Why We Measure Market Size

Knowing the size of a market is a fundamental requirement for all marketing plans. The market size is a measure of the potential available to a company and it is the starting point for developing a marketing strategy. This paper discusses how market size can be assessed.

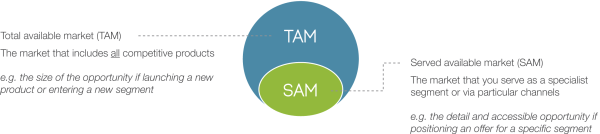

There are two measures of market size; the Total Available Market (TAM) and the Served Available Market (SAM).

Irrespective of whether it is the TAM or the SAM that is being assessed, the researcher needs to know what level of accuracy is required. Sometimes a rough estimate backed by certain assumptions is sufficient. For example, if the market size estimate is required to justify market entry, it may be sufficient to know that the market is, as a minimum, equal to a certain figure. Time spent arriving at an accurate estimate beyond this minimum figure could be time wasted.

The estimate may be required to guide strategic thinking and for this purpose an approximation may suffice. And clearly, if the marketing investment which will follow the market size study is relatively small, it will not justify a detailed and expensive research project.

How We Measure Market Size

The assessment of market size is nearly always just that – an assessment. For this reason it is worth attempting to calculate the market size in two or three different ways to validate and cross check the answers.

Market researchers assess markets in three ways:

-

Top-down – here they take a bird’s eye view using published reports and macro data wherever possible.

-

Supply side – these estimates are based on assessments of the size of each competitor supplying the market.

-

Demand side – this is sometimes referred to as “bottom-up” assessment in which the researchers combine end-user data with the numbers of operators within a market to create a formula that leads to the market size.

The Top-Down approach uses a combination of published data, previous research, government reports and potentially input from industry experts to offer a high-level view of the market.

Government statistics, trade associations and published reports can provide instant figures. These should always be reviewed with caution and where possible cross checked and validated. Seldom is the researcher blessed with exactly what is required and it may be necessary to use the statistics as the base for a further calculation.

The skill in this sort of work includes bringing together disparate pieces of data from separate sources. For example, if the researcher has a reasonable idea of a market size in one country, it may be possible to make estimates for other countries by relating the known market size to readily available statistics on population, gross domestic product (GDP) or some other proxy that indicates the relative size of the market in the other country.

A Demand Side approach sees a market size figure calculated by assessing likely demand for the product or service from the number of potential users in the market.

Whatever drives the market size can be used to “model” the market by applying the drivers to the calculation. For example, an obvious driver of the market for workplace gloves is the number of workers in an industry. In addition to knowing the number of workers in an industry, it would also be necessary to have other inputs such as the proportion of those workers who actually wear gloves, and how long they wear them before they are thrown away. Different estimates can be put into the model to see their effect.

The third approach is to assess a market from the Supply Side. This calculation is built from an assessment of the organisations serving it. The sum of the sales of all firms in the market equals its total size.

There are some obvious difficulties in this approach. Although it may be possible to get some indication of the total revenue of the suppliers, there may not be any detail on the specific product or service of interest.

Where information is not clearly available on company websites, press articles and sales literature can provide clues but often judgement and experience will be required to convert published information into useable sales figures.

Survey data may provide a reasonable estimate of the market shares of different suppliers to a market. If the researcher has the revenue data for just one of the suppliers, through simple arithmetic, it is possible to calculate the sales of the other suppliers based on their market shares.

Other sources of data are the suppliers to the market themselves. Suppliers may not openly offer their own sales figures but they may be happy to venture an estimate for their competitors.

5 Top Tips

Once clear on why and how we assess market size, a number of tips aid the process.

-

Comprehensive market sizing requires both primary and secondary research to build a clear picture across top-down, supply-side and demand-side analysis.

Secondary research rarely provides the final answer it does build a broad picture of the market, identifying criteria or assumptions on which to base further analysis or point to gaps that need further exploration. Primary Research explores the specific aspects of a market not addressed without talking to those directly involved.

-

It is usually necessary to speak with different audiences including end-users, suppliers, distributors and manufacturers to understand all aspects of the supply chain. An important but sometimes overlooked group are industry experts i.e. those who comment on a market or have significant experience such as Regulators or Legislative bodies, Trade Associations or Industry groups.

-

Even the most comprehensive analysis may leave gaps of understanding. This requires the confidence to make assumptions and to be explicit as to what they are.

-

It is important when market sizing to keep things simple. With significant quantities of data it is easy to become lost in the detail. Also it is important to ensure that all sources are documented so that they can be updated and referred to at a later date.

-

Finally, seeking client input throughout the process is essential. Though they may claim to know little about the market, there is likely to be much knowledge within the organisation that can add significantly to the analysis. As a broad generalisation it is also worth noting that many clients believe market size is to be much larger than they actually are, based on gut feel. It is therefore important to work with them through the calculation so that they can see the logic of the Independent approach.

Readers of this white paper also viewed:

Market Sizing: Is There A Market Size Formula? Market Segmentation in B2B Markets Entering Chinese Business-to-Business Markets: The Challenges & Opportunities