TURF analysis is a statistical technique to help optimize your product or service offers, and to fine tune the effectiveness of your communications strategies.

How TURF analysis works

TURF analysis helps answer research questions, such as:

- How do we get the largest market share possible from a range of potential offers in cases where the number of offer combinations is limited?

- What will happen to our market share if we drop a product from or add a product to the range?

- How do we ensure our marketing budget engages with and is seen by as much of the target audience as possible?

- Which two or three product or service benefits are most important to focus on in communications, given the diverse needs of our target market?

TURF analysis is useful in any situation where the overall number of choice combinations is high, but where the number of combinations that can be pursued is restricted, owing to practical factors such as resourcing, budgets or space.

TURF analysis in practice

The classic hypothetical example of TURF analysis in action is the dilemma of the ice-cream seller. Imagine that up to six different flavors of ice-cream could be offered for sale, but there is only room to fit three flavors into the serving stand.

A market research survey indicates that consumers “strongly like” the following flavors – on a 5-point scale, running from “strongly dislike to strongly like:”

|

Flavour |

Proportion that “strongly like” |

|

Chocolate |

50% |

|

Caramel |

45% |

|

Vanilla |

40% |

|

Strawberry |

25% |

|

Pistachio |

20% |

|

Rum & Raisin |

12% |

Conventional wisdom suggests that the best three flavors to offer are chocolate, caramel and vanilla, as these are the top three in terms of flavor preference. This decision is not necessarily correct, however, because it ignores which three flavors have most potential overall in combination. Let’s assume that the research also shows that:

- 60% of people overall like any of chocolate, caramel or vanilla: Although these flavors have high preference individually, it transpires that many of those expressing a strong preference for these flavors are, in fact, the same people;

- By contrast, 75% of Rum & Raisin fans (9% overall) do not “strongly like” any other flavor

- Pistachio is similarly divisive, albeit to a lesser degree: 50% that strongly like this flavor do not like any others (10% overall)

Taking the above observations into account, we can deduce how the following 3-way combinations may perform in the marketplace:

- Option 1: 60% of all consumers would strongly like an ice-cream stand that served Chocolate, Caramel and Vanilla;

- Option 2: At least 69% of consumers would find a flavor they strongly liked at a stand that sold Chocolate, Pistachio and Rum & Raisin (the 50% that like chocolate, plus the 9% that exclusively like Rum & Raisin, plus the 10% that exclusively like pistachio);

Based on the above analysis, we can say that Option 2 has the bigger ‘reach,’ in that at least one of the flavors will appeal.

That is not to say that Option 2 would necessarily be preferred in practice. Although the overall reach of Option 2 is high, the total amount of ice-cream that would be sold may be lower, as two of the flavors are relatively niche. Moreover, the most popular flavor may well sell out quickly, restricting the volume of sales that could be made. This is where the frequency part of TURF analysis comes into play.

Output from TURF analysis

TURF analysis exhaustively tests each combination of potential options and evaluates both the reach, and number of occasions reached (i.e., the frequency).

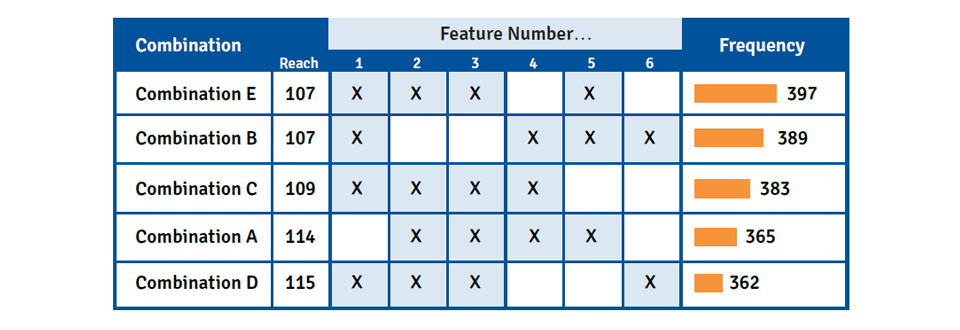

The results of the TURF analysis are usually presented in a table, like the one below. The reach figure refers to the overall number of survey respondents that expressed a preference for at least one of the feature combinations indicated in a row. The frequency figure expresses the total number of times that the features in each line have been preferred.

The below example shows the importance of attaining both high reach and frequency within a TURF analysis. Although some combinations may have marginally higher reach than others, they may not “hit the mark” as often in terms of preference for a range of features. In these cases, a “sweet spot” or optimal trade-off may need to be found between the two measures.

Case study: Increasing market share with ‘bundles’

Business challenge

Our client is an Enterprise telephony and communications provider who wanted to identify which specific ‘bundles’ of telephone calls, broadband Internet and cloud-based office productivity services were likely to increase market share.

What we did

In this study it was highly important to prioritize reach as a measure of success because our client wished to secure first-mover-advantage within an emerging product category.

Different decision makers saw virtue in very different aspects of the product, and there was no single feature that had wide appeal. At the same time, marketing budgets for the launch campaign were limited, and initial marcomms could only emphasize two or three of the main benefits.

Case study 2: Identifying the most important product features

Business challenge

Our client is a business software company who wanted to identify which features of a novel information management product were most important to include in launch communications.

What we did

Our research identified that companies were highly segmented in the features of the concept that they found most interesting.

TURF analysis was used to quantify the three product features (out of 16) that stood the best chance of appealing to as wide a range of potential customers as possible.