequences of losing them very serious.

The long-term nature of many B2B purchases also leads to inertia when it comes to switching suppliers. Due to the potential risks involved, many organizations fear change as changing suppliers means having to deal with potential disruptions and unwanted upheaval. It therefore becomes easier for B2B buyers to put up with a mediocre supplier rather than switching.

Our own research into B2B decision-making shows that the primary trigger to look for a new supplier is as a result of internal circumstances and change (48% of businesses), such as cost reduction exercises, new business requirements and organization growth. 20% of businesses stated external reasons such as regulation compliance or keeping up with competitors, 16% stated previous supplier issues and a further 16% mentioned being made aware of new possiblities following an approach by a new supplier as the primary trigger to start looking around.

What does this mean for the business-to-business marketer?

The longer-term focus in business-to-business markets reiterates two key points for the B2B marketer to bear in mind: first the importance of relationship-building in business-to-business markets, particularly with key customers; and second the importance of a technically focused sales team.

9. B2B Markets Drive Innovation Less Than Consumer Markets

A look at the derived demand diagram (Figure 1) demonstrates that most innovation is driven by consumer markets. B2B companies that innovate usually do so as a response to an innovation that has already happened further upstream. B2C businesses tend to be less risk averse, as they have to predict and respond to the whims and irrational behavior of consumers rather than the more calculated decision-making of businesses. B2B companies have the comparative luxury of responding to trends rather than seeking to predict or even drive them.

This is not to say, of course, that companies in B2B markets are ‘worse’ innovators than those in consumer markets. Indeed, the opposite is repeatedly the case, as innovations are often more carefully planned and successfully commercialized in the B2B world, in which audiences are more clearly defined and trends more easily identified.

What does this mean for the business-to-business marketer?

Business-to-business marketers have both the time and the indicative data from upstream to carefully assess their options before making a decision. As competitors are in the same position, this makes gathering good quality intelligence absolutely critical. B2B marketers are advised to undertake detailed market research, combining this with upstream information in order to build up a complete market intelligence picture.

10. Consumer Markets Rely Far More On Packaging

There has been a huge growth in the packaging of consumer products in recent years, as marketers seek not only to protect and preserve their products, but also to use the packaging as a vehicle through which aspirations and desires are transmitted to the customer. Consumers being less rational than business-to-business buyers, this approach has proved enormously successful at adding perceived value to products.

Adding value through packaging – making packaging a key part of the extended offer – is far more difficult to achieve in business-to-business markets, where product is judged primarily on technical criteria and the extended offer is built around relationships rather than dreams, aspirations or appearances.

What does this mean for the business-to-business marketer?

The implications for business-to-business marketers are clear – packaging, like product, plays a primarily functional role. Resources are far better directed towards developing relationships and expertise.

Conclusion: B2B Buyers Are More Demanding

The final distinguishing factor of B2B buyers is a suitable conclusion to this paper: simply that business-to-business buyers are more demanding. They have a responsibility to make the right decision when purchasing on behalf of their companies. They take less risks and therefore need quality to be absolutely right. They have the expertise to recognize a bad offering when they see one. They are used to getting what they want. They are often paying more than they would as a consumer and therefore expect more in return. They are likely to regard themselves as interacting with the product or service supplied to them, rather than playing the role of passive recipient.

What does this mean for the business-to-business marketer?

The implications for business-to-business marketers are clear. It is our job to meet the target audience’s needs; we must therefore raise our game to ensure that our product, services and intangibles meet and exceed customers’ requirements.

In our favor is the fact that business-to-business buyers are more predictable than their consumer counterparts. This means that good quality market intelligence and close attention to our target markets’ needs place us in a strong position to meet the needs of the market.

Readers of this white paper also viewed:

2 Frameworks to Help You Understand Every B2B Decision Making Unit The Brand Practitioners Podcast Series: Catch up on Episodes 1-4 Spotlight on the Millennial B2B Decision Maker A 5-Step Framework for Driving Action and Seeing Results from your CX Programs The Importance of Measuring Brand Strength