Make accurate and informed decisions on the scale of your investment

Through interviews, data mining, competitor analysis and consultancy, our market sizing analysis help you to understand the size and realistic sales opportunity of new and potential markets.

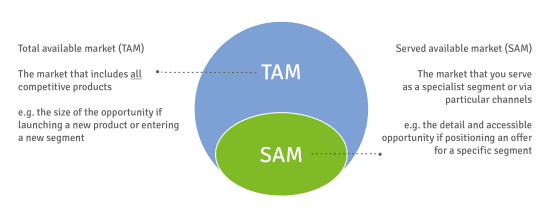

Underpinning every great business plan are two insights: how big is the market, and how much of it can we win? Market sizing research enables you to make accurate and informed decisions on the scale of your investment, as well as quantifying the potential returns.