BPTO – or Brand-Price Trade Off – is a statistical technique used in market research and marketing sciences. It models the relationships between your brands and the prices they command relative to other brands, providing a measure of relative ‘brand value’ or ‘brand equity.’

BPTO analysis answers questions such as:

- How much of a premium is your market willing to pay for your brand relative to your competitors (if at all)?

- What market share could you expect to attain at different price points relative to your competitors?

- Bearing in mind your market and brand positioning, what sort of pricing strategy makes most sense to improve market share, or increase revenue or profit?

- What is the maximum price that your brand can charge before losing significant market share to competitors?

- What is the relative influence of price and brand when the market is considering purchasing your product or service?

BPTO is useful in any situation where there is a strong interest in the interrelationship between brand and the price that a product or service is offered at. It is suited to categories where products and services are relatively similar to each other, and where brand is a strong determining factor behind decision-making.

Where the buying decision is more complex, for instance, where the specific features of a product or service are critical, a full conjoint modelling exercise is often more appropriate.

How BPTO works

BPTO entails a basic set up, as follows:

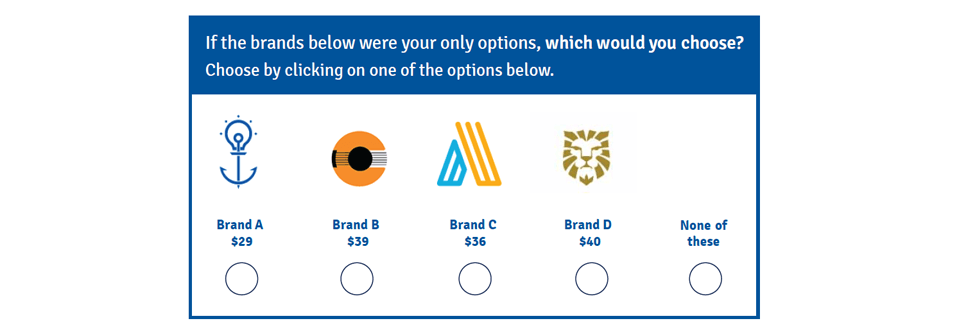

- Survey respondents are shown a series of branded products or services at once, each with a price associated with it – between 3 and 5 ‘offers’ are typically shown at once

- Consumers are asked which of the offers presented is most appealing in a hypothetical buying scenario. Respondents are able to choose a “none of these” option if none of the brands nor their price points are of interest

The price that is associated with each brand is determined in one of two ways:

1. Prices for all brands that are tested are shown from the same base level.

If a brand is selected, its price increases by one increment relative to the others. The exercise continues in this fashion across multiple questions until such a point that a different brand is chosen. Evaluation of the remaining brands continues until all are chosen, or the “none” option is used.

It is also possible for the respondent to continually reject offers at the price offered. In some variations of the exercise, the base price is lowered for those brands that have not yet been selected. In general, this version of the exercise is used less frequently as it tends to draw attention to the dynamics of price, and so unduly affects how respondents behave.

2. Prices are randomly varied for each brand within a range of possible values.

Survey participants then give feedback about the brand they would choose at these different price points. Respondents are asked to give their feedback on several iterations of randomly generated price and brand combinations.

An example of a BPTO exercise under this setup is shown below:

The brand and price preference data is then analyzed statistically to derive several important outputs:

- The ‘shares of preference’ (akin to market shares) of each brand at any given combination of price points.

- Price sensitivity coefficients and price curves for different brands, simulating the expected demand for each brand for different price scenarios.

- The relative influence (utility) of price and brand in shaping decision-making.