Brand Tracking Research

How Can Brand Health and Awareness Tracking Help?

68% of B2B buyers agree that the brands they see at work all sound and act the same. With buyer expectations increasing rapidly and the gap to the competition narrowing, building a strong B2B brand is essential. Brand tracking research helps to measure the ROI of your brand building efforts.

Measure Brand Funnel Health

Understand Brand Perceptions

Track Brand Performance

Trusted Research Partner for Top B2B Brands

Why Partner with B2B International for Brand Health Tracking?

A Project as Unique as Your Business

Trusted B2B Data Quality

Action-Orientated & Outcome-Focused

Speak to One of Our Brand Tracking Research Experts

Want to discuss how brand health tracking and brand awareness tracking could benefit your business? Get in touch to schedule an introductory call with one of our team.

Contact UsBrand Tracking Insights Designed for Sharing

Our proprietary Brand Health Wheel captures how well your brand is executing on awareness and usage, brand positioning, and brand delivery, against individually-agreed KPIs. The framework can then be used to strengthen brand building efforts, while also guiding improvements to marketing and messaging.

The visual nature of the Brand Health Wheel makes it an appropriate framework to share with leadership and business teams as a quick and easy-to-interpret summary of the brand tracking study.

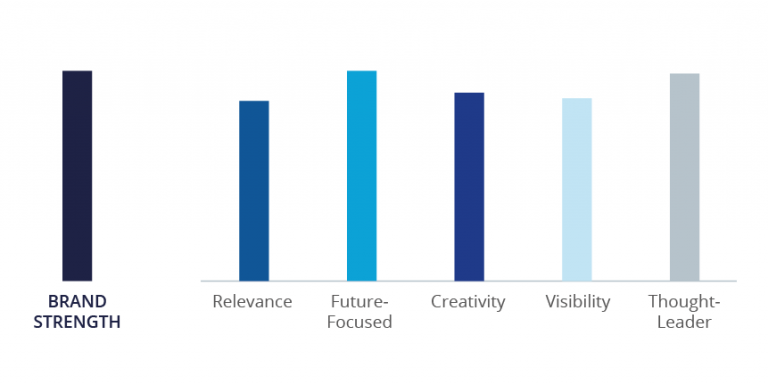

A Single Measure of Brand Strength to Drive Action

To provide a single measure of your brand’s performance, we developed an approach to measure brand strength that is tailored to your own strategic objectives and goals, is based on recognized and robust statistical techniques, and provides clear direction on which areas to focus on to improve competitive performance.Video: The Right Way to Measure Top-of-Funnel Performance in B2B

A video is being shown

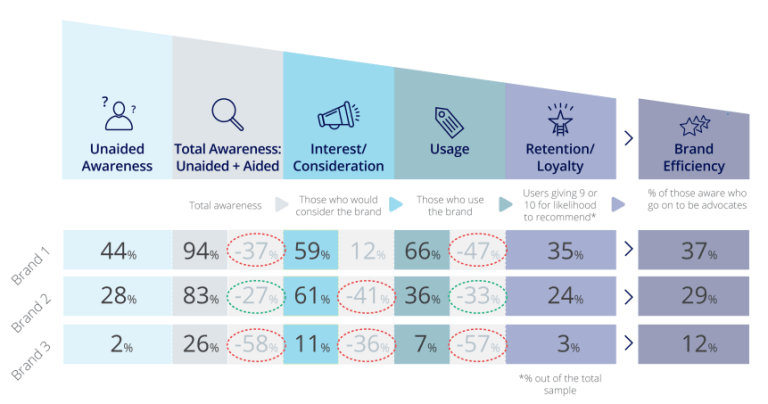

Diagnosing Dropout Points in the Brand Funnel

Analysis of the brand funnel helps to establish where in the awareness chain changes occur and where brand marketing efforts should be focused to improve conversion. Separate brand funnels can be prepared for different areas of the business, and repeated tracking following brand marketing efforts will identify the measurable impact on the brand funnel.Understanding Brand Health in the Context of the Competitive Landscape

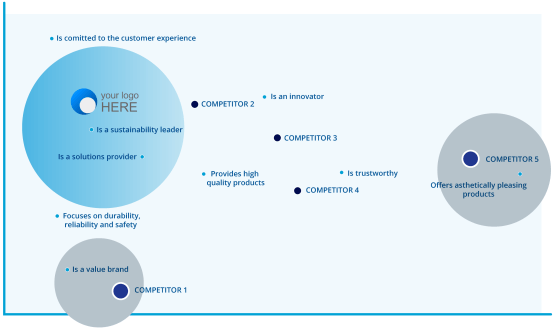

A key component of brand health research is perceptions – understanding what your brand stands for, its essence, and its core values. Brand mapping based on correspondence analysis will be used to understand which brands share a similar position and which brands are differentiated in the eyes of the market.Unlocking Brand Potential and Driving Brand Growth for Hyland

Business Challenge

Hyland is a leading global provider of enterprise content management and content services (ECM & CS) software. The company has grown rapidly since its inception through a combination of organic growth and acquisitions but sought a consistent, structured approach through which to assess the performance of its brand assets and to guide its brand building efforts.

To achieve its goal, Hyland recognized a need for an independent market research program with the following key priorities:

- Benchmark and understand brand performance to then assess the progress of brand building initiatives and campaigns

- Diagnose the brand’s core strengths and weaknesses to ascertain improvement areas

- Identify market needs and priorities and leverage these to drive brand messaging strategy

- Assess performance across the Hyland brand portfolio including brands inherited through acquisitions

- Develop a comprehensive brand playbook to continue and deepen its leadership position in its industry

What We Did

B2B International designed a global brand health tracking survey to measure and assess Hyland’s brand performance. The first, baseline wave of this blind survey comprised 1,150 senior decision makers at organizations that met sample criteria by size, across 9 countries, a wide range of industries and job functions. The same sample size and composition was leveraged in annual repeat tracking.

As thought leaders in brand research, B2B International employed a suite of relevant tools and frameworks designed specifically for this type of brand equity assessment. A core piece of this program was the inclusion of B2B International’s “Brand Health Wheel”, a proprietary framework designed to provide a holistic view of brand performance and to help identify brand strengths and investment priorities quickly and efficiently.

The research captured brand funnel data to identify which brand metrics to address as priorities for increasing market share and revenue. We also uncovered more specific, tactical insights around how to optimize the brand’s positioning, which benefits to emphasize in messaging collateral, and which media investments to prioritize.

Complementary Solutions to Take Your Brand Further

Video: The Right Way to Measure Mid-to-End Funnel Performance in B2B

A video is being shown

Featured Content on Brand Health Tracking

Speak to One of Our Brand Tracking Research Experts

Want to discuss how brand health tracking and brand awareness tracking could benefit your business? Get in touch to schedule an introductory call with one of our team.

Contact Us