Of the many differences that distinguish business-to-business markets from consumer markets, two are particularly notable.

First, the more complex nature of the b2b decision making unit. Whereas the decision to choose a particular consumer good is generally made by one or two people, the decision to purchase a product on behalf of a business commonly involves several decision makers, each with a different area of expertise.

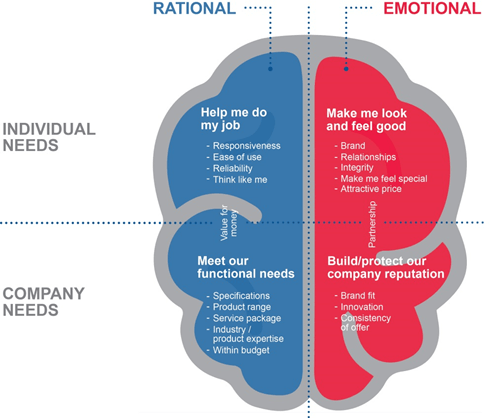

Second, business decision makers are accountable to others within their organisation. B2B buyers therefore have a more complex set of needs in comparison with consumer buyers. Like consumers, business decision makers have both rational and emotional needs that must be fulfilled by suppliers. The difference is that these two types of needs each operate on both a personal and company level.

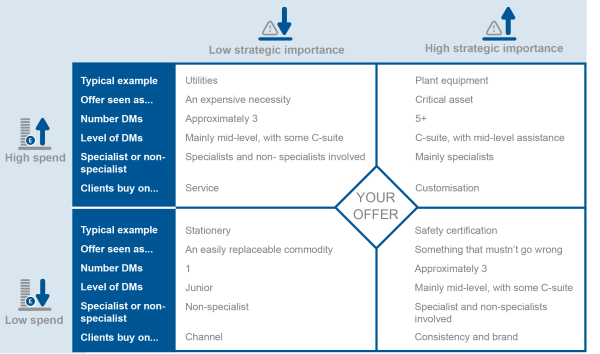

The two matrices below are designed to help the business-to-business market navigate the two key topics of exactly who to target in a b2b market and which needs to focus on meeting.

Who decides whether to buy your offer?

Think of the importance of your offering to the customer in two respects: the proportion of their budget they spend on the offering; and the level of strategic importance they place upon it.

Spend: If the customer spends less than 5% of their overall annual budget on your offer, classify this as ‘low’. Otherwise, classify their spend on your offer as ‘high’.

Strategic importance: If your offer is critical to the continuation of the customer’s operations and cannot be immediately replaced by an alternative, classify your offering as ‘high strategic importance’. Otherwise, classify it as ‘low strategic importance’

Now plot your offer on the matrix below.

Low-spend, low strategic importance (example: stationery)

Your offering is a commodity in the eyes of the client. Customers do not want to think about your offer; if it is not there when they need it they will be mildly irritated. This lack of interest in your offer is reflected by the fact that the decision making unit consists of one, junior, non-specialist decision-maker. The customer may spend no effort looking at the price of your offer, providing you with high-margin opportunities.

The few opportunities to differentiate tend to involve relationship and the channel – for example ease of ordering, speed of delivery and being ‘low hassle’. There may well also be opportunities to bundle your offer with other products and services in a similar category. If you let the customer down, they will quickly go elsewhere and may never bother coming back.

Low-spend, high strategic importance (example: safety certification)

Your offering may not dent your client’s budget, but it is essential to the continued operations of the business. With little to gain and everything to lose by switching from a proven supplier, clients are ultra-cautious and extremely loyal.

The client’s decision making unit will comprise several people and include at least one technical specialist, who will require a partnership-style relationship with you and involve him or herself in the finest details of your offer. They cannot afford for anything to go wrong. You have many opportunities to differentiate – around expertise, knowledge, reliability, proactivity, partnership and brand.

Low strategic importance, high-spend (example: utilities in a service company)

Whilst your offering does not keep your client awake at night, its price may do so. The client will try everything in his or her power to reduce the company’s spend with your business. The decision making unit will comprise several people, including a purchasing professional and often someone from the C-suite.

Differentiating your offer is extremely difficult, even if it is customised. The customer is likely to focus on the price you charge rather than the value you add, and may force you to crowbar your price into a pricing matrix. Opportunities to differentiate are likely based around service – being easy to deal with, simplifying the purchasing process, getting administration right and not overdoing the ‘hard sell’.

High strategic importance, high spend (example: plant equipment)

Your offer is high value and critical to the ongoing operations of the client. The client is extremely discerning and its requirements often very individual. You are a strategic partner, an intrinsic part of the client’s business. The client-side decision making unit comprises 5 or more people, including several specialists and members of the C-suite.

Your whole offering is about differentiation, as each client is different. Product, service, relationship and brand will all provide differentiation opportunities.

Which needs should you focus on meeting?

When we buy a consumer product, we are generally only accountable to ourselves or those closest to us. When we buy a product on behalf of our employer, we are making a decision that can affect those who work with us, those who work for us, and those who will decide whether we are promoted or given a rise. We therefore place great emphasis on company needs. However, few of us are altruistic enough to leave our personal motivations at home, meaning that both company-oriented and individual needs are reflected in the decisions we make.

Our emotions as human beings are part of us, whether we are at home, at work or at play. In the workplace, the fact that we are accountable to others means that many of our emotions relate to insecurity about our own position and performance, and the need to impress others.

The inter-relationship between rational versus emotional motivations and individual versus company needs gives rise to the matrix below. In any purchase decision, needs from every quadrant come into play. However the relative importance of each quadrant depends on company culture, the nature of the individual, and the strategic importance of the offer in question.

Rational motivations, company needs

Ask open-ended the question ‘what do you require from a supplier’ to any business decision maker, and they will quickly list their rational, company-level functional needs. These are the needs that are clearly articulated in RFPs and well recognised by supplier and customer alike. They are the needs that absolutely have to be met for a supplier to be considered. They define the consideration set but they do not impact upon supplier choice. Relative to other needs, they have most influence with items that are high spend/low strategic importance; items where the price is a key focus.

Rational motivations, individual needs

The typical business-to-business wants to do his or her job as effectively as possible, or at the very least reach the minimum standard defined by the company and its customers. This impacts upon every decision he or she makes – “how will this help me do my job?”. If the delivery is 2 hours late, will I end up having to work late? If the supplier is not proactive, will I waste time chasing them? Such needs are not necessarily clearly articulated, but impact hugely on all business purchase decisions and are one reason why b2b buyers are risk-averse. Buyers are less willing to take risks with the satisfaction of their personal needs when in the workplace rather than the home environment.

Emotional motivations, individual needs

As human beings, we take our idiosyncrasies, strengths and weaknesses to work with us. Our accountability to others frequently brings these attributes to the fore, as we try to impress, influence and avoid upsetting others. Again, we frequently become risk averse. Why try a new supplier, if there is even the tiniest risk of me looking an idiot in front of my boss? Our egos also influence our decisions, just as they would in our ‘consumer’ lives – why should we use a supplier that doesn’t seem interested in us? Likewise our reaction to brands – is this ‘my sort of company’?

Emotionally motivated individual needs are the most difficult to satisfy, not least because they are the most difficult to identify. Two individuals in the same industry, even the same company, will intrinsically possess completely different emotional tendencies. Generally two themes predominate –business-to-business buyers want suppliers to make them feel good and look good in front of others.

Emotional motivations, company needs

It could be argued that it is individuals rather than companies that have a heart and a soul. But every organisation has a set of values that both result from and determine the behaviours and needs of those within it. The modern company recognises that its brand is its biggest asset and builds its whole decision making architecture around that brand. Companies want to deal with other companies that have a similar ethos to them. Big brands want to deal with other big brands. Innovative brands want to deal with other innovative brands. In today’s ‘brand as business’ organisation every aspect of the offer, every step of the customer journey, must externalise the values of the supplier. A desire for ‘brand fit’ is the ultimate manifestation of a company’s emotions.