Customer Segmentation Research

How Can Customer Segmentation Research Help?

B2B businesses that provide more personalized experiences can enjoy higher contract values, shorter sales cycles, and greater loyalty from their customers. However, only 5% of B2B experiences are delivering fully on this, so there’s a big opportunity for businesses to create meaningful competitive advantages (Source: Superpowers Index research).

Find Where to Play

Define What to Offer

Identify How to Win

Trusted Research Partner for Top Brands

Why Partner with B2B International for Customer Segmentation Research?

A Project as Unique as Your Business

Trusted B2B Data Quality

Action-Orientated & Outcome-Focused

Speak to One of Our Customer Segmentation Research Experts

Want to discuss how customer segmentation research could benefit your business? Get in touch to schedule an introductory call with one of our team.

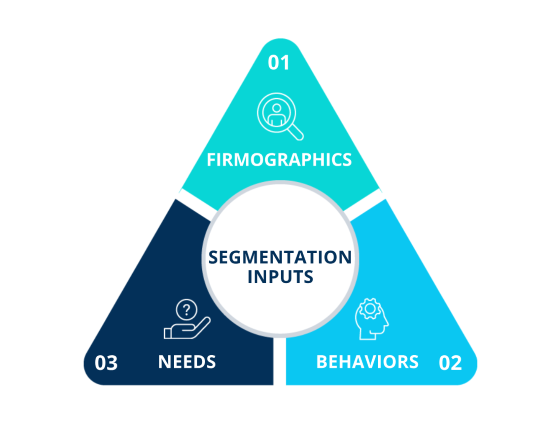

Contact UsA Holistic Approach to Segmentation Inputs

There are several types of input for a segmentation, ranging from the most basic such as firmographics, to the most complex, such as identifying needs. The most effective segmentations incorporate aspects of all three.

Firmographics: Segmenting by firmographics - such as company size, industry, or spend - is the most basic approach and offers a solid foundation to build on.

Behaviors: Behavioral segmentation goes deeper by grouping customers based on buying habits like frequency, brand loyalty, or product preferences. It’s a useful bridge to needs-based segmentation, as behaviors often reflect underlying needs.

Needs: Needs-based segmentation recognizes that even similar-looking customers can have vastly different motivations - whether driven by price, quality, service, or partnership. This approach enables more targeted, persuasive messaging and is harder for competitors to copy.

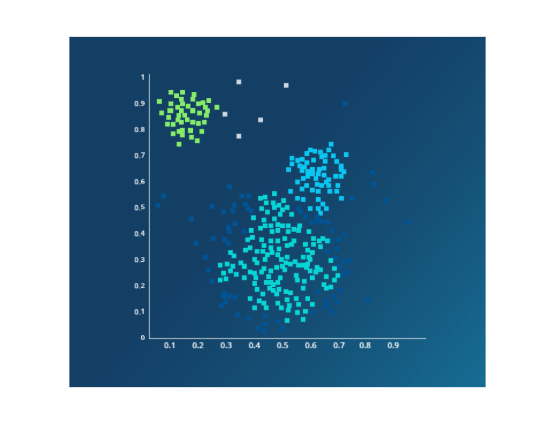

Advanced Statistical Techniques

To develop effective and actionable segmentation, we apply advanced statistical techniques throughout the project.

This includes using factor analysis to identify the main dimensions that differentiate respondents, cluster analysis and latent class analysis to identify distinct segments, and CHAID/CART methods along with firmographic profiling to accurately assign businesses to the appropriate segments.

Video: The Benefits of a Tailored Approach to Marketing

A video is being shown

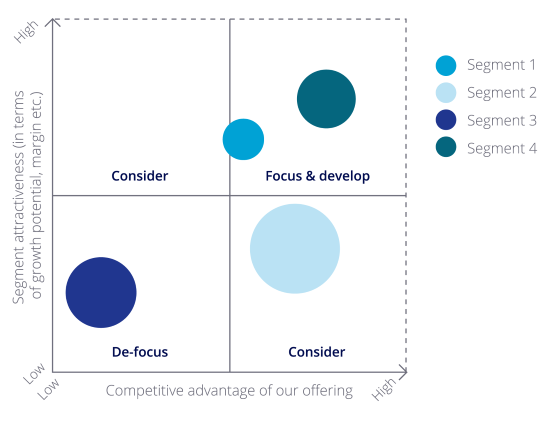

Sizing and Prioritizing Segments

Frameworks such as the Directional Policy Matrix (DPM) are used to size the prize for each segment (e.g. the number of firms or individuals, market value, growth opportunity), and determine which segments to prioritize by evaluating their attractiveness and your company’s competitive advantage in each.

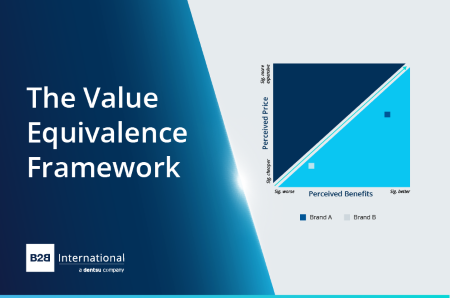

Developing Tailored Propositions

Buyer personas are used to profile and bring to life the unique needs, communication preferences, and information requirements of each segment, ensuring the insights are easy to share across the business.

Frameworks such as the Value Proposition Canvas are used to ensure that your product or service is positioned around what the priority segments value and need.

Segmentation Allocation Tools

Segmentation analysis can help identify a few key questions that can accurately assign customers to specific segments. This allows businesses to tailor their marketing and engagement efforts for existing customers, while sales teams can use these same questions to categorize prospects and adjust their sales strategies accordingly.

These questions can be simplified to include basic firmographic data, which is often already available for each customer. Alternatively, more advanced tools can be used, incorporating additional inputs to enhance accuracy.

Consumer Segmentation Research for dentsu

Business Challenge

At the end of 2022, the UK’s economic and cost-of-living crises were dominating the headlines. Brands were left wondering whether the same course of actions taken after previous downturns, such as the financial crisis of 2008 and the fallout from the pandemic, would still apply or whether new strategies and tactics were required.

B2B International were commissioned by parent company dentsu to undertake proprietary research to understand how consumers were responding to the UK economic conditions, with the aim of building a framework of consumer behaviors and motivations, and resulting recommendations for brands.

What We Did

B2B International designed a consumer and business decision-maker quantitative survey. The online survey ran during a 2-week period in Q4 2022 among a representative sample of 2,000 consumers in the UK.

This led us to develop our consumer segmentation, based on the financial products consumers hold, their spending, and attitudes towards their finances. We identified seven core groups in the UK to help brands understand how uncertainty is impacting different consumers and what this means for them.

We knew we had a great segmentation because several behaviors changed significantly between them: age, income levels, attitudes towards macro issues, and plans for the near future. It was striking that defining consumers based on their income and outgoings was not enough to predict their needs and behaviors. Similar life-stages and income levels need to be further segmented by attitudes and emotions.

To make the segmentation relevant and actionable for brands, we developed a set of key actions and strategies to help brands engage with the segments.

Segmentation and Persona Research for AgriFutures

Business Challenge

AgriFutures Australia is an Australian Government Statutory Authority at the heart of the Australian rural industries.

The organization recognizes the importance of leveraging primary research to ensure that their efforts meet the needs of their target markets. AgriFutures Australia partnered with B2B International to better understand and profile the stakeholders that they serve.

A great emphasis was placed on understanding the types of information their stakeholders consume, so that AgriFutures Australia could create more engaging content and allocate it’s marketing budget and resources more efficiently.

What We Did

B2B International began by helping AgriFutures Australia consolidate internal knowledge and perceptions of their stakeholder base. Hundreds of telephone interviews and online surveys were conducted across the organization’s 4 key stakeholder audience types.

A key challenge faced was that all the stakeholder groups were uniquely different, yet the study needed to identify commonalities in the information and the content they consumed.

This was solved by splitting the questionnaire into two. The first part was structured around the stakeholders needs and was unique to the stakeholder group. The second part was based on content consumption habits and was consistently asked to all the stakeholder groups.

The value of splitting the questionnaire into two was that it allowed for personas & segments to be created at the audience level based on needs, challenges, and motivations (input personas) and at the overall level based on content consumption habits (output personas).

The input personas were segments and personas unique to the stakeholder group, meaning internal departments could use this insight to ensure that products and services can be tailored to their audience. The output personas were segments that could be used to plan, prioritize, and distribute information and content effectively to all stakeholder groups.

Complementary Solutions to Take Your CX Further

Video: Bringing Segmentations to Life

A video is being shown

Featured Content on Customer Segmentation Research

Speak to One of Our Customer Segmentation Research Experts

Want to discuss how customer segmentation research could benefit your business? Get in touch to schedule an introductory call with one of our team.

Contact UsFurther Insights on B2B Customer Experience and Loyalty

How Market Research Can Help Sharpen B2B Strategic Positioning

3 Often Overlooked CX Metrics that Make your Customer Experience Program Stronger

B2B Insights Podcast #68: How to Build Effective CX Programs

Rediscovering Customer Needs in the Age of AI: Why Deep CX Insights Matter More Than Ever

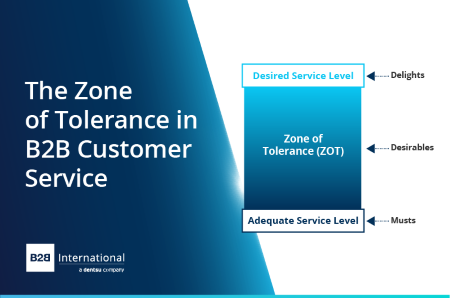

The Zone of Tolerance in B2B Customer Service: The Key to Customer Satisfaction