Satisfying people’s needs and making a profit along the way is the purpose of marketing. However, people’s needs differ and therefore satisfying them may require different approaches. Identifying needs and recognizing differences between groups of customers is at the heart of marketing.

What Is Marketing If It Is Not About Segmentation?

CVS Pharmacy is one of the most successful drug store chains in America. What is the reason for this success? They understand their market and have approached it through market segmentation and targeting.

The company looked at its customer base and found that 80 percent are women. With this in mind, CVS redesigned 1,200 of its 6,200 stores to meet the needs of busy, multi-tasking women by offering shorter wait times for prescriptions, wider and better-lit shopping aisles, and more beauty products. In doing so it fulfilled the requirement of all good marketing orientated companies – it identified the needs of its customers and organized its offer to better meet them. This is at the heart of all good marketing – meeting customers’ needs profitably, and allocating finite resources in such a way that profit is maximized. This means not wasting time or resources on customers who would be less profitable, and treating the key targets not as one homogeneous population but as distinct groups with distinct needs.

It is very rare for even two customers to have identical needs to each other. In a perfect world, we would identify those customers that we deem to be profitable, and then treat each one of those individually according to their unique needs. In any market with a sizable target audience, even this is likely to require more resources than is practical or profitable. To reiterate, segmentation, like marketing itself, is all about the profitable satisfaction of customers’ needs. It is designed to be a practical tool, balancing idealism against practicality and coming up with a solution that maximizes profit.

This means we have to be clever in targeting our offers at people who really do want them, need them and are willing to pay for them. Equally, we have to be strong in setting aside those who do not. We have to choose our target audience on the basis of our capabilities and strengths. In other words we have to choose our own battlefield where we are confident that we are more attractive than our competitors. This early observation is fundamental, as it requires us to think as hard about where we don’t want to sell our product as where we do.

This brings us to the consideration of the difference between marketing and selling. Selling focuses on the product in hand and our pressure to get rid of it, almost regardless of the needs of the customer. It is clear that brutal selling may leave a customer with a product they wish they had never bought and, therefore, they may never return as a customer again. Marketing takes a longer-term view. Marketing, and in particular segmentation, concerns itself with the matching of customers’ needs with suppliers’ needs and capabilities. More time and effort may be required but the customer is more likely to be comfortable with their decision and be loyal.

The fundamentals of marketing are the same fundamentals of segmentation. Know your customers, know how they differ, and have a clear proposition that lights their fire. We will return to these issues but first we will examine the differences between consumer and business-to-business markets, as our challenge is to arrive at a business-to-business segmentation.

B2B Customer Segmentation Challenges

Business-to-business markets are characterized in a number of ways that makes them very different to their consumer cousins. Below we summarize the main differences between consumer and business-to-business markets, and set out the implications for b2b market segmentation:

1) B2B markets have a more complex decision-making unit: In most households, even the most complex and expensive of purchases are confined to the small family unit, while the purchase of items such as food, clothes and personal items usually involves just one person. Other than low-value, low-risk items such as paperclips, the decision-making unit in businesses is far more complicated. The purchase of a piece of plant equipment may involve technical experts, purchasing experts, board members, production managers and health and safety experts, each of these participants having their own set of (not always evident) priorities.

Segmenting a target audience that is at once multifaceted, complex, oblique and ephemeral is an extremely demanding task. Do we segment the companies in which these decision makers work, or do we segment the decision makers themselves? Do we identify one key decision maker per company, and segment the key decision makers. In short, who exactly is the target audience and who should we be focusing on in b2b market segmentation?

2) B2B buyers are more “rational”: The view that b2b buyers are more rational than consumer buyers is perhaps controversial, but we believe true. Would the consumer who spends $3,000 on a leather jacket that is less warm and durable than the $300 jacket next-door make a similar decision in the workplace? Consumers tend to buy what they want; b2b buyers generally buy what they need.

It perhaps therefore follows that segmenting business markets based on needs should be easier than segmenting a consumer audience. In business-to-business markets it is critical to identify the drivers of customer needs. These often boil down to relatively simple identifiers such as company size, volume purchased or job function. These identifiers often enable needs and therefore segments to be quite accurately predicted.

3) B2B products are often more complex: Just as the decision-making unit is often complex in business-to-business markets, so too are b2b products themselves. Even complex consumer purchases such as cars and stereos tend to be chosen on the basis of fairly simple criteria. Conversely, even the simplest of b2b products might have to be integrated into a larger system, making the involvement of a qualified expert necessary. Whereas consumer products are usually standardized, b2b purchases are frequently tailored.

This raises the question as to whether b2b market segmentation is even possible – if every business customer has complex and completely different needs, it could be argued that we have a separate segment for every single customer. In most business-to-business markets, a small number of key customers are so important that they “rise above” the segmentation and are regarded as segments in their own right, with a dedicated account manager. Beneath these key customers, however, lies an array of companies that have similar and modest enough requirements to be grouped into segments.

4) B2B target audiences are smaller than consumer target audiences: Almost all b2b markets exhibit a customer distribution that confirms the Pareto Principle or 80:20 rule. A small number of customers dominate the sales ledger. Nor are we talking thousands and millions of customers. It is not unusual, even in the largest business-to-business companies, to have 100 or fewer customers that really make a difference to sales. One implication is that b2b markets generally have fewer needs-based segments than consumer segments – the volume of data is such that achieving enough granularity for more than 3 or 4 b2b segments is often impossible.

5) Personal relationships are more important in b2b markets: A small customer base that buys regularly from the business-to-business supplier is relatively easy to talk to. Sales and technical representatives visit the customers. People are on first-name terms. Personal relationships and trust develop. It is not unusual for a b2b vendor to have customers that have been loyal and committed for many years.

There are a number of b2b market segmentation implications here. First, while the degree of relationship focus may vary from one segmentation to another, most segments in most b2b markets demand a level of personal service. This raises an issue at the core of customer value segmentation – everyone may want a personal relationship, but who is willing to pay for it? This is where the supplier must make firm choices, deciding to offer a relationship only to those who will pay the appropriate premium for it. On a practical level, it also means that market research must be conducted to provide a full understanding of exactly what “relationship” comprises. To a premium segment, it may consist of regular face-to-face visits, whilst to a price-conscious segment a quarterly phone call may be adequate.

6) B2B buyers are longer-term buyers: Whilst consumers do buy items such as houses and cars which are long-term purchases, these incidences are relatively rare. Long-term purchases – or at least purchases which are expected to be repeated over a long period of time – are more common in business-to-business markets, where capital machinery, components and continually used consumables are prevalent. In addition, the long-term products and services required by businesses are more likely to require service back-up from the supplier than is the case in consumer markets. A computer network, a new item of machinery, an HVAC unit or a fleet of vehicles usually require far more extensive aftersales service than a house or the single vehicle purchased by a consumer. Businesses’ repeat purchases (machine parts, office consumables, for example) will also require ongoing expertise and services in terms of delivery, implementation/installation advice, etc that are less likely to be demanded by consumers.

In one sense this makes life easier in terms of b2b segmentation. Segments tend to be less subject to whim or rapid change, meaning that once an accurate segmentation has been established, it evolves relatively slowly and is therefore a durable strategic tool. The risk of this, and something which is evident in many industrial companies, is that business-to-business marketers can be complacent and pay inadequate attention to the changing needs and characteristics of customers over time. This can have grave consequences in terms of the profitability of a b2b market segment, as customers are faced with out-of-date messages or benefits that they are not paying for.

7) B2B markets drive innovation less than consumer markets: B2B companies that innovate usually do so as a response to an innovation that has happened further upstream. In contrast with FMCG companies, they have the comparative luxury of responding to trends rather than having to predict or even drive them. In other words, B2B companies have the time to continually re-evaluate their segments and CVPs and respond promptly to the evolving needs of their clients.

8) B2B markets have fewer behavioral and needs-based segments: The small number of segments typical to b2b markets is in itself a key distinguishing factor of business-to-business markets. Our experience of over 2,500 business-to-business studies shows that B2B markets typically have far fewer behavioral or needs-based segments than is the case with consumer markets. Whereas it is not uncommon for an FMCG market to boast 10, 12 or more segments, the average business-to-business study typically produces 3 or 4.

Part of the reason for this is the smaller target audience in business-to-business markets. In a consumer market with tens of thousands of potential customers, it is practical and economical to divide the market into 10 or 12 distinguishable segments, even if several of the segments are only separated by small nuances of behavior or need. This is patently not the case when the target audience consists of a couple of hundred business buyers.

The main reason for the smaller number of segments, however, is simply that a business audience’s behavior or needs vary less than that of a (less rational) consumer audience. Whims, insecurities, indulgences and so on are far less likely to come to the buyer’s mind when the purchase is for a place of work rather than for oneself or a close family member. And the numerous colleagues that get involved in a B2B buying decision, and the workplace norms established over time, filter out many of the extremes of behavior that may otherwise manifest themselves if the decision were left to one person with no accountability to others.

It is noticeable that the behavioral and needs-based segments that emerge in business-to-business markets are frequently similar across different industries. Business market segmentation tends to generate common characteristics, resulting in the following needs-based segments:

- A price-focused segment, which has a transactional outlook to doing business and does not seek any “extras”. Companies in this segment are often small, working to low margins and regard the product/service in question as of low strategic importance to their business.

- A quality and brand-focused segment, which wants the best possible product and is prepared to pay for it. Companies in this segment often work to high margins, are medium-sized or large, and regard the product/service as of high strategic importance.

- A service-focused segment, which has high requirements in terms of product quality and range, but also in terms of aftersales, delivery, etc. These companies tend to work in time-critical industries and can be small, medium or large. They are usually purchasing relatively high volumes.

- A partnership-focused segment, usually consisting of key accounts, which seeks trust and reliability and regards the supplier as a strategic partner. Such companies tend to be large, operate on relatively high margins, and regard the product or service in question as strategically important.

How To Segment

The benefits of b2b segmentation are not hard to grasp. The challenge is arriving at the most effective groupings.

A common approach when segmenting business markets is to base this mainly on company size. The consumption levels of business-to-business customers are so widely different that this often makes sense due to large companies usually thinking and acting differently to small ones. A further sophistication may be to classify customers into those who are identified as strategic to the future of the business, those who are important and therefore key and those who are smaller and can be considered more of a transactional typology.

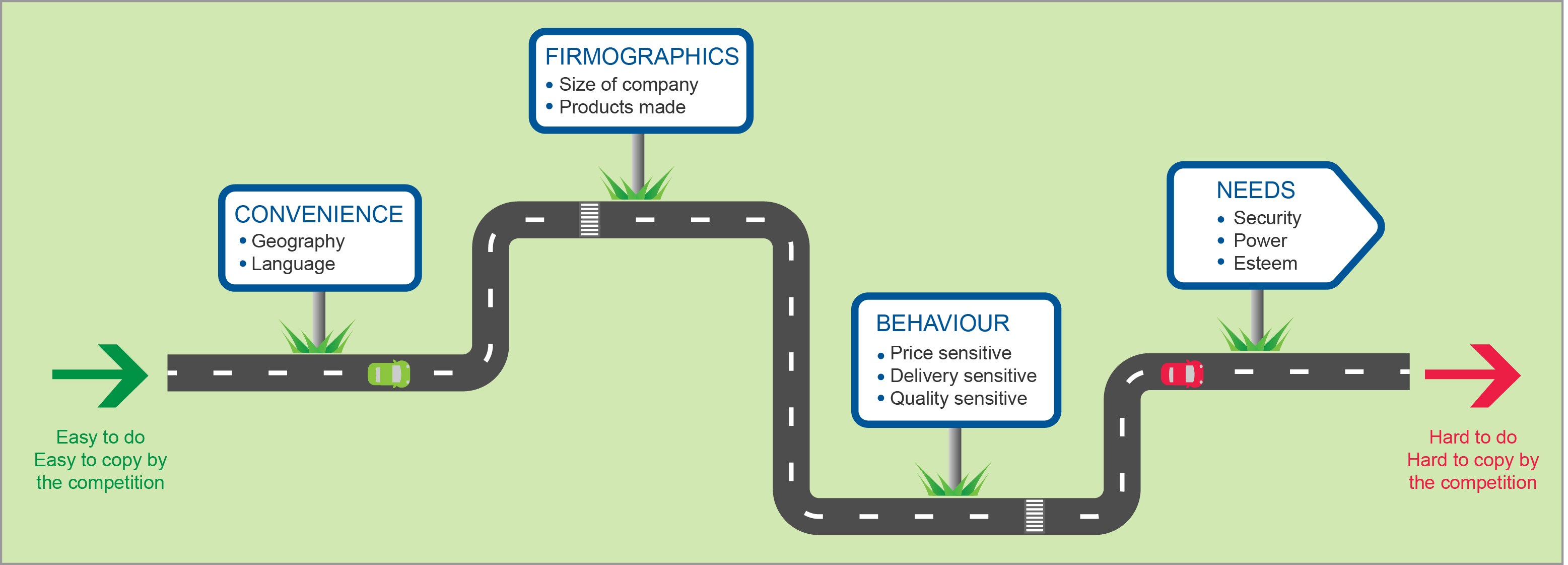

These “demographic” approaches to business market segmentation, sometimes referred to as “firmographic segmentation”, are perfectly reasonable and may suffice. However, they do not offer that sustainable competitive advantage that competitors cannot copy. A more challenging segmentation is one based on behavior or needs. Certainly large companies may be of key or strategic value to a business but some want a low cost offer stripped bare of all services while others are demanding in every way. If both are treated the same, one or both will feel unfulfilled in some way and be vulnerable to the charms of the competition.

It is not easy to jump straight into a fully-fledged needs-based segmentation. Most companies are starting with some history of involvement in business market segmentation, even if it is only a north/south split of its sales force. Companies move down the road of segmentation learning all the way.

There may be problems in developing a needs-based segmentation but this is at least an aspiration to drive towards. The question is “how?”

The starting point of any business-to-business segmentation is a good database. A well-maintained database is high on the list in any audit of marketing excellence in a business-to-business company. The database should, as a minimum, contain the obvious details of correct address and telephone number together with a purchase history. Ideally it should also contain contact names of people involved in the decision-making unit, though this does present problems of keeping it up to date.

Management is frequently blissfully unaware of the parlous state of its databases as it is rarely involved in inputting and maintaining data. Sometimes the best database in the company is the Christmas card list held close to the chest of every sales person.

A comprehensive and up-to-date database is only the start of the segmentation process. A mechanism is now needed for determining every need of every company on the database. The commonsense approach may appear to be to ask them. However, what questions would you ask and could you be sure of the answers? It is not that people lie but they may not be able to acknowledge the truth;

- Do people really buy a Porsche for engineering excellence?

- Do people really choose an Armani suit because it lasts so well?

- Do people, who say they buy their chemicals purely on price, never require any technical support or urgent deliveries from time to time?

Sometimes the simple question and the straightforward answer is enough. At other times a more sophisticated approach is required. Statistical techniques (specifically factor analysis) can be used to show the association between the overall satisfaction with a supplier and satisfaction of that supplier on a whole range of attributes that measure the customers’ needs. It can be determined that any individual attributes receiving high satisfaction scores must drive the overall satisfaction score and therefore be an important reason for choosing that supplier. In other words, instead of asking what factors are important, we can derive them. Buyers of Armani suits may show a strong link between overall satisfaction with the suit and attributes related to the brand and so point to the importance of the brand in the buying decision.

Using Statistics To Arrive At A Segmentation

The classification data on questionnaires provides demographic data while questions in the body of the interview determine aspects of behavior. Cross tabulations of data on these criteria allow us to see the different responses among groups of respondents. This is market segmentation at its simplest level and every researcher uses the computer tabulations of findings to establish groups of respondents with marked differences.

However, we can use statistical techniques, in particular multivariate analysis, to allow more sophisticated segments to emerge. In a b2b segmentation study (or even in a customer satisfaction study), respondents are asked to say to what extent they agree with a number of statements. These statements are designed to determine the needs and interests of the respondents. Typically there are a couple of dozen such statements, sometimes more. The possible combinations of groupings from 200 interviews are literally millions and we need some means of creating combinations that have a natural fit.

Using a technique known as factor analysis, statisticians can work out which groups of attributes best fit together. Looking through the different statements or attributes that make up these groupings it is usually possible to see common themes such as people who want low prices with few extras, people who want lots of services or add-ons and are prepared to pay for them, people who are concerned about environmental issues and so on. Factor analysis reduces the large number of attributes to a smaller but representative sub-set. These sub-sets are then given labels such as “price fighters”, “service seekers” and any other such terms that help the marketing team know exactly who they are addressing.

The groupings of needs that have been worked out by factor analysis are now run through further computations using a technique known as cluster analysis. These factors are presented to the cluster analysis whose algorithms rearrange the data into the partitions that have been specified and so determine how neatly the population fits into the different groupings.

The statistical approach to a needs-based segmentation has become extremely popular and it is certainly an important objective means of finding more interesting and possibly more relevant ways of addressing the customer base. However, the tastes and needs of populations are constantly changing and we should always be mindful of new segments that may not show up as more than a dot on the current radar screen. For example, if Guinness had carried out a needs-based segmentation among its customers in the 1960s, it may not have recognized the opportunity to re-position the drink as young and trendy. This segment was developed by a series of astute marketing campaigns.

Will The Segmentation Work?

By whatever means the segmentation is arrived at, be it by judgement, by classifying the database or by statistical techniques, the segments must pass a four-question test:

- Are they truly different in a meaningful way? If not then they are not a segment and should be collapsed into one of the others. In determining, if and how segments differ from one another, it is helpful to give each a characterizing nickname i.e. price fighters, range buyers, delivery buyers and whatever else suits. The name will ultimately become the shorthand description used in the company that immediately identifies the customer typology.

- Are the segments big enough? If they are not, they will require too much resource and energy.

- Do companies fall clearly into one of the segments? A company cannot be in more than one segment. This is unlike consumer segments where one week I may fit into an airline’s business-class segment and another week fit into low cost.

- Can each company be easily identified as belonging to a specific segment? The strongest criticism of needs-based segmentations is that they work well in theory but poorly in practice. Saying that there is a “partnership-focused” or “service-focused” segment is one thing; allocating companies to these segments and building sales and marketing activity around this is quite another. Combating this problem is not easy. In many cases, companies pick out the key firmographic characteristics of each needs-based segment and use these as segment identifiers. In other cases, “killer questions” based around needs are employed – the difficulty here is that significant resource is required to ask such questions to a whole database of potential customers.

Choosing Segments To Work With

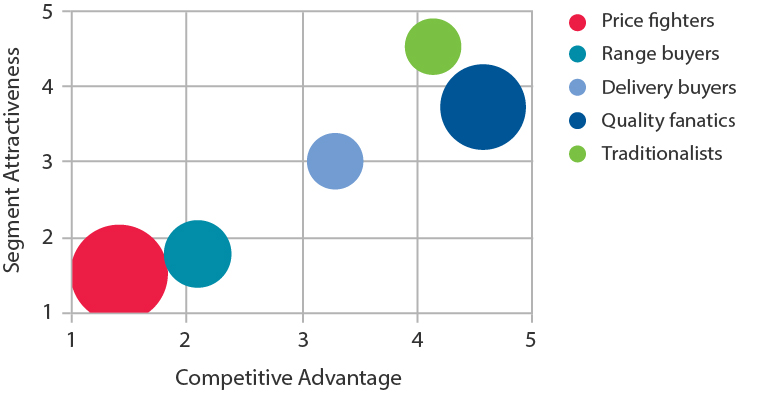

By plotting the different segments on an X Y grid it is possible to determine which are worth targeting and, equally important, which are not. The two factors that influence this decision are the attractiveness of the segment against the supplier’s competitive position within that segment. In this way it is possible to identify targets that justify resources in targeting and development. In the example below it may be thought that the price fighters offer no margin and are not worth targeting, even though they form a large segment. However, the traditionalists may be worth working on to see if they can be moved north and east to join a more attractive segment such as the range buyers, quality fanatics or delivery buyers.

Figure 2: The Directional Policy Matrix Used To Select (and De-Select) Segments

Final Thoughts

Segmentation is the first crucial step in marketing, and the key towards satisfying needs profitably. It is often the mix of where-what-who and why (the benefit or need) which is driving the segmentation. The grouping together of customers with common needs makes it possible to select target customers of interest and set marketing objectives for each of those segments. Once the objectives have been set, strategies can be developed to meet the objectives using the tactical weapons of product, price, promotion and place (route to market).

Readers of this white paper also viewed:

Customer Satisfaction Surveys & Research: How to Measure CSAT B2B Marketing: What Makes It Special? A Practical Guide to Market Segmentation