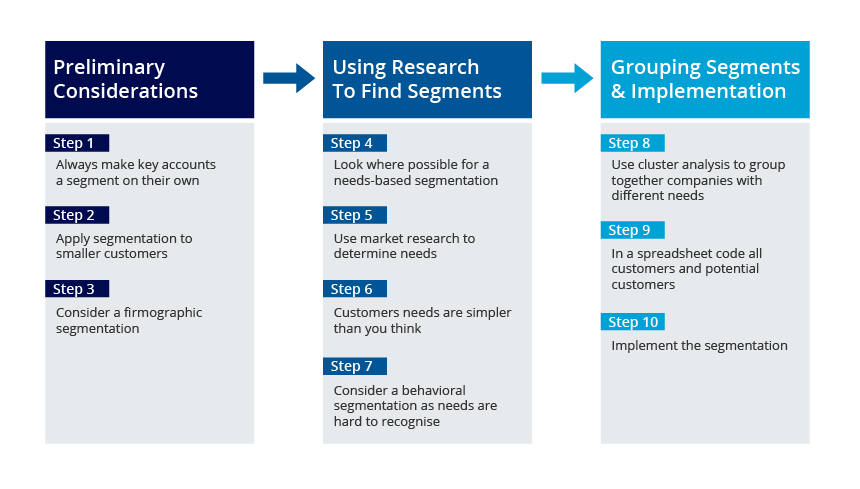

Figure 1 – A Practical 10-Step Guide to Market Segmentation Research

Step 1: Always Make Key Accounts A Segment On Their Own

Every company needs to segment its customers. Customers aren’t all the same and they shouldn’t be treated as such. Virtually every business to business company has key accounts and these are recognized as different and given special treatment.

The 80/20 rule which determines that 20% of customers account for 80% of turnover focuses special activity on those large accounts which determine the future of a business. For many business to business companies these key accounts amount to just a couple of handful of customers. It is quite reasonable therefore that such large and crucial customers should be treated as individuals, scoping products and services to exactly meet their needs. This is market segmentation research at its best – segments of one.

Step 2: Apply Market Segmentation Research Analysis To The Smaller Companies

However, the corollary of the 80/20 rule is that 80% of customers account for only 20% of revenue. Eighty per cent of customers are, by definition, relatively small accounts and they dominate the customer population. Clearly they should not be treated in the same way as the key accounts. Since this tail end of customers can run in to many hundreds of accounts, some sort of segmentation is needed. Without market segmentation research these companies will either be treated as all the same (in which case many will be disappointed by an offer that does not suit them) or, equally unsatisfactory, an attempt will be made to treat each and every one as a special accounts, swallowing up a huge resource and yielding very little in the way of profit.

Segmentation enables us to group together customers with similar needs so that we can bring together limited resources to best serve them.

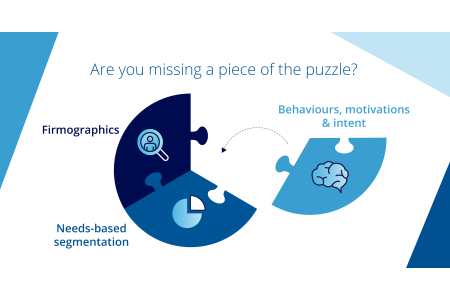

Step 3: Consider A Firmographic Segmentation

The question is, “how to segment?”. One of the simplest ways is to group together companies with a common physical attribute such as they are in a certain region, or classified in a particular industry. This is the equivalent of demographic segmentation in a consumer company. The classifications are important as they are often critical to understanding their needs. Demographics in consumer markets and firmographics in business to business markets is after all an important driver of its needs. A company selling welding equipment knows that welders in shipyards have quite different needs to welders in car assembly plants and so the industry grouping immediately flags up their need for a different offering. The needs for oil lubrication in the engine room of a supertanker are quite different to the needs for lubrication in the engines of the cars you and I drive. A market segmentation research exercise according to industry grouping is therefore one of the most obvious and often most useful we can employ in business to business markets.

Step 4: Look Where Possible For A Needs-Based Segmentation

However, there are potential problems with segmentations based on industry. A company selling accountancy software may find that there is little difference in the needs for its products in a food company compared to one that makes steel. A company selling office copiers is unlikely to find much help from an industry segmentation that separates out manufacturers of safety pins from manufacturers of safety products. In many markets the needs of customers have a good deal of crossover. Customers in a segment made up of heavy manufacturing companies could have the same need for customer service as companies making light electronic goods.

Furthermore, market segmentation research based on industry groupings is so obvious that the chances are that this is how everybody does it. In other words there is no competitive advantage to be achieved in doing what everyone else is doing.

A segmentation based on needs is, in theory, the ideal as it gets to the heart of marketing; that is the identification and satisfaction of customers needs’ – at a profit of course. There are however, a number of practical problems in achieving a needs based segmentation in business-to-business markets.

Step 5: Use Market Segmentation Research To Find Out Needs

The first and very obvious problem is that needs are difficult to recognize. Market segmentation researchers are able to help in this regard. Certainly it is possible for market segmentation researchers to devise questions which ask people what they require from suppliers, though this is not without some difficulties. How do we decide whose needs are to be satisfied? Is it the needs of the company, or the needs of the department that is involved in choosing the supplier, or is it the needs of the individual within the department who is a key decision maker?

All three of these needs must be addressed but there could be conflicts. At a company level, there could be an overriding need to choose suppliers that offer quality products, suppliers that are committed to the market, and suppliers that can be trusted. And yet, at a personal level, the purchasing manager may think he has to drive down prices to demonstrate that he is doing an excellent job. A market research question addressed to the buyer may elicit an answer that leads us to believe that the company is price driven when in fact the company demands quality products with full service.

The decision-making unit in many businesses comprises no less than two or three people. The professional buyers look after the day today procurement of supplies. The same company may also have chemists, engineers or technicians who play an active role in screening products and suppliers before they are approved list. A production manager could have a say in which suppliers are used as the choice could materially affect output levels on his production line.

Another problem in classifying companies according to their needs is that they can change quite quickly. When products are in short supply, deliveries are critical and many business to business markets have a large segment expressing a need for suppliers to deliver full orders, on time, every time. If the same market takes a downturn and frees up the supply of products, delivery may not be the issue that it once was. In a recessionary environment the company purchasing the products may be fighting for its life and be driven by the need to get costs as low as possible. A needs based segmentation would have to be capable of recognizing the shift that can take place in a company’s needs if they change or if the personalities involved in the decision-making unit change. If these changes cannot be recognized an offer could be pushed to a group of customers who simply are not interested in it.

These cautionary notes do not mean that needs based segmentations are inappropriate in business to business markets. Quite the opposite. They are the ultimate segmentation if they can be achieved. Indeed, it is healthy for every company to constantly be reviewing its customers’ needs and responding to them. If a company has a mechanism for recognizing the needs and making adjustments when they change, this focus on customers and what they want will pay huge dividends. Sales forces will become skilled and practiced at asking customers what they want and ensuring that the right offer is directed at them, so satisfying them and achieving the maximum profit. A needs based segmentation is the best means by which business-to-business companies can change from being product orientated to marketing orientated.

Step 6: Customers’ Needs Are Much Simpler Than You Think

The starting point of a needs based segmentation is to have a heart searching review of what these needs may be. It is wise to keep the list of possible needs relatively short. Although we like to believe that buying decisions are a sophisticated synthesis of the many attributes in an offer, the reality is that there are usually just one or two factors that drive the choice of which product to buy or supplier to use. This is the action of cognitive misers. People are economical with their mental resources and make decisions based on just one or two criteria rather than a multi-attribute utility decomposition. Some of these criteria could be in the following list

- Quality products

- High levels of sales service

- The excellent reputation of the company

- Low prices

- High levels of technical service

- On time and reliable delivery

- Ease of doing business with the supplier

The list could be extended and modified according to the market but there will almost certainly be many of the above criteria that look and feel similar. And there should never be more than 10 factors on the list – eight is better.

It is now necessary to find out how important these different criteria are to our customers. We can do this in general conversation but that would make it difficult to analyse the results from hundreds of conversations with customers. Also customers may say that something is important and fail to mention others factors which they take for granted. It is helpful therefore to remind respondents of the different criteria by showing them the list or reading it out.

Some researchers use scales (from 1 to 10) to indicate the importance of the criteria to the customer. The trouble with this approach is that all the factors are seen to be important generating scores of 7, 8, 9, or 10. It is more useful to use a simple tradeoff question in which the respondent is given 20 points and asked to spend these points to indicate what they look for in a supplier. This forced choice is getting closer to how decisions are made for, as has been said, most people have just one or two criteria that are really important.

Step 7: Consider A Behavioral Segmentation If Needs Can’t Be Recognized

There is a half way house between a firmographic segmentation and a needs based segmentation and this is behavioral segmentation. In some markets identifying needs can be truly difficult for the reasons discussed earlier in this paper. The decision making unit is made up of many people; the needs are always changing. If this is the case, an alternative segmentation could be to find a measure of behavior that provides a good clue as to the hidden needs.

For example, some companies exhibit considerable loyalty to suppliers while others are constantly switching. This simple classification based on behavior may be a good indication of the needs of the customers. Some preferring a long-term partnerships and being prepared to pay for this while others roam the market seeking cut price deals wherever they can.

Another example of buyer behavior could be to divide the market between companies that go out to tender with a closely scoped brief of their requirements versus companies that talk about their requirements with suppliers, asking for suggestions as to how their needs can best be satisfied. Not surprisingly, companies that exhibit the behavior of a tightly scoped brief are more likely to be driven by price and basic transactions whereas those that are more open to suggestions could value service and be prepared to pay for it.

Behavioral segmentation is therefore a strong option if it is too difficult to find a segmentation based directly on needs.

Step 8: Use Cluster Analysis To Group Together Companies With Different Needs

Once customers have been asked the trade-off question or their behavior has been successfully determined, the answers are analysed using cluster analysis to group the respondents with similar answers. SPSS or some other statistical analysis tool is used to generate two, three, four or five clusters. It is unlikely that a market segmentation with more than five clusters will be useful as each segment requires a distinct and different offer. The whole aim of a good segmentation is to find a result which meets the needs of the market but reduces the number of offers so as to improve the efficiency of the supplier.

It is not unusual in segmentation analysis of this kind to find that a significant proportion of the population (often around 50%) requires the full package of criteria. They want a bit of everything from the list. However, there will be groups of customers who are strongly driven by just one or two of the criteria. For example, some will for sure want low prices and be prepared to forego other elements of the offer. Others may value the quality of products to the point where price is of little consequence. Quite clearly these groups of customers require different offers with different pricing scenarios.

Having achieved a segmentation based on customers’ needs, a procedure is required for placing new customers into an appropriate segment. This should not be difficult as the points spend question can be asked of new customers and their answers will enable them to be classified accordingly. The points spend question should also be repeated every six to twelve months with current customers to ensure that any changing needs are recognized and addressed.

Step 9: In A Spreadsheet, Code All Customers And Potential Customers

Almost every business-to-business company has its customers listed in some sort of spreadsheet. This record of customer activity could be a sophisticated customer relationship management system or in most cases a simple Excel file. In the segmentation process, every customer on the spreadsheet must be located in one of the segments.

The starting point for grouping companies on the spread sheet is to use the answers to the points spend question. This should not be without some debate. It is conceivable that the answers to the trade-off question (or behavior questions) do not fit with the actions of the respondent company. It would not be the first time that the answers given in the interview were wrong, either because they were not given sufficient consideration by the respondent and answered glibly, or it was someone other than the key decision maker who answered, or that the respondent was simply being mischievous and trying to make a point (such as saying they were looking for lower prices in order to drive prices down).

Each response must pass a review and debate until there is sufficient confidence to allocate it to a particular segment in the spreadsheet. This spreadsheet will then be used to group companies, to direct messages and mailings, and to measure sales and profitability. The ultimate test of a good market segmentation is that it brings in business which is profitable. The spreadsheet is the control mechanism by which this is measured.

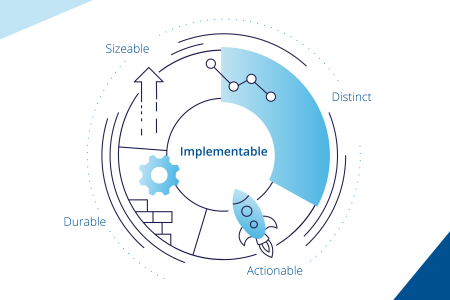

Step 10: Implement The Market Segmentation

Having established a segmentation based on either customers’ needs or behavior, the final and arguably one of the most difficult tasks is to implement it. Each segment by definition requires a different offering. The offering, or as we prefer to refer to it the customer value proposition (CVP), must be recognizably different and distinctive for each segment. Where claims have been made for the value proposition, these must be defendable in that it should be possible to demonstrate and prove to customers that the wonderful claims that distinguish it really are true.

Armed with the segmentation and appropriate CVPs that go with them, it is now time to engage the support of the sales force. Winning the cooperation of the sales force is not always easy. Salespeople have a built in resistance to being told that there are customers in their patch who are not necessarily interested in the lowest prices. In many business-to-business segmentation studies, price fighters usually account for less than a third of all customers and sometimes considerably less. This flies in the face of a salesperson’s instinct who believes that all customers are price conscious and therefore driven by price.

Implementing market segmentation research requires the sales force to understand the benefits of segmentation. It also requires them to be trained in asking the “killer questions” that determine which segment customers and potential customers fall into. In the early days of implementing a new market segmentation it is essential to closely monitor the sales force to ensure that they work towards a successful needs segmentation and do not kill it in order to return to a cozy life in which they are given free rein and any offer will do.