In this week’s review of findings from our COVID-19 tracker, we explore business sentiment and the emotional impact of the crisis. A number of surprises emerge…

Fear. Distress. Anguish about loved ones, angst about our employment, anger about our predicament. In our personal lives, the COVID-19 pandemic has unleashed a range of emotions and a jumble of coping mechanisms in all of us. Surveys have tracked consumers’ emotional and physical responses to the crisis. In the US, Medical News Today reported 22% of people turning to alcohol and 36% experiencing sleeping problems. More positively, 84% claimed to be focusing on being more productive and over half believed laughing about the situation had improved their wellbeing.

At B2B International our interest is in the behavior and emotions of businesses, which are after all collections of people and thus intrinsically emotional. Just like individuals, businesses seek relationships, pride, self-actualization. As employees we are often at our most emotional when partaking in our working lives. Proud of our achievements. Distressed, even humiliated by our failures. Protective yet jealous of our colleagues. And as our working lives and personal lives become irrevocably intertwined, the emotional sensitization of us and our businesses only increases.

And so as we continue to track business sentiment throughout COVID, this fourth week we focus on the emotional state of businesses. What emotions are business decision makers experiencing, what is causing those emotions, and what does this mean for their businesses?

Widespread concern and defiant optimism

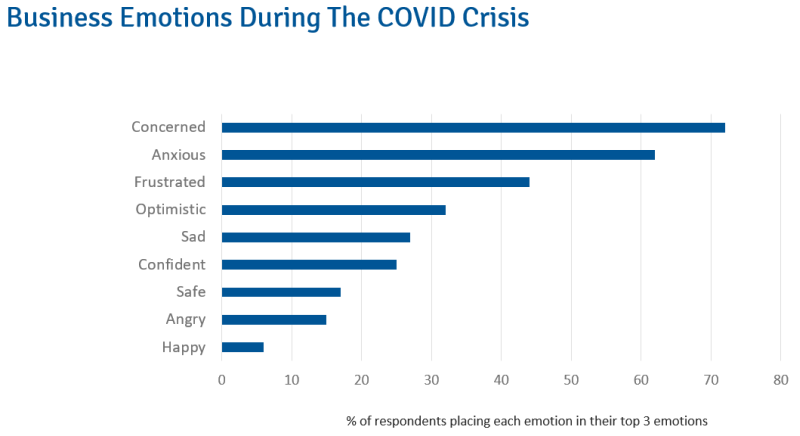

It will be no surprise to learn that decision makers’ negative emotions have outweighed the positive over the course of the crisis. Over 70% of businesses feel that ‘concerned’ is one of the top 3 emotions they are feeling, with ‘anxious’ not far behind. Beneath these top issues the picture becomes more intriguing. Almost half of decision makers describe themselves as simply ‘frustrated’ in these times of budget cuts, investment reductions, furloughs and other drastic changes of plan.

But a full third of businesspeople remain ‘optimistic’, with 25% ‘confident’, even as we head into a recession that may be unprecedented for centuries. It is easy to forget that many businesspeople (in fact many people in general) are optimists by temperament; in addition the greatest moments of disruption create the greatest opportunities for companies that are in the right sector and at the right moment.

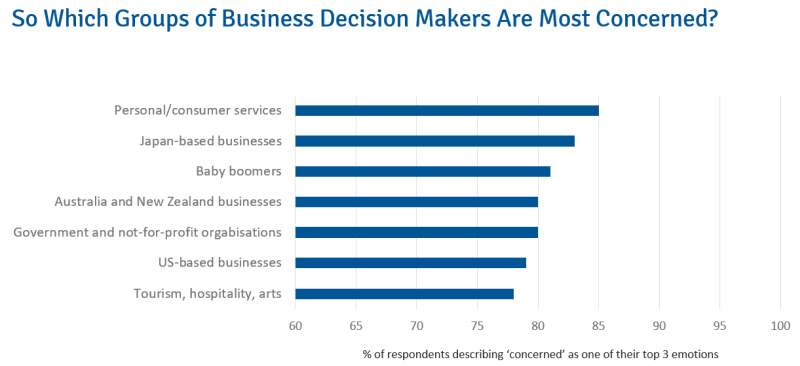

So which groups of decision makers are experiencing most concern?

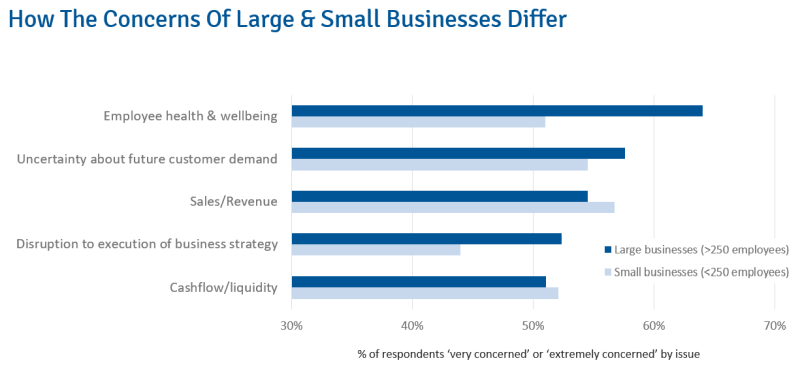

Big businesses are just as concerned as the SMEs

Our findings on which businesses are most concerned by the impact of COVID dismantle a number of stereotypes. Large businesses with over 250 employees (68%) are almost as concerned by the situation as the small businesses (76%) that are often assumed to be intrinsically fragile. This level of concern has barely changed since we began tracking business opinion in late March – most businesses are worried, and this worry has become ingrained. On the fundamentals of cashflow, sales generation and future business prospects, smaller businesses and larger businesses are equally anxious. All sizes of business are worried that prospects and sales will remain reduced in the medium-term, and that a lower cost base will soon have to follow.

Big businesses are most concerned by employee engagement & wellbeing

The general public is extremely sceptical that large companies care about their employees. A 2017 YouGov survey in the UK showed that only 23% trust people who run large companies, and most believed that business leaders need to be fairer with employees and other stakeholders. Smaller businesses are frequently seen as more in touch with their communities, more authentic, more altruistic.

Yet our tracker shows that during this pandemic, concern for employee engagement and wellbeing is far greater in larger businesses than in SMEs. Two thirds of large businesses are ‘very concerned’ or ‘extremely concerned’ by this issue, making it more worrisome to them than even their businesses’ financial concerns. Yet among smaller businesses, only just over half state that they are concerned by these employee issues. If small businesses are not prioritizing the employee experience during these difficult moments, we can expect their employer brands to be tarnished, and their staff attrition rates to increase when the economy recovers and vacancies for new roles re-emerge.

Our many studies on business lifecycle show that as businesses grow, their planning becomes more strategic, more long-term and more granular. It is unsurprising therefore that in the current pandemic, these larger businesses are more concerned than smaller businesses that their strategies will be disrupted.

Outside Germany, worry is everywhere

Counterintuitively, businesspeople based in countries at the epicentre of the crisis (generally regarded to be Western Europe for most of the past 8 weeks) are less likely to be feeling concern than those in the Americas or APAC. This is due in large part to a low level of concern (44%) in Germany – seen by most to have effectively limited the spread of the disease and subsequent fatalities. But even businesses in the UK (worst affected country in Europe by number of fatalities) are not significantly more concerned than businesses in most other locations. This may be due to Government response – despite its perceived poor performance on disease management, the UK’s furlough scheme in particular is widely seen to have improved the short-term prospects of businesses.

Millennial business decision makers – most relaxed about the crisis, and most positive about their Governments’ response

Perhaps most stereotype-defying of all, the millennial generation of new decision makers and entrepreneurs is ostensibly showing greater emotional fortitude than older generations. In fact the level of concern and anxiety felt by the business community is shown by our study to increase with age. The psychologist’s view that emotional regulation skills increase throughout adulthood is perhaps outweighed by the health risks faced by over-50s and the caring responsibilities that must be woven into the working days of the middle-aged. Millennials (65%) are more likely than anyone to be confident in their Governments’ handling of the epidemic, more likely to be confident in their Governments’ funding for businesses and employee retention programs (65%) and more likely to be confident in their Governments’ ability to handle future disruptions (68%).

Overcoming The Concerns

So if worry is almost everywhere, how does business navigate the COVID crisis? Here, businesses see one solution above all other.

During a pandemic, an online presence is an excellent relaxant

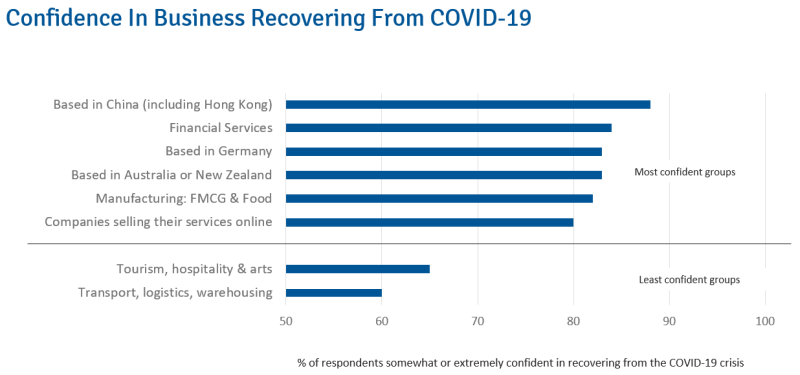

Those who do not sell online or via an e-commerce platform are notably more worried than those that do – unsurprising given that millions of bricks and mortar businesses have been forced to close down in the short-term, and welcome fewer customers into their outlets in the long-term. Online businesses are among the most confident not only that they will successfully recover from the COVID crisis, but also that their country will. Most strikingly of all, they are 6 times more likely than businesses not selling online to predict considerable revenue growth during 2020.

So Who Will Succeed?

Future predictions are difficult in such a fluid and unprecedented situation. However the mood is measured rather than unduly pessimistic, with a 74% of businesses expressing confidence that they will recover. Businesses fall into clear groups of optimists and pessimists. In addition to companies operating extensively online, specific sectors and countries see themselves as well prepared to recover from the pandemic.

On the pessimistic side, ability to travel is the big driver: tourism, hospitality and distribution/logistics are generally feeling negative, albeit 60% or more believe their businesses will recover. Most positive? German businesses, financial services firms, FMCG/food manufacturing companies and those with an online presence all report in large numbers their confidence that their businesses are resilient and will recover.

But most confident of all are businesses based in China, a country which has largely put the pandemic behind it and reached a ‘new normal’. A reminder, perhaps, that the crisis will not last forever, and business’ emotions will continue to change.