This week’s review of insights from the B2B International COVID-19 tracker focuses on business resilience – To what extent have companies been disrupted so far? How well prepared were they? And, crucially, how well set are they for recovery?

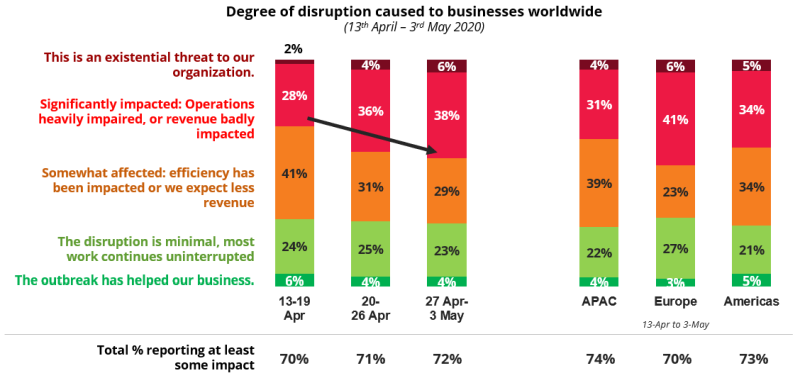

For the last 3 weeks, we have been checking in with businesses across the globe to see how they have been faring with the pandemic. A topic that we will be monitoring regularly is the degree of disruption that has been caused. In the past week, 72% of firms surveyed mentioned experiencing at least some negative impact (see the chart below):

This indicator of around three-quarters of organizations having been affected to at least some degree was stable throughout April and is consistent across regions and different company sizes. 1 in 20 businesses even regard the pandemic as presenting an existential threat to their organization. Despite large government initiatives in many markets designed to shore-up the finances of severely impaired firms, there will clearly be many businesses that are struggling to survive.

Of some concern in the past 2 weeks of April are early signals of movement towards a greater proportion of businesses being at least significantly impacted – that is, where respondents reported operations or revenue having been badly affected. This increased from 31% in mid-April to 44% by early May.

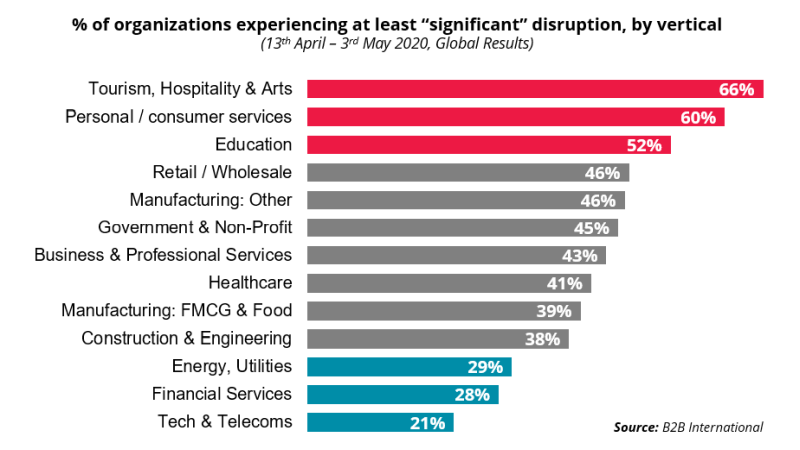

Digging deeper into verticals: Substantial proportions impacted, except for a small number of industries

Focusing in on firms that are currently “significantly” affected, our data shows some clear disparities by industry sector:

-

Tech firms, financial services and energy and utilities businesses currently report being significantly less affected.

-

Tourism/hospitality/arts, personal services firms and educational establishments are seeing much more severe impacts. In the case of education, the impact is twofold: First, is the clear impact upon how teaching is delivered; Second, future revenue projections for higher educational institutions are deeply uncertain with universities across Europe and North America expected to see falls in domestic and overseas student numbers in forthcoming academic years.

-

Beyond these more clear-cut “winners” and “losers”, what is notable is the relatively similar degree of current impact for many sectors – from production-driven firms through to knowledge-heavy verticals.

Resilience and preparation: Most businesses had inadequate plans

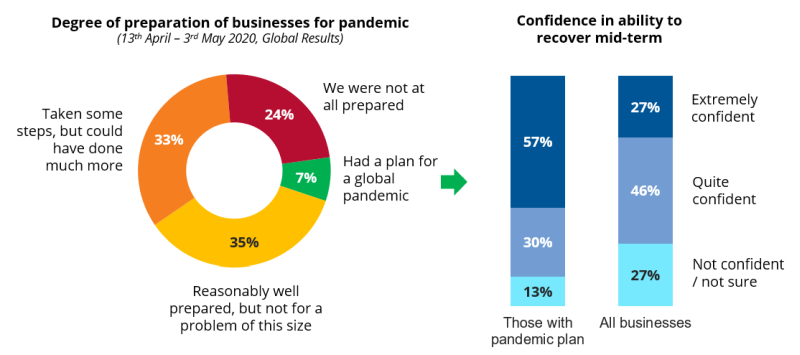

Overall, our survey of businesses shows there were very low levels of preparedness for a public health crisis: Only 7% of firms stated they had plans that were designed for a pandemic specifically and which were fit-for-purpose. Indeed, almost a quarter of businesses reported not being prepared at all. A further 33% admitted they could have done much more to mitigate the effects of COVID. In total, almost 3 in 5 companies (57%) were on the side of being relatively unprepared (see chart below):

Our data show that those organizations with pandemic-specific preparations were not only to be found in industries where companies are better-versed in contingency planning generally. For instance, 6% of smaller businesses (SMEs) reported having such a plan – not much lower than the overall average.

While it’d be easy to berate most companies for not giving these issues more attention, the reality is that the threat of a pandemic had been slipping “off the radar” for some time in favor of other topics such as geopolitical tensions, environmental issues and cyber-threats. For instance, The World Economic Forum’s Global Risks Report for 2020 rated “infectious diseases” as one of the least likely long-term risks expected to impact the global economy.

So, what can we learn from the 7% of “enlightened” organizations in our sample that did properly anticipate the risk? It is telling that these organizations appear to report much higher levels of confidence in their ability to recover in the medium term (see the right-hand side of the figure above). Overall, only 27% of all businesses we surveyed globally reported a high level of confidence in their ability to recover. However, this figure rises to 57% of those that had strong pandemic preparations.

The business strategy of these highly prepared firms is also markedly different, and which may go some way to explaining why their prospects appear better. Our study shows strategies that these companies have pursued disproportionately prior to COVID-19 included:

-

Product development / innovation: Very likely linked to innovation in digital business models.

-

Employee branding / employee engagement: Vital in maintaining morale and productivity during this challenging period.

-

Driving greater share of wallet / spend: By commanding a larger share of customer budgets, these firms may be financially better able to ride out interruptions.

Prospects for recovery: Construction and business services may soon face challenges

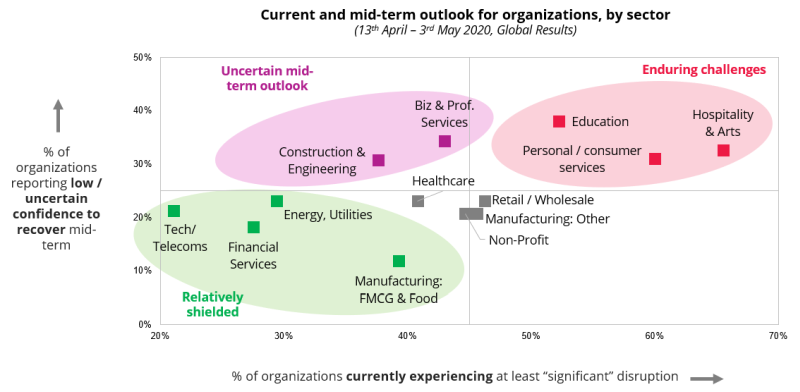

On average, we’ve seen that 27% of businesses currently are not confident in or not sure of their ability to recover from the pandemic in the medium-term. We then studied this in more detail by industry. In the figure below, the % of firms that are currently “significantly” affected by the crisis is shown on the x-axis, and their future expectation of being unable to recover is shown on the y-axis:

Here we see some interesting patterns:

-

Personal / consumer services, educational establishments and hospitality & arts institutions anticipate challenges for some time to come.

-

Likewise, several verticals that are presently quite well insulated from economic issues expect this to continue (e.g. tech, financial services etc.). FMCG & Food manufacturers also anticipate fewer issues on the horizon than they are currently experiencing.

-

Construction and business services are two sectors that despite only being impacted currently to an “average” extent, are nonetheless expecting their medium-term prospects to be less secure. This is likely to reflect the fact that while there is presently reasonable workload in these sectors, sales pipelines for these industries are likely to be weak (or at best uncertain).

As we progress through future weeks of our COVID-19 tracker, we will be on the lookout for developments in this situation.

These findings are from the B2B International COVID-19 Tracker. They are derived from n=817 interviews with business professionals in SME and Enterprise firms in the UK, France, Germany, USA, Canada, China, Singapore, Australia and Japan. Fieldwork was conducted from 13th April – 3rd May 2020.