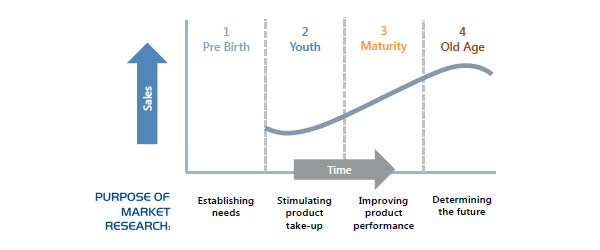

Product development is a key issue for any organisation who is looking to gain ground or remain ahead of the competition within a marketplace. At the initial stages of the product lifecycle, market research can be used to establish respondent needs and differentiate between which new concepts to offer and which ones to scrap. At the maturity end of the lifecycle, research can also prove a valuable tool for uncovering potential additions or modifications to existing products.

Figure 1: Product Lifecycle

Examining the potential uptake of completely new, previously unseen concepts is a delicate issue for any organisation. Indeed, many organisations struggle to successfully launch new products – as many as nine out of ten product launches fail, mainly due to a failure to thoroughly investigate whether the product is likely to succeed before it is launched. Whilst market research can help to provide evidence to support the launch of a new concept, it is important to use the correct approach when testing concepts. How the question is asked, the research audience selected and how the products are presented can all have significant implications on the results of any given concept test. Standard approaches within the industry include:

- Likert scales – asking respondents their likelihood to purchase a product on a scale.

- First choice approach – asking respondents their preferred choice from a set of concepts.

- Ranked preference – asking respondents to rank their preference for different concepts.

Whilst these approaches have successfully been used by organisations over a long period of time to test concepts, they are also subject to a number of biases that are likely to affect the validity and reliability of results. Likert scales are prone to a lack of differentiation when average scores are analysed, whilst cultural differences have the ability to skew ratings in multi-country studies. A more fundamental problem is ingrained within human behaviour. Most individuals are likely to conduct unconscious deceit when choosing between ideas. Given the choice between a cheap product and an environmentally friendly product, most respondents are likely to opt for the environmental product as this response is more socially acceptable than the cheap product. However, we know that these choices are unlikely to reflect reality. There is also a tendency for respondents to offer an opinion on concepts that they have no intention of ever purchasing in practice. As a result, these methods tend to offer a lack of predictive validity when examining the potential uptake of new concepts.

Prediction markets offer an alternative approach to concept testing. An article named The Power of Prediction Markets, which featured in the May 2013 edition of Quirk’s Marketing Research Review by Julie Wittes Schlack, summarises the methodology and advantages behind this approach. The concept of prediction markets is rooted in the University of Iowa’s Electronic Markets, which have been used to successfully predict election results since 1988. Instead of asking individuals for their own opinion, prediction markets offer respondents the ability to place themselves within the mindset of others. Questions are reframed to ask respondents which concepts they think others would be most likely to purchase, as opposed to asking which one they would purchase themselves. In particular, respondents can be asked to invest in concepts they think will be successful by allocating a hypothetical monetary amount or a number of shares across the ideas presented to them. In more advanced approaches, an active market with fluctuating share prices can be created to reflect the changing tide of opinion over time. However, the approach is just as effective when posed to respondents on a one-off basis as part of a product development survey.

Using prediction markets has a number of advantages over standard concept testing approaches:

-

Survey engagement – using prediction markets offers a more interactive survey experience to respondents than standard rating scales, creating greater engagement among respondents and encouraging thought out responses.

-

More considered answers – framing the question to include monetary values creates an investment mindset among respondents. As a result, responses are likely to contain more judgment than standard results. Likewise, the fact respondents are asked to judge the behaviour of others allows inclusive opinions even if respondents are unlikely to purchase a concept. For example, someone who does not hold a driving license is unlikely to purchase a car. However, they may still hold knowledge in the market as they will likely know other individuals who do drive and can thus offer an opinion on what they would purchase.

-

Strong predictive value – prediction markets are stronger predictors of mass-market appeal due to the fact that they iron out niche selections. For instance, though respondents may prefer niche products, they are likely to recognise the fact that these products will not be selected by others. Studies in consumer markers have uncovered a strong correlation between prediction market shares and real-life product shares. In addition, prediction markets offer a strong correlation with other, more advanced product development techniques, such as conjoint testing.

In conclusion, whilst prediction markets offer a strong approach for product testing, it is important to remember that the product is only one element of the marketing mix; a strong product alone does not guarantee success. Wittes Schlack offers the following advice:

“But the biggest caution is to remember that picking winners and losers is only one small piece of the puzzle. In both incremental and breakthrough innovation, whether developing new products or promotions or tweaking existing ones, the magic lies in generating the insight that leads to a deeper understanding of consumers and where their unmet needs lie.”