What is a business-to-business community?

Market researchers have been criticised for designing huge surveys that take too long to complete and cost a fortune to commission. Now imagine that your company is able to tap into customers and potential customers at a moment’s notice and obtain valuable feedback on a subject of interest to you. This is the lure of the online community.

Market research online communities (MROCs) are virtual communities that interact with each other over the internet. The internet has provided a platform by which people with interests can readily get together despite being separated by distance or time zones.

A community is effectively a large “family of invisible friends” with a strong common interest. This strong common interest is of great value to market researchers. They provide a ready assembled group, knowledgeable on a subject and willing to give feedback through polls or forums. They have long been used by consumer market researchers. Indeed, according to Greenbook, around a half of all market researchers claim to use them. Their use amongst business-to-business audiences is highly appealing though more difficult to manage. This paper explores the use of communities in business-to-business markets and discusses where they work, how they can be managed, and what they can provide. Our focus is on large groups of people who are recruited to take part in discussions over a number of months. The term “community” is sometimes used to describe online focus groups that are commissioned as a one-off event. This undoubtedly accounts for the high proportion of companies listed by Greenbook as users of communities. These online focus groups are not part of our consideration in this paper.

Conditions required for a successful business-to-business community

A successful community is made up of people who “love” their subject. Members of a community must feel passionate or at least very strongly about a subject for them to want to join with others and spend time talking about it. Members of a community must be “givers” not “takers”. They do not join a community because they want advice on how to do something; they join because they want to share their views. The community survives by the desire for interaction and not as a helpline. In a business-to-business community the members need to feel that the subject of discussion is very relevant to them. They may not be in love with their subject, indeed they don’t need to be, but they should be happy to enter into discussions which they believe are relevant and contribute to their continuous professional development.

Members of a community will want to feel that they are contributing to the community and not exploited by it. Since most people operating in businesses seek a competitive advantage, they may not want to give away their “state secrets” which could remove that advantage. They must therefore feel safe in any interaction and if they want anonymity, they would expect it to be granted.

We can imagine a number of situations where successful communities can be created in business-to-business markets. Farmers have already been mentioned as prime candidates for communities and so are a perfect audience for a supplier of farm equipment such as John Deere. Medics like to keep up-to-date with their subject and are a suitable target for recruiting into a community. Human resources managers, architects, small business owners and the like could similarly be interested in joining a community so that they can discuss aspects of their jobs.

Financial incentives are usually required to maintain the interest of members of a business community. The honorarium that may be necessary to maintain interest amongst the business community over a number of months will vary depending on the status of the members, the country where they are located and the degree of interest that they have in the subject. Members of a business community are typically paid only if they participate and over the lifecycle of the community they will “earn” no more than a few hundred dollars. It is clear that money is not the main motivation for taking part.

Managing business-to-business communities

The business community is recruited at some cost by phone or through online invitations. There is a high price to pay for this as dozens of calls will be necessary to enlist each participant. It will also be necessary to over recruit for there is certain to be a significant proportion of people who say they will participate but fall out right at the start. For this reason business communities tend to be relatively small, most with less than 500 members.

The community must be supported by a constant stream of content that is fed to the members. The community should feel that it is special; that it is an inner sanctum and is listened to on a variety of subjects. Receiving requests to take part in short polls weekly or even twice a week is a necessary part of keeping the community alive and engaged. Members will also expect feedback from the surveys in which they have participated and warmly welcome the latest news on products and events from the sponsor. Writing and sharing content which knits a community together has a cost which must be factored into its maintenance. A good community receives a balance of polls and moderated discussions. Furthermore, members of a community like to see the active participation of people from the sponsoring company. It confirms their belief that they are part of a decision-making inner circle.

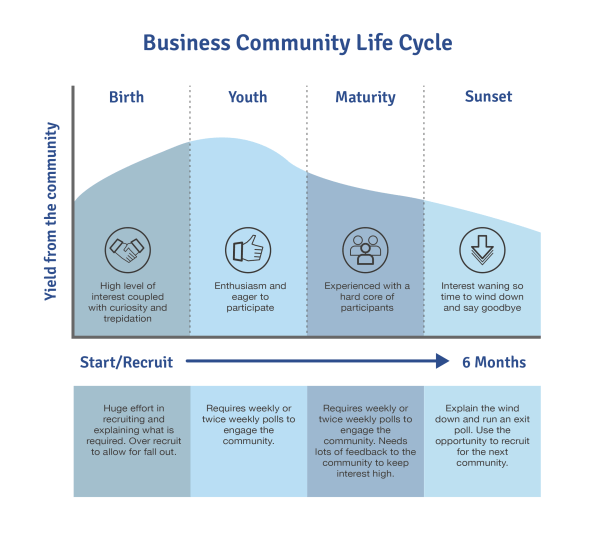

Business communities have a life cycle. There is the painful and sometimes protracted setting up of the community. In its youthful stage there is a high level of enthusiasm to participate. As long as the polls are short (around 10 questions) the community can handle one or two surveys per week. Not everyone in the community will participate so a poll of 500 members may, in any survey, generate only 100 or so responses. A well moderated community can see participation rates in the 40% to 50% range.

The initial trepidation about the community will soon be dispelled once people realise that the polls are quick and easy to complete. This will generate enthusiasm and an eagerness to participate in more surveys. It is inevitable that the novelty of taking part in surveys eventually begins to wane. The community can be expected to remain active for a few months but after six months participation rates will fall as the novelty of filling in polls begins to fade. When it becomes clear that the community is moving towards old age, it is better to retire the members and close it down rather than spend money and effort on rejuvenation. At the time of closure it is important to thank the members for their help and participation, to find out what they liked and disliked about the community experience, and possibly to recruit them to a new community.

The value of an online community

The online community is not going to replace other research tools. The polls that are completed by community members are short and sharp and will not always provide the depth that can be obtained from telephone interviews or focus groups. Even a large business community comprising 500 people will not yield more than 100 responses and so will not provide a sufficiently large database to yield insights into sub groups of respondents. Quantitative surveys will still be necessary. Where the online community comes into its own is in the speed of response. A request for information on a Friday night can be met with a full report by the following Wednesday. The fixed cost of setting up the community has been met and so the cost of the request is minimal.

Of course, the setting up and management of the online community has a significant cost. The justification for the online community therefore has to be based on the sure knowledge that it will be used many times over the six months or so that it operates. Like any high touch research, running a community the right way comes with a commensurate price tag.

Conclusions

Online communities are a new and exciting addition to the toolkit of the professional and industrial market researcher. In some cases they will replace focus groups and at other times they will replace quantitative surveys. Their strength lies in the fact that they comprise a ready recruited group of people with a high level of interest in a subject and who are prepared to engage in discussions with like-minded people.

The key to running a business online community is recruiting the appropriate audience in the first place and then having sufficient content to keep the community engaged. Frequent short polls are essential to justify the high fixed costs of the community and also to encourage participation from members. There are surprisingly few business communities in the world today but their contribution to business-to-business research could be considerable and we confidently expect to see more in the future.