All commercial organizations exist to make a return on their investment (ROI). Organizations that are not commercial, such as government departments and charities, still have to justify their investments in most cases. Money is a scarce resource and it is therefore reasonable to question how well it is spent whenever it is in any quantity. Indeed, most substantial sums of money require justification and the most frequently sought justification is the return on the investment – the ratio of money gained or lost on an investment relative to the amount of money invested.

What Is ROI And Why Is It Considered Important?

All substantial investments are scrutinized for their return. Different criteria are used in this justification and typically the percentage annual return and the payback period are considered vitally important. Management may feel more comfortable with a 30% annual return on a “soft” investment such as market research as it could have a short period during which it can payback (compared with a 15-20% return on a fixed investment that has a payback over many years). Payback in itself may be a limited measure because the value of money can vary over time, because the levels of risk vary depending on the type of investment, and because there could be different opportunity costs for the investment, i.e. the money could be spent elsewhere.

In the main, most companies measure ROI on fixed investments, such as new buildings – capital items that are listed on the balance sheet. The day-to-day running costs of businesses, however, have traditionally never had ROI measured. For instance, organizations do not measure the ROI of paper clips or the coffee machine. That said, organizations also spend considerable amounts of money on the likes of insurance – office and property insurance, health insurance, and liability insurance, to name but a few examples – and yet organizations do not measure ROI on these expenditures. With this in mind, why have organizations become so interested in questioning the potential return on investment of market research projects, when market research is, in effect, insurance for reducing risk in business decision making?

Indeed, marketers appear to be taking the measurement of marketing ROI increasingly seriously, as a recent study of surveyed marketers has shown:

- 26% of marketers indicated that their companies calculate ROI for at least some of their marketing campaigns or investments, up from 18% in 2007.

- More than half (53%) of marketers indicated that their firms use ROI and profitability metrics to assess their marketing effectiveness.

- Almost two thirds of companies (61%) assess their ability to measure the financial returns of marketing either as entirely adequate or as a real source of leadership.

In short, ROI has become a mantra for many companies. No investment is allowed unless it can be justified and market research is no exception. The question is, “does ROI work when judging whether an investment in market research is worthwhile?”

The Role Of Market Research In Decision Making

With very few exceptions, market research projects should contribute to decision-making or solving business problems. The output of research may be interesting, but it should always go beyond providing insights and assist management in making more informed and intelligent business decisions.

The decisions which market research can guide are undoubtedly as varied as the businesses which make them. A few examples are:

- Should we enter the Chinese market?

- Should we develop a new product?

- How effective is our advertising or promotion?

- Which style of packaging will be most effective?

- What price should we charge for our products or services?

- Have we got the best channel to market?

Such decisions will often entail secondary decisions and the research may need to take these into account. For instance the decision to enter the Chinese market will also require decisions on how to do this, which products to offer, how to distribute them, what prices to charge, what promotional methods to use etc.

Sometimes a business is faced with an obvious problem but cannot initially see which decisions may have to be made. For example:

- Sales of a particular product are declining

- New competitors have entered the market

- Legislation has changed the demand for a product

In such cases, market research may be used to provide a diagnosis of the problem. However, if the research is well planned, the outcome will also point to the decisions that need to be taken.

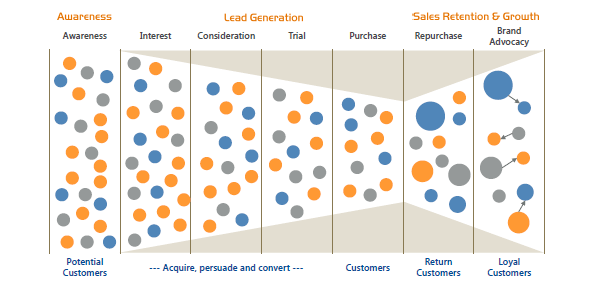

Many marketers are too easily discouraged by the price tag on a market research project, which results in research not being commissioned and the potential return on investment remaining unknown. In such cases, many marketers are failing to realize the impact market research can make to the bottom line. Figure 1 below shows marketing ROI in the form of a bow-tie and illustrates how it is necessary to invest all the way through the bow-tie, from potential customers through to return and loyal customers. The brand advocacy segment on the far right is the ultimate goal, where loyal customers act as advocates of the brand, providing return custom, and promoting and selling the brand by recommending it to others. This is a sequential process and in order to reach brand advocacy, organizations have to first focus on the left segments of the bow-tie, where awareness and interest levels must be created and measured. Hence the return on investment is achieved on the right side of the bow-tie where the effects of the marketing program bear fruit. Market research at the front end will show how successful the campaign has been and how its effectiveness could be improved to further increase the ROI.

What Affects The Decision To Commission Market Research?

In most business planning processes, there is a sequence which follows the SOSTAC (PR Smith, 1990) acronym:

S – Situation analysis – a starting point of any business decision is to fully understand the situation and analyze it in every way. It is here that market research makes its greatest contribution.

O – Objectives – these may be set in advance of doing the situation analysis or they may arise from it.

S – Strategies – these are the long-term actions that will be required to achieve the goal.

T – Tactics – these are the short-term specific actions that are part of the overarching strategies.

A – Action – these are the tasks that need doing by different people and with a given resource over the short, medium and long term.

C – Controls – these are the measures that ensure the actions are successful in achieving the goal.

In the SOSTAC paradigm, market research is used at the front end to provide a full understanding of the situation. It could also be used to test hypotheses and determine if and how an objective can be achieved. Plus it could be used at the back end as a control to see if the objectives are being achieved.

Herein lies one of the major problems for measuring the ROI of market research. Market research may come so early or late in the chain of events leading to a project launch that it is far removed from the end result, and in isolation it is hard to see its contribution.

Consider the launch of the Yorkie chocolate bar by Rowntree Mackintosh. The company commissioned market research to help identify needs and guide its product development. Using focus groups it identified a gap in the market for a bar of thick chocolate at a time when other manufacturers of chocolate bars were making their products thinner. Product development followed; packaging design took place and the hugely successful advertising campaign featured hunky truckers. There is no doubt that market research was instrumental in the launch of this successful product but it is almost impossible to separate out its contribution from all the other component parts of the campaign.

Every research project should have its own defined and explicit objective which states why the research is being carried out. The objective of the research should, of course, relate to the marketing decision which will have to be made or the problem that needs a solution. For example:

To identify the opportunity for “the company” to enter the Chinese market and to show the most appropriate product, price, promotion and channel to market that will help achieve this.

Research Accuracy

In advance of commissioning such a survey, the sponsor of the market research will want to know how accurate the findings will be. However, in some cases a high level of accuracy may not be needed. In the case of the example of a company seeking to enter the Chinese market, for example, it may consider sales of $5 million per annum to be sufficiently attractive. In such circumstances it would not really matter if the total market size was $400 million or $500 million (an accuracy of +/- 25%).

However, if in an advertising research study the objective were to measure the impact of the campaign on brand awareness by comparing before and after measures of awareness, the accuracy of the results must be sufficient to be believable.

Accuracy levels need to be considered at the research design stage and they could affect the cost of the survey and therefore the notional return on investment (quite clearly an expensive research project requires a bigger ROI than a low-cost research project).

Since accuracy may define or influence the cost of market research, it has to be a serious consideration in the ROI debate.

How Do We Measure ROI?

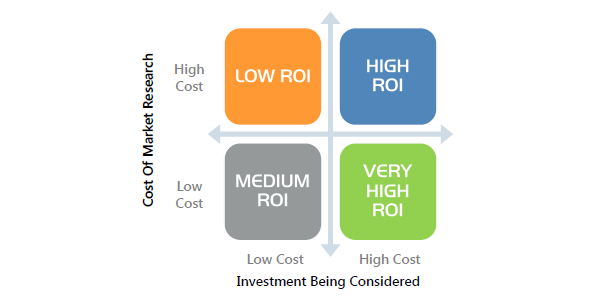

If the decision that will be made using the market research entails capital expenditure of $100 million, a research budget of $100,000 may be well worth spending. However, if the decision involves much less risk and has a lower capital expenditure, say less than half a million dollars, it may not justify a research budget of more than $20,000. In general, most research projects have a cost in the range of $20,000 to $200,000, with a typical project costing between $40,000 and $100,000.

Hence investments guided by the market research are likely to range from as little as $100,000 up to those of many millions. Plotted on a matrix, it can be seen that the ROI on market research is likely to be high and more clearly justified whenever the investment or the risk of that investment is high.

Where Is The Measurement Of ROI Most Feasible?

It is clear that the measurement of the return on investment of market research is a valid concept, even though there are difficulties in making the measurement. The more general the market research objective, the more difficult it is to achieve the ROI measurement.

Measuring the ROI on the market research used to evaluate the opportunities in new markets is difficult because so many other factors will influence the success and a length of time will be required before it is possible to check out whether the research was “correct” in the long term. Furthermore, if the outcome of the research project indicated that there was no opportunity, it has potentially saved the company many millions of dollars in what could have been a disastrous investment. However, it is impossible to be absolutely certain whether negative research findings were correct, and in the case of no investment, there is, in theory, no ROI.

Nevertheless, it can be possible to measure the ROI more easily on market research carried out to guide a very specific and tightly scoped research objective, such as “can we raise our prices and by how much?”.

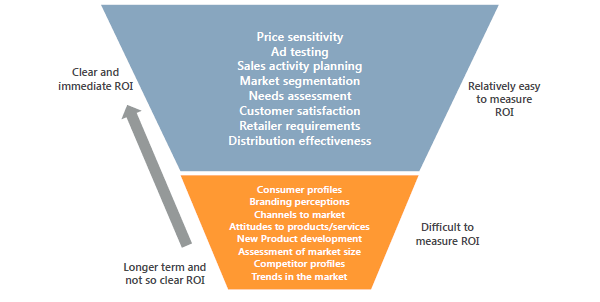

Figure 3 provides an illustration of types of market research projects most suited to the measurement of ROI and those where the measurement of ROI is more difficult.

In possibly half or more of the market research projects which are commissioned, it is likely to be difficult if not impossible to measure the ROI. For these projects, a more subjective approach would be useful to justify the market research expenditure, as summarized in Figure 4 below.

Figure 4 – Questions To Judgementally Assess The ROI Of Market Research

| Importance to the business decision: 5 = high/important; 1 = low/not important |

|

|---|---|

| What is the size of the investment for which market intelligence will guide the decision? | ________ |

| What is the need for market knowledge that does not already exist within the organization? | ________ |

| What is the risk to the business of taking a decision without market intelligence? | ________ |

| What is the need for independent research to resolve internal differences on a proposed decision? | ________ |

| TOTAL | ________ |

If the answer to any one of the above questions was a score of 4 or 5, then market research could be justified.

Conclusion

In conclusion, all significant expenditure in business should be justified. Measuring the ROI of market research is laudable and in some cases it is entirely feasible.

Finally, it is worth considering measuring the success of every market research project carried out by holding a post mortem after the research is completed. On conclusion of the study, the sponsors and users of the market research should judge the project in terms of the insights it has provided and whether in retrospect they believe the research was justified. In other words, a straightforward satisfaction score on the research project may, in itself, be as good a measure as any.