Examples Of Market Research Focus Groups In Action

In a hotel in the centre of London, a group of IT managers are discussing the type of information they need from a supplier of application serving software. They are all involved in the technical side of management and have the requirement for technical information to help them to keep their systems updated. They are looking at, and evaluating different examples of communication material from pamphlets to newsletters, from press releases to websites. They need specific information and regular contact and they discuss how best a supplier can deliver this to people like them.

In a room in the Students Union, a group of students discuss their experiences as students at the University. They are talking about what they like and dislike at the University and how this compares to their expectations before arriving. They are brainstorming words which come to mind when thinking abut the University and are working in pairs to come up with a “strap line” which typifies their experiences.

Eight plumbers have been invited to discuss domestic showers. They are talking about trends in bathroom design and how much influence they have on the final decision about which shower is finally installed. They go into great detail about the installation issues and the problems they face with certain types of showers. The group is being held in a viewing centre and the Client, a leading European shower manufacturer is watching and listening first hand through a two way mirror.

These are all examples of a focus group in action. Focus groups are essentially group discussions which rely heavily on the interaction between group members and the relationship between the researcher and the respondents. Focus groups have been a dominant form of qualitative data collection in market research for more than 30 years.

History Of The Focus Group

Tony Blair may well be responsible for increasing public awareness of the focus group as a tool for collecting people’s views. The newspapers have been proactive in reporting his affinity for the methodology and some have even suggested he dares not make a move without testing out his intentions within a focus group.

Despite their recent shunt into the public eye over the past decade, focus groups are nothing new. Within the social sciences, they can be found detailed in the literature as far back as the 1920’s. This non-directive approach increased in appeal in the 1930s and 1940s as many sociologists were looking for alternative ways of conducting interviews as the traditional closed response choice questionnaires were being questioned. Paul Lazersfeld, an academic also involved in marketing,used and documented the approach in evaluating audience responses to stimulus material such as films, radio and written manuals. Robert Merton, himself a Sociologist was introduced to the focus group technique by his colleague Lazersfeld, and he pioneered the approach with his work during World War II exploring morale in the US military for the War Department (Merton & Kendall 1946).

Focus groups played a valuable part during the Second World War including evaluating the effectiveness of propaganda efforts and the effectiveness of training materials for the troops (Merton & Kendall 1946). It had become recognized that people revealed sensitive information when they felt they were in a safe, comfortable place with people like themselves. This marked the inception of the focus group, and many of the procedures accepted as common practice in focus groups were laid down in the work carried out by Robert Merton with his contemporaries Marjorie Fiske and Patricia Kendall (The Focused Interview 1956).

Despite this early enthusiasm, the focus group as a research method seemed to disappear from usage among the academic community. However, the market research community embraced the approach. After the war, business was booming, development was high, and market researchers were charged with finding out how to make their products most attractive to potential customers. The focus group appeared to be the ideal method to stay in touch with customers, in both exploring their needs and identifying their attitudes. The focus group technique has evolved over the years within market research and has strongly influenced the business community from product design through to promotions and advertising.

In the early 1980s the method re-emerged in the academic community and was being used in academic research to understand attitudes and behaviors. Around this time, the communications industry adopted the methodology to examine how audiences interpreted media messages, and with this the value of the focus group became increasingly recognized. In 1987, the first full length focus group text book by marketers was published (Goldman & MacDonald 1987). With this recognition, focus groups have become an increasingly well known method for collecting qualitative data in all fields of research.

What Is The Focus Group?

The focus group is a research technique used to collect data through group interaction on a topic determined by the researcher. Thus the Client determines the focus of the group and the data comes from the group. Essentially, it is a group experience. It comprises a small number of carefully selected people who are recruited to a group discussion based on their commonality of experience.

Focus groups have four key characteristics:

- They actively involve people

- The people have a commonality of experience

- They provide in depth qualitative data

- Discussion is focused to help us understand what is going on

The People

Focus groups typically comprise five to ten people. The group needs to be small enough to allow everyone the opportunity to share insights, and yet large enough to provide group interaction and diversity of experience. Larger groups can inhibit discussion due to lack of opportunity and smaller groups can result in a smaller pool of ideas.

Commonality of Experience

Focus group participants have a degree of homogeneity, and this is important to the researcher. This similarity is the basis for recruitment, and indeed, specific requirements may be necessary for attendance at the group. It is crucial to identify who can give you the information you need.

It is common for researchers and Clients to jointly identify the key criterion which identify the individuals for focus group discussions. For example, when researching the use of sealant and filler compounds, it may be necessary to recruit builders with a certain number of years experience and a minimum level of usage of sealant and fillers in their work practice.

Depth of Information

Focus groups are a research method which delivers qualitative data that is rich in depth and not numerical in nature. Data tends to be in words, pictures, symbols etc. The group provides the forum for discussion, and the group moderator, i.e. the researcher guiding the group, uses their skills to assist the group members to engage in discussion, thus flushing out ideas, attitudes, and experiences. The focus group is more than a group interview. The key element is the group process; the interaction between the group members.

The topic of discussion

The questions in a focus group discussion are carefully designed to elicit the views of the respondents. A discussion guide is prepared prior to the group and the group moderator uses this as the vehicle for discussion. Careful design of the guide ensures a logical flow of conversation around the topic area, and ensures a clear focus for the discussion.

The topic guide is reflective of how groups operate, commencing with introductory questions to help the group to form. This serves to get people talking and feeling comfortable enough to proffer their opinions and experiences. Questions then progress to yield more information, and there should be no pressure on the group members to alter their views, rather, attention is centred on understanding the comments and thought processes as the issues are discussed.

When Do You Use Focus Groups?

Focus groups deliver qualitative depth information, where exploration and identification of attitudes, behaviors and processes are the chief research objectives. They are best used where “why?” “what?” , and “how?” questions require illumination. They can be used in three ways in the research design:

- Stand alone method: where the focus groups are the sole data collection method and they serve as the principal source of data

- Supplementary to a survey: where they are used to enhance an alternative primary data collection i.e. before a survey to identify the issues, or after a survey to expand and illuminate particular issues

- As part of a multi method design: where studies use several sources of data collection and no one method determines the use of the others.

The type of design will depend on the objectives of the research. When focus groups are used as the sole source of data, the objectives centre on identification, exploration, and illumination, whereas, when these objectives are coupled with quantification, a multi method design will be the preferred option (McQuarrie 1996).

Group discussions are especially useful techniques for researching new products, testing new concepts or determining “what would happen if…” They work because of the interaction between the group members. Individuals are not under pressure to give spontaneous answers. They can digest the points raised by other members and, as they consider the implications of issues raised, and ideas may be sparked off which would remain untapped in a personal interview. Typical market research situations when focus groups are used are:

- To unravel complex processes from the basics e.g. a complicated buying process

- To identify customer needs i.e. where there is a complex interaction of factors influencing motives

- To identify working practices e.g. how a particular product is used

- To test new products i.e. where something needs showing to people

- To explore a concept with stimulus aids

- To explore and identify issues of satisfaction for customers, staff or suppliers

- To explore perceptions of brand and service elements associated with the brand

For the researcher, the decision about whether to carry out focus group discussions or individual interviews is based on several factors. Focus groups are not always practical, and within the business community, it has to be accepted that geography often precludes the bringing together of a focus group. For this reason depth interviews are and will remain (until multiple verbal/visual link ups become feasible) the most widely used qualitative research technique.

In general, focus groups are NOT the preferred option where:

- Measurement of size and distribution is required

- The sample base is widespread and small

- There is the need to protect the respondent from possible bias introduced by others

- The topic area is sensitive e.g. requiring disclosure of production techniques or identification of customers

- Respondents require preparation to answer knowledgeably

Areas Of Special Consideration

Focus groups are no different from any other research method in that they too have their strengths and weaknesses. They are not always suitable and some situations and topic areas need to be dealt with accordingly. Culture, the sensitivity of the topic area, difficulties with disclosure, the effect of the hierarchy within the respondent group and the moderator themselves are all considerations that need to be looked at when taking the decision to use focus groups in the research design.

Culture

The culture of the respondents in relation to openness, honesty and disclosure warrants consideration. In many cultures, particularly in Western countries, people have less difficulty sharing their views with others and engaging in debate where their views may differ from others within the group. The culture is of free speech and Western familiarity that makes the focus group discussion come naturally. However, this cannot be assumed for all cultures. In many Eastern countries, this is not the case. To appear openly critical of products, services and suppliers cannot be assumed to be so easy. The natural response is to be more polite and present the account which represents that which is expected to be heard rather than the personal account, which may be considered less socially acceptable.

The market research industry is less well developed in eastern countries, and this may well be due to the nature of disclosure. Using the same focus group methodology to seek the views of end users about what they want from a bathroom shower would reveal a completely different depth of information if carried out in the UK and Hong Kong. Associated with this is the consideration of gender and age of the respondents in the creation of a comfortable permissive environment.

Sensitivity of the Focus Topic

Focus groups are an excellent tool for getting people to open up and for flushing out ideas. However, consideration has to be given to the sensitivity of the topic area.

It is not surprising that the toilet seat has not changed in design over the years; that condoms do not come in a variety of sizes and that personal hygiene products tend to be developed through test marketing. To carry out research which requires disclosure of sensitive, personal information and experiences in a group setting is confounded with inherent problems. Such sensitive and potentially personally embarrassing topics are best discussed in a private non threatening setting, and this is better achieved though a feeling of anonymity, with the researcher being distanced from the respondent i.e. collection by telephone interview or self completion questionnaire.

The Effect of the Group Hierarchy

Every researcher has to recognize the inherent imbalance of power in the group situation. In general, if people feel equality within the group; between the group members and the group moderator, they are more likely to feel at ease to share their views, question others within the group and engage in lively debate. For example, when exploring the needs of people using hearing protection, the views of plant workers, supervisors and purchasers would need to be sought. When in the group situation, plant workers may find it difficult to discuss their experiences in front of their supervisors, particularly if some of their actions contravene company policy. Therefore, in planning focus groups, keeping respondent types as similar to each other as possible facilitates more open and candid discussion.

Difficulties with Disclosure

Some people, however similar they feel to other group members, find self disclosure more difficult than others. The group moderator needs to be aware of all individuals in the group and adopt an approach which facilitates the inclusion of all respondents, however potentially subversive ideas they may express. For example, focus groups with plumbers which involve disclosure of how they plumb a central heating boiler may reveal practices which are considered to be substandard by other members of the group, and this may cause a group member to remain silent about their practices at work. Therefore, intimidation by more skilled and knowledgeable plumbers may inhibit some group members and thus give a skewed view of plumbing practice when it comes to boiler installations.

Equally, the commonality of the group members often means the group is made up of people who are, in fact in competition with each other in the market place, and there may be a reluctance to disclose their practice for fear of losing a competitive advantage they feel they have.

Match of moderator

When carrying out focus groups with members of the legal profession, a moderator will tend to wear a suit. When carrying out groups with students, s/he might be more inclined to wear casual clothing. The match between the moderator and the group participants has been the subject of much research i.e.

- How is the credibility of the moderator seen by the group participants?

- How much does this affect the group dynamics?

No consensus has been reached, though the key point is that the moderator needs to be accepted by the respondents and have the ability to create a “safe” environment where respondents feel comfortable and confident to express their own personal viewpoint freely.

The age, gender and experience of the moderator may be critical factors in some topic areas, but not in others. In general, the moderator’s standpoint will be one of a researcher, not an industry expert, and usually the detachment of the moderator from the topic area works to their advantage. However, in some sensitive topic areas, it may be necessary to match the moderator to the group respondents.

Planning and Recruiting Groups

Between six and eight members normally constitute a group though there are no rules as to the ideal number. Ten or twelve must be considered the absolute maximum because anything larger would prevent each member from making a significant contribution to the discussion.

As few as three to five group members can still be effective since even with this small number there is sufficient scope for the cross fertilization of ideas. These small groups are often termed “mini groups” and can be used where respondents are thin on the ground, but the research requires the topic area to be shared in a group.

Number of Groups

There are no hard and fast rules for deciding how many group discussions should be held. One is rarely ever sufficient, and even two is considered an absolute minimum, as even with two groups, a disparity of views would raise doubts as to which was correct. To obtain a better feel and counter the possibility of a rogue response, it is therefore advisable to conduct three or four groups. Due to the saturation of ideas, the benefit of more than (say) eight is questionable.

A large number of groups is justified only if it is thought necessary to hold separate discussions with different classes of respondent (e.g. respondents from large companies as opposed to small ones; Northern companies as against Southern; users and lapsed users, etc).

Venues and Timing of Groups

Focus group discussions can take place in a number of locations. It is common for viewing centres to be used for both consumer and business groups. It is, not uncommon for business groups to take place in hotels, at courses and conventions or at trade exhibitions. The venue should be carefully chosen to match the respondents and should suit the expectations of the respondent group, especially those of a person attending on behalf of his/her company.

The venue must be easily accessible to all, preferably well known in the area and with good car parking facilities. The memory lingers of holding a group for independent pharmacists at a Hotel in the centre of Birmingham where the directions to the hotel were poor, and the parking turned out to be an expensive public car park with no concession for hotel users.

The room in which the group is to be held should be inspected in advance. It needs to be small and intimate. It should also be free from traffic noise or piped music. It should be set up in board room style for business groups, though a less formal set up is adopted for consumer groups. The table should be the appropriate size for the number of respondents expected. Too small can be too cosy and too large can be very off-putting and distant.

The equipment for recording i.e. audio and video recording should be checked beforehand. If the group is being conducted in a viewing centre, this will be taken care of by the viewing centre; otherwise, the moderator will take this responsibility.

Working hours are a favorite time for holding most business to business groups, and the evening is favorite for consumer groups. However, the combination of travelling time to the venue and the duration of the group itself takes at least two hours and puts pressure on busy schedules and needs to be considered when setting the group times.

Many business to business groups have been held very successfully at conferences and seminar locations. Here, the captive audience makes recruitment easier and the abundance of suitable rooms makes this an ideal choice among some professional groups.

Getting Respondents to Attend

Because group discussions rely on such a small number of respondents, it is essential that care is taken to recruit the right profile. The ideal profile must be decided at an early stage and might include any of the following criteria:

- Job function of status

- Awareness of a product or company

- User or past user of a product or company

- Represent a company of a certain size (or buying volume)

A list is constructed of companies for interview, and recruitment begins by telephone. A recruitment questionnaire provides a screen to eliminate respondents that do not meet the criteria and collects advance data on basic questions.

The success of a group discussion is dependent on meeting the target attendance rate. The prospect of the group discussion should therefore be made to sound inviting, and barriers which could prevent attendance must be removed.

Several techniques are used by the recruiter to ensure the maximum attendance from those recruited to the group. It is important that the respondent has been “hooked” into the topic area for the group. If an interest has been generated in the topic area, the respondent is more likely to attend. The recruiter needs to sound enthusiastic and make the respondent feel that they have been specially selected to attend the group.

It is usual to give an incentive to respondents to attend, and this can help. Whilst a financial payment of around £50 is usual, in business to business groups other incentives can be considered. Testing reactions among builders to a new building product can be incentivized by free products and equipment which often has a value to the respondent that is higher than the financial payment.

After the initial approach has been made and a promise of attendance has been obtained, a letter should be sent confirming the arrangements. The letter acts formally to remind the respondent of the date, the time and the venue and verifies the purpose of the project. The content and construction of the letter must be businesslike, fully descriptive and emphasize the importance of attendance. A map showing the location of the venue should be enclosed.

One or two days before the group, respondents should be telephoned to remind them of the event and also to provide the researchers with view as to the attendance level. Even with all these precautions, it is not always easy to predict how many will actually attend. The stronger the relationship with the group respondents prior to the group, the greater the likelihood of attendance. The weather, football matches and television programs cannot always be foreseen and can play havoc with response rates.

It is usual to over recruit for groups as unforeseen circumstances are bound to happen to at least a couple of respondents. In the event of a very high turnout the researcher must decide who should be sent away with their incentive.

The Role of Online Focus Groups

With remote working and social distancing becoming the norm throughout the COVID-19 pandemic, market research methods have had to adapt significantly. Face-to-face methods such as focus groups and in-depth interviews were replaced by their virtual counterparts.

But while COVID-19 forced a complete shift towards online focus groups and market research online communities, their use had been rising steadily in the years preceding the pandemic and is expected to continue rising in popularity despite the return of face-to-face methods for insight collection.

Online focus groups have emerged as a practical alternative to traditional face-to-face groups as they overcome some of the key challenges faced by in-person methods. Learn more about the growth of online focus groups here.

One of the biggest challenges is attendance. Finding a sufficient number of potential recruits within a 30-minute journey of the chosen venue, particularly for niche B2B audiences, can be tricky. Recruiting for an online focus group doesn’t have the same limitations as respondents can be from anywhere in the world as long as they’re able to log-in when needed and can communicate in the same language.

A second advantage that online focus groups offer over traditional face-to-face groups is increased flexibility. Online focus groups are typically set up as a forum, are open over several days and with various topics already lined up. Respondents can log-in whenever they want and post their views on any of the topics or respond to questions and comments from other participants. This gives every respondent an equal opportunity to participate and often results in more considered and well-balanced views.

The increased flexibility of online focus groups also means that more participants can be recruited for a single group (up to 25 rather than 10), increasing the sample size and market coverage.

The Group Moderator

Groups are led by a researcher whose role differs greatly from that of an interviewer. The group moderator’s role is:

- To steer the discussion through a range of topics which are relevant to the problem. The order of these topics is determined as much by spontaneity within the group itself.

- To act as a catalyst to provoke responses or introduce ideas. Sometimes the researcher should play devil’s advocate or feign ignorance.

- To draw a response from those who are quiet and curb those who attempt to monopolize.

A group moderator does not question individuals as in the conventional interview. Empathy must be created with the members, relaxing them and getting a lively discussion underway. A brief introduction should be followed by an explanation that a tape recording will be made in view of the difficulties of note taking. It is then necessary to break the ice by asking each member to introduce themselves and their company.

Working from the topic guide, developed prior to the group, the researcher moves the discussion from the broad to the particular. In this way, the group is encouraged to express their viewpoint and challenge the views of other group members. Thus, all the issues will unfold with the resultant discussion surrounding the topic area, enabling greater and deeper understanding of the phenomena being researched.

Within a small number of respondents, invariably there can be a dominant personality who may attempt to run the group or whose views color those of the other members. Equally there may be slow thinkers, introverts, wits, compulsive talkers and the indifferent to deal with. The ability to be able to bring out the best from each without insulting or embarrassing anyone requires both authority and tact.

Groups generally take between 60 and 90 minutes to administer, depending on the complexity of the subject and interruptions from films or product presentations.

Tools Of The Group Moderator

The focus group can take many different forms, and the materials used to stimulate discussion will vary according to the purpose of the group. The group moderator will establish the stimulus materials prior to the group in conjunction with the Client, to ensure all issues are covered.

The line of questioning will be defined through the topic guide and any additional stimulus materials will be introduced at particular points in the discussion. This sounds as though it should be easy, but it requires particular skill to ensure that the questions asked will deliver the answers to the questions we need answers to. This is because the questions we ask and the questions we need answers to are not one and the same. For example, whilst we usually need the answer to “Why?” questions, the way to discover this is often to ask “How?” and “When?”, or “What?”. Paul Lazersfeld (1986) suggested that this line of questioning is more productive as the “Why?” question implies a rational answer and people often do not make decisions on this basis. The “Why?” question is too harsh and people have not often thought of this beforehand and therefore find it difficult to answer. Equally, the questions need to be of the type where conversation will be opened rather than closed.

The questioning route will be clear to the respondents and take account of the time available for discussion. It will generally have an easy non-threatening beginning designed to make the respondents feel comfortable, and will follow a clear sequence moving from the general to the specific. Good questions are conversational in nature; they use the language of the respondent rather than the Client, they are clear and easy to express, they are open ended and they do not mix dimensions. If respondents are required to carry out a task, or outline a process, the directions need to be clear and well thought out.

The best focus group questions are simply stated. Complex questions are confusing for the respondents and difficult to remember. By contrast, however, the simple question does not produce the simple answer. Stimulus materials, in addition to conversational are:

- Visual stimulus materials eg video, story boards, photographs, advertisements, web sites

- Auditory stimulus materials eg tapes, video

- Product trials and demonstrations

In addition to stimulus materials, there are a number of specific techniques which can be utilized in the focus group. Many of these techniques are termed projective techniques and are borrowed from the field of psychology. They are used to seek information on a particular topic by asking about a different or easier topic. They work because they circumvent potential barriers to expression and tap into different ways of thinking (Kreugar 1998).

- Brainstorming is a common technique used in most business meetings and this is useful in a focus group to identify issues. It is also closely linked to word associations where respondents are asked to think of words which are associated with a product or brand.

- Sentence completion is a development of word association where the moderator presents the group with an incomplete sentence for completion. This can be carried out individually and introduced into the group for discussion, or the group can engage in discussion to complete the sentence jointly.

- Word sorting is a technique where the groups are presented with a number of words or sentences and asked to sort them into groups according to the attributes of a product, or brand, or need they have. This is commonly used in advertising research and identifying positioning statement for products and brands.

- Developing a campaign is a group activity that can be used. Here, the group is asked to work together to come up with a campaign around an issue, for example to get other mature people, like themselves to study at the University of XXX

Some issues are difficult to express in words and picture drawing can be used to stimulate discussion. One example is the heraldic shield. In this, the four quadrants of the shield are designated to various issues and the respondent is required to draw something to represent this (see example below).

Projective techniques are generally designed to extend people’s imaginations, other projective techniques which can be used in the focus group include:

- Creating Fantasy e.g. if you had a magic wand and could change anything about the way you buy metal working oils, what would you change?

- Creating analogies questions e.g. If brand X was a car, which would it be?

- Futuristic Imagination e.g. Looking forward to the next 5 years, how do you think things will change in the way people supply and deliver graduate education

- Personification e.g. if the retailer Y were a person, what would it be like, what gender, how would it behave? What would it look like?

- Role play e.g. If you were the MD of Brand X , how would you go about promoting your products to people like yourself

Analysis and Reporting

Most groups will be both audio and videotaped for analytical purposes. This record assists the researcher in making a full analysis of each individual group, and the groups collectively. Transcripts from the audiotapes will be prepared and the videotapes allow those Clients unable to attend the groups first hand to observe the group dynamics. They also serve as a record against the audio transcripts of who said what, which enables the researcher to look for particular features in the responses. For example what did those from large companies with several sites say.

Focus groups tell us what is going on. They put the issues on the table. What they cannot do is measure with any accuracy, the frequency with which these issues occur within a given population (though an idea of frequency is often gained by the pure strength of feeling within the group). In Quantitative research, the emphasis is on the general view, the average, common perspective, whereas in focus group research, it is equally important to highlight and understand the unique and the peculiar.

The data can be analysed in many ways by the researcher. It can take the form of narratives i.e. reconstruction of the accounts in order to tell the story, identifying key issues, using frameworks arising from the data (see below) or other recognized business frameworks such as Porter’s Five Forces and qualitative segmentation. Sometimes, focus groups are followed by quantitative research, where the issues that have been uncovered are measured for distribution across the study population through a broader survey. However, qualitative research, using the focus group methodology is frequently a stand alone method and the learnings are sufficient to direct action.

There is a considerable volume of output from focus group research. It is not unusual for just one group transcript to run to more than 60 pages, and it is the job of the researcher to bring meaning to the data. The analysis of the data is inevitably related to the intent of the study. Qualitative analysis is often subject to criticism for subjectivity, and analysis must follow a process. Focus group analysis must be systematic, sequential and verifiable. By this, it must be deliberate and planned. It is all too easy to focus on particular comments within a group which have been committed to memory, but the analysis must systematically follow a process which actively looks for competing and alternative explanations.

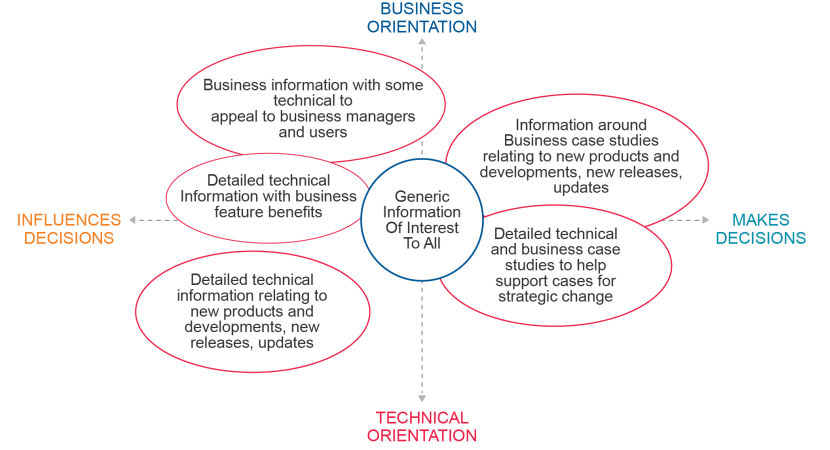

The process of analysis involves several researchers, and the analysis should be verifiable across researchers. This acts as a critical safeguard against the selective attention to some details of the data. The trail of evidence which can be found by a number of researchers looking at the data is located into a framework. For example, when looking at the communication needs of IT managers, key variables are identified and the communication needs and requirements can be located within these (see example below):

Summary

Focus groups take their roots in the social sciences and have been adopted by market researchers as a valuable interface between businesses and their customers. Focus group research has been used in the industry for more than 30 years and there is a wealth of published literature on the relative merits of the methodology and its contribution to business practice. Whilst some idea of frequency can be gained from focus groups, in essence, focus groups do not seek to measure; they uncover issues, unravel processes and test reactions and perceptions. They can be used stand alone, and they can augment and complement other methodologies. When choosing this data collection methodology, the purpose of the study needs to be considered carefully.

Human beings are programmed as social beings; we perform in groups for much of our day to day interactions. The focus group uses this feature as a tool to collect data about people’s experiences. Focus group interviewing is about observing and listening. The focus group is a powerful tool and the learnings are great in a short space of time. The group experience is key; it is about creating the right environment to enable people to freely express their views, using the right tools to get them to open up and to listen to and make sense of their views.

The ingredients of a successful focus group are getting the right people, in the right place, with the right group moderator and the right line of questioning. The logistics of setting up groups cannot be underestimated; the best moderator with the best stimulus tools will not manage to achieve the research objectives with wrongly recruited respondents and vice versa.

The data generated from focus group studies can be voluminous. Listening to the accounts alone is not sufficient and after the groups have been conducted, therein starts the job of making sense of these accounts. It is the job of the analyst to bring together the findings into clear frameworks.

Focus groups have made a huge contribution to the business world. They can be criticized for their subjectivity, for the small sample sizes and the purposive sampling methods that are used. However, it must be remembered that each research design has its flaws and the objective of the research is crucial in determining the methods which are used to collect data. Quantitative methodologies have their strengths in standardization, reliability, and measurement, usually through surveys with larger sample sizes; however the qualitative focus group design has its strength in the richness of the data, the ability to understand and explore perceptions, behaviors and motivations. It is not the type of research that seeks to control and predict, rather it will provide understanding and insight, and it is this very feature that gives the focus group its unique position as a research methodology.

References and Further Reading

Goldman AE & Mac Donald SS (1987) The group depth interview. Englewood Cliffs, NJ: Prentice Hall

Hague P (2002) Market research: 3rd Edition. London, Kogan Page Ltd,

Kreugar RA (1998) Developing questions for focus groups (Focus group kit 3). Thousand Oaks, CA, Sage Publications

Kreuger RA & Casey MA (2000) Focus Groups 3rd Edition: A practical guide for applied research. Thousand Oaks CA, Sage Publications

Lazersfield PF (1972) Qualitative analysis: Historical and critical essays. Boston: Allyn & Bacon

Lazarsfeld P (1986) The art of asking why. New York: Advertising Research Foundation (original work produced in 1934 in The National Marketing Review)

McQuarrie EF (1996) The market research toolbox: A concise guide for beginners. Thousand Oaks, CA: Sage

Merton RK & Kendall PL (1946) The Focused Interview. American Journal of Sociology, 51, 541-557

Merton RK, Fiske M & Kendall PL (1956) The Focused Interview. Glencoe, IL: Free Press.

Morgan DL & Kreuger RA (1998) The focus group kit. Thousand Oaks, CA, Sage

Morgan DL (1993) Successful focus groups: advancing the state of the art. Newbury Park, CA, Sage Publications

Readers of this white paper also viewed:

Focus Groups Loyalty – How To Win Devotion From Your Customers What Is the Future for B2B Focus Groups?