Unfortunately “globalisation” has become one of the great buzz-words of our time and this poses a problem. The problem is that many, if not most, commentators on globalisation do not appear to have an elementary understanding of economics and are fixed in a view of the role and power of the nation-state.

The key to understanding the essence of globalisation is found in the reasons why commodity flows and divisions of production occur. This is important because economic exchanges very rarely take place between nations or groups of nations: they take place between organisations (“firms”, etc). The national perspective is a politically sensible but economically synthetic aggregation of activity, because there is no automatic congruence of interest between nation-states and the economic entities located within them. This has been discussed in academic literature ever since the birth of economics as a discipline. As globalisation has gathered pace in the past 20 years, it has prompted some analysts to suggest that the nation-state as a player in the business part of economics has all but disappeared. (Ohmae 1995)

Consider the following – as a starter. Currently the USA spends about 12 per cent of its income on imports; in 1890 that figure was around 8 per cent. During this period his market has shifted from just about the most protectionist to the most open in the developed world. During the 1850s the United Kingdom’s foreign trade element of Gross Domestic Product was around 40 per cent. That is slightly higher than today’s. So if globalisation is to any significant extent about increased international trade, how do we interpret these figures? It is not difficult in economics: the answer is to do with technical progress, production specialisation and factor mobility. Quite simply, a lot of the activity that constitutes globalisation does not appear in trade statistics. Trade is not the totality of international business and it is not always the most important dimension. International production specialisation and optimal allocation of resources are often much more significant. Information technology and the tools and techniques of supply chain management (SCM) are facilitating and accelerating this trend.

Therefore my key points are (a) that globalisation is not about making and/or selling products in all regions of the world and (b) that, more importantly, globalisation is not restricted to marketing and selling. Marketing and selling are not always the most significant aspects of globalisation: globalisation is, however, a powerful techno-economic phenomenon with profound implications for marketers. These are my main themes in this White Paper.

Basic Issues

Let us consider two related issues that have very different content and impact – (a) international trade theory and (b) international trade policy. International trade theory is about the flow of goods, services, factors of production and knowledge between countries/regions. International trade policy is about the mechanisms used by governments and inter-governmental organisations, for socio-political reasons, to intervene in the workings of economics. There is no implied value judgement here: pure economics has no moral or social dimension and clearly these dimensions matter.

Not long ago we operated in a market in which goods, especially commodities, could flow freely, but the international mobility of services was much lower and the mobility of factors of production (especially labour) was extremely low internationally whilst being fairly high domestically. Prices tended to converge through the increasingly free (“floating”) exchange rate system, whilst factors of production were accounted in domestic currency. It was therefore the input rather than the output side of economic activity that prompted greater internationalisation of operations. Let us return to the trade figures cited earlier. Though we can correctly point to the absolute growth of trade over an extended period, its growth relative to the general economic trend, reflective of demand as well as supply, shows us something quite different. As markets have become more deregulated there has been a major change in the way in which and the speed with which knowledge is disseminated. This has had profound impact on organisations, often in a way that national governments find uncomfortable and that some social and political groups find threatening. This is the basic reason why so many governments are still stuck with the self-delusion that export is good and globalisation is bad. In trying to define and understand holistically the phenomenon of globalisation, we get to understand the new way in which economies and organisational components of economies interact.

Globalisation is, in my view, about creating a new set of competencies that enable a company to utilise resources on an optimal basis to meet differentiated customer demand profitably and cost-competitively without regard for geography. Put more simply, globalisation is about getting an organisation into a position of doing business in any market it chooses, and doing business is not just about marketing and selling. Looking at globalisation as a process of acquiring and renewing competencies helps us understand how and why new forms of organisation are emerging to take on and defeat established high-profile companies. Additionally globalisation is not restricted to large companies. Many very large companies are not global, and vice-versa. Our concepts of “top” or “leading” companies are changing too. One can justifiably pose the question whether many of the world’s huge (often merger- and acquisition-driven) corporations are true leaders or truly global. There is increasing evidence that such large organisations are not leaders in any real sense of the word. The crucial question is this: in what respects are large merger- and acquisition-based conglomerates “multinational/global” rather than owners of a portfolio of fragmented, under-optimised operations stretching across a diverse range of countries.

I would like to turn to a number of key factors that are influencing the trend towards globalisation and then to assess the implications for marketers and marketing.

1. Key Factors

The key interlinked factors influencing the tendency towards globalisation are as follows.

- GATT and the WTO

- Structural shift in the world economy

- Integration and operational velocity of financial markets

- Diffusion of computer-based technologies and information systems

- The “agile” corporation

- Competitiveness based on supply chains

GATT and The WTO

The main objective of the General Agreement on Tariffs and Trade (GATT) and The World Trade Organisation (WTO) is to reduce physical and administrative barriers to international trade. What is generally overlooked is that the activity of these two organisations has often been to prevent the consequences of rational economic behaviour rather than to facilitate them.

Economics is about optimal allocation of resources: it is not about issues such as equal opportunity and social fairness. This is not to claim that somehow the latter do not count: it is simply a statement to prevent us using economics in a corrupt manner to justify desirable social outcomes. That is where GATT in its time and nowadays the WTO operate.

Economics treats individuals, even societies, as factors of production or assets. Whereas other factors/assets can be amortised and disposed of at will, very few of us would advocate the same for human assets. The USA labour market is more flexible than its counterparts in Europe. This happens for historical, social and legal reasons. The fact is that these differences account to some degree for decisions on location of production and the product/money flows that result from this are not to do with physical trade in the products in question (an exchange function) but with the creation of an optimal balance of competitive advantage and resource flexibility in conditions of less than 100% predictability. Therefore one further main function of GATT and WTO is to prevent the major social and political disruptions that could occur in the event of a totally free market in all factors of production. WTO has the powers to create the borderless world: its big challenge is to minimise the negative social effects of the transition.

Structural Shift in the World Economy

The USA has stagnated; Japan continues its slump that commenced some 10 years ago; Germany has become the “sick man” of Europe: the “Asian Tigers” are roaring less noisily than in the recent past. China marches on, but at lower velocity than in recent years. Where is the structural shift taking us? The answer is to be found in (a) increasingly integrated economic institutions that characterise late capitalism and (b) greater interactivity found in supply chains.

Where organisations integrate across borders they contribute to several economies simultane-ously. This has potentially positive and negative dimensions from the point of view of national governments. This is pointed out clearly and analysed humanely by Nobel prize-winning economist Joseph Stiglitz (Stiglitz 2002). The increase in “connectedness”, he argues, has given rise to the need for a new type of social, political and legal regime that takes into account the dangers of a widening of the gap between the ‘haves’ and ‘have nots’. The basic point made here is not that there is something economically unjust about globalisation, but that its processes give unscrupulous human beings and interest groups at all levels of society new spheres of opportunity. Politicians and law-makers are simply not up to speed with the reality of 21st-century economics and I.T., but are in many cases either slow on the uptake or amorally self-seeking.

Sticking with the economic and business dimensions, we have a new set of consequences of decisions. These decisions bring into sharper focus the basic laws of economics as they relate to optimal utilisation of resources. Markets may not work perfectly; but they do work in accordance with principles that can be easily understood. Therefore in an increasingly connected world, decisions on interest rates taken in Washington, London, Tokyo, Berlin, etc can have a significant economic effect. Where, for example, manufacture of unsophisticated consumer goods has declined in developed countries, a decision to cut interest rates will stimulate consumption for goods produced in China and elsewhere in the Asian region. This accounts to some extent for the continued high level of growth in GDP in China – it is buoyed up by demand in the developed world, particularly the USA. The impact on measures such as the trade balance is clear.

The implications are that firms operating in the developed world now need to view their operations in a different light. For example, the future for a company manufacturing, say, automobiles in Western Europe is not too good if such a company is vertically integrated in Western Europe whereas it could be fine for a company that is headquartered in Western Europe and sources the elements of the total supply chain that contribute to its finished product from the location that is best suited to that activity. This could involve R&D and final assembly in, say, Munich or Stuttgart and buying-in components and sub-assemblies from Eastern Europe – or anywhere else, for that matter. This inevitable structural shift gives rise to two strategically significant phenomena.

- New technologies of logistics and supply chain management are simultaneously catalysing the trend of globalisation and decoupling value creation from the locus of decision-making.

- Competitiveness and hence marketing focus are gradually moving from product-versus-product to supply chain-versus-supply chain.

There is a further aspect of globalisation, which manifests itself in the social as well as in the economic/business dimensions. Prowess in harnessing the core competencies of globalisation on the part of a number of firms has seen the relative strengthening of countries where knowledge capture and utilisation has been high.

Take two contrasting examples. The emergence of Nokia in Finland has seen (a) the rise of clusters and chains of telecommunications- and IT-related firms as collaborators and suppliers and (b) the establishment of Finnish research institutions as world-class. Similarly the initial rationale for inward investment in electronics and pharmaceuticals in Ireland was access to low labour cost and gaining a foothold in the European Economic Area. This has given rise to the establishment of world-class operations (a) up and down these and other sectors’ supply chains; (b) in international and global logistics companies grown out of traditional transport and freight forwarding firms; and (c) in high-class research and training institutions whose work enhances Ireland Inc as a whole.

Integration and Operational Velocity of Financial Markets

Financial markets have been e-based for a long time and they operate 24 hours a day with a speed that is several times higher than a generation ago. Organisations, irrespective of size, can now cost-effectively manage banking relationships outside the home base. It is no longer an operational necessity for a UK-based company to bank in the UK, other than to have the means of meeting the day-to-day requirements of the business, such as paying suppliers and transacting payroll – though even these activities are getting increasingly decoupled from any country base. I know of several UK companies – some not very large – whose banking is done far from the UK.

Globalisation has affected the financial services sector to a greater extent and more quickly than other sectors. Since the “transfer” of money is very rarely a physical transfer and lends itself to computer-based operations, it is perhaps not surprising that this sector was the first to experience the effects of globalisation. Mergers and acquisitions in the banking sector have been both a driver of globalisation and a response to its anticipated potential.

Capital is a commodity and is tradeable on an arbitrage basis. The problem with this is that, given the much-increased circulation velocity of capital, markets adjust and attempt to clear much more quickly than in the past. This gives rise to a potentially higher level of foreign exchange risk ion the search for optimal foreign exchange cost. This gives us a very significant aspect of globalisation. If a firm can operate a global financing policy, the process of hedging minimises the effects of currency movements. If this is allied to a global sourcing policy, there is a closer balance between costs and revenues and a more even cash flow. Thus, purchasing gradually becomes more strategically significant.

This argument extends to ownership. Though a firm may be incorporated in one country, many are listed on several stock markets. Ownership of capital is thus a discriminator. Whilst it remains hard to find a firm whose stock is majority-owned outside its country of incorporation, the trend is clear. Therefore, even with minimal foreign trade, a company could be regarded as global via its ownership structure.

Diffusion of Computer-based Technologies and Information Systems

The advent of affordable computing power, previously available only to organisations with lots of money and strong cash flow, has helped to level the playing field. The concept of a “leading” company is changing. Large conglomerates are no longer automatically admired for their scale – indeed many are shunned by the increasingly well-informed investment houses. Many of the major breakthroughs are made by small, entrepreneurial companies based in mutually supportive clusters and supply webs.

The basic business question is how to satisfy the demand of customers who have a (now increasing) range of choice. Classically we used to see this as a choice between innovation/differentiation and operational efficiency/cost leadership. Nowadays there is usually no choice: both are necessary. The dimensions of quality and price are no longer a trade-off.

Information has become the “body tissue” of the modern corporation. Whereas previously trade arrangements were concluded substantially on the basis of asymmetrical information, the greater transparency in information has lead, simultaneously with the opening of markets under GATT and WTO, to a situation in which optimisation is easier and it takes no account of geographical boundaries. Though we are still faced with the principles of choice, complexity and incomplete information, the greater diffusion of I.T. has made the downside of this basic aspect of business a lot easier to deal with. Quite simply it makes it easier for companies to see where true value is added. It is my belief that we are seeing the end of the trade-based chain, in which a middleman imports, holds stock and then sells at a mark-up into a computer-based chain in which there are no middlemen but jointly-managed inventory based on integrated and interactive supply-demand systems between prime supplier and final customer. Superimpose this on a production function that operates across national boundaries and the result is much better resource utilisation. This leads us naturally to the concept of the “agile corporation”.

The “Agile” Corporation

As a direct result of the development of affordable computing capacity, a whole new range of organisational forms has become available. From the fixed, asset-based form we are observing more activity completed on the basis of “web” or “network” organisations. These have been termed “virtual” or “extended” companies: the more significant form is the “agile corporation”.

In most manufacturing sectors of the world’s developed economies there is one issue above all others that concentrates the mind of management; the erosion of unit prices and the decline in control of manufacturers over pricing. Each year manufacturers of many industrial products are facing the need to reduce product prices, or offer more features for the same price. Producer prices are, quite simply, eroding throughout the developed world and most notably in economies that have been noted for their manufacturing leadership in the whole of the post-World War 2 period – the USA, UK, Germany, Japan. In response to this phenomenon most manufacturers in the developed world have changed the way in which manufacturing is managed. The first phase of this response was termed “Lean Manufacture”, which was pioneered in Japan.

However even by the late 1980s, when the classic textbooks on lean manufacturing were appearing, the concept was already mature. Lean manufacture may be cost-effective in simple accounting terms: it is, however, somewhat inflexible. Individual lean manufacturing operations respond badly to fluctuations in demand. Therefore a concept of “Agile Manufacturing”, developed initially in the USA for defence-related manufacturing operations, emerged under the support of the United States government in the early 1990s. This concept is one of “stitching together” alliances of lean manufacturing operations. If one operation experiences a sudden surge or drop in demand, it can call on other members of the alliance to provide or accept product from any member of the alliance. For example, if we look at the despatch area of an electronics or consumer durable goods factory we will see product boxed under another manufacturer’s brand name, almost certainly a competitor’s.

Quite simply, agile manufacturing enables participants to undertake effective “operational smoothing” activity. However, it does not guarantee profitability. Manufacturers of television sets have seen profits erode year over year whilst the features of the product at a given price level have increased and product reliability has improved to the point where demand for chargeable after-sales service has fallen. In contrast General Electric has experienced considerable price erosion in its mainstream products and yet has improved profitability consistently, partly as a result of improvements in the basic operations of the company but mainly by selling related high-value services along with the products.

Manufacturing efficiency still matters: nowadays, however, manufacturing is not always the main source of added value in the total supply chain. This value has migrated elsewhere.

Competitiveness Based on Supply Chains

Related to a great extent to the emergence of the agile corporation, we see a major change in the basis of inter-organisational rivalry. Particularly in business-to-business markets we have an increasingly well-informed customer base that is capable of analysing where value is created. The response of many successful suppliers is to base their product on the efficiency of the complete supply system – assigning to each element of the supply process those activities that are logically located there. Where there is value that can be ascribed to the individual set of assets (defined holistically), such activity is performed internally. Where is it appropriate to assign this activity to a different player in the supply chain, the activity can be performed externally. Whether we are in the business of offering a physical or service product, the position is the same.

To take one example, a very high percentage of the final value of the modern Boeing aircraft is outsourced: the comparative advantage of Boeing, its value-add and hence its return on assets derive from its knowledge and skills ranging from basic R&D through engineering design and logistic system management to complex final assembly. Boeing controls but does not undertake fabrication of components and sub-assemblies: these products come from elsewhere. The “elsewhere” is becoming global, and the new core competency in managing sophisticated I.T. systems enables Boeing to control the whole of its supply chain. I have addressed this in more detail elsewhere in a previous “White Paper” for B2B International (Park 2003).

2. The Managerial Dimension of Globalisation

Globalisation brings about changes in the content of the activity we term “management”. The overarching requirements imposed by globalisation are the replacement of procedure-based systems of command and control with a tissue of shared vision and values; an awareness and sensitivity for the commitments other parts of the organisation have made and an acceptance of the role a single part of the company plays in achieving an optimal result for the company as a whole; and a system of empowerment and common, rational performance and reward objectives.

Few organisations, especially in Western Europe and North America, have these managerial characteristics. Fewer accept, even in the face of hard data to the contrary, that effective performance in the global economy includes a radical change in the attitude required for survival let alone competitive success. If you doubt this, just take a look at any UK company of significant size and you will find national sales targets in markets defined on a national basis, national organisations “empowered” (i.e. restricted) to act nationally; reward on the basis of nationally-measured outputs.

Let us assume that the above problems can be overcome. What then will differentiate the global form the national approach?

The starting point is the abandonment of any nationally-based mode of thought and a move towards considering the business domain in which one operates. By “business domain” I mean simply that one defines one’s business as the totality of added value that one can access on the basis of leveraging relevant assets and capabilities – some of which will be owned and others of which will be bought-in or hired-in. Thus there will eventually be no such thing as the “German” or “French” market, but a borderless business domain which will have as its segments not product types or countries but global customers within supply chain structures, each having distinct characteristics. The customer or the supply chain becomes the market segment.

Take the case of telecommunication. The emerging segments are either globalising systems integrators (e.g. Ericsson, Lucent) or globalising telecommunications authorities (eg BT, Deutsche Telecom) which are changing from negotiating nationally to negotiating globally).

How will these single-company segments buy? It will depend on their view of their business domain. Some will source components, some will require complete subsystems, others will require something between. The response will be a mix of product packages that could involve direct product supply from a global product supply function, local or international collaboration with related manufacturers, acquisition of companies up and down the supply chain.

Past management approaches will change. I find it useful at this point to quote Robert Bischof as CEO of the Boss UK Group. What he had to say about the fork-lift truck business is true in most business sectors.

“In global markets stretching from Europe to North America, from the “tiger” economies of South East Asia to Japan, even large companies need strategic alliances and/or further acquisitions to fulfil the conditions of global membership. In marketing terms this means a departure from wholly owned subsidiaries with direct selling organisations in every corner of the world, and instead a network of locally-focused dealerships, licence agreements, co-operation etc.

The biggest change however has to happen in the minds of management and employees of a company going global, and a much larger culture change is necessary than the one from a national to a European player. Globalisation does not just mean global marketing: it also means global sourcing to stay competitive and it means global benchmarking for the best manufacturing locations in the world.”

Let me summarise what all this means in terms of managing a business. There is a process of change which can usefully be looked at in terms of declining and emerging influences on business that illustrate the quite significant change that is now taking place.

| Declining Influence | Emerging Influence |

|---|---|

|

|

The above changes have major implications for the whole of the corporate management field. They influence marketing in a very profound and challenging way. Let us now turn to this dimension.

3. Implications for Marketers and Marketing

Globalisation offers marketers the opportunity of reaching a much wider range of consumers than has been the case in the past. This makes some aspects of marketing easier and others more difficult.

Basic Tools and Techniques of Marketing

In an increasingly integrated business environment the emphasis moves from an individual to a collaborative marketing platform. This is set out in detail in a multitude of academic studies on global management (see esp. Coulson-Thomas 1992). The essence of changes in tools and techniques of market is in the response to national/regional aspects that remain during the processes of transition – different aspects of corporate activity mature and globalise at different rates, and national/regional legal requirements and product standards change very slowly.

This has led to Sony’s concept of “global localisation” and this drives the company’s marketing worldwide. The basics are globalised – core technology, design, branding – and the final product specification, mix, promotion, customer support are undertaken just as if Sony were acting as a national/regional company.

Behaviours are converging, but slowly. The influence of history and culture difference will remain significant. However the impact of the information revolution is such that there is convergence and it is beginning to accelerate. Levi’s are in demand in China as on the USA West Coast and can no longer be portrayed as a manifestation of Western decadence. The basic marketing messages aimed at young, well-informed consumers work in Beijing as in San Francisco: the percentage of localisation will slowly decline over time.

Working out the physical channels to market is not enough: marketers now need to understand the informational channels to market.

Supply-Chain Marketing

Marketing is based increasingly on three interacting supply chains; product/service, information and money. Transfers of information and money are relatively easy, since these are two elements of business that became globalised most easily and most rapidly. The product/service supply chain is more difficult because it is less homogeneous and remains subject to local (mainly cultural) variances. Because of (a) constant migration of value under conditions of competitive supply and (b) decision-making under conditions of asymmetrical information, the scope of the concept of marketing is moving gradually beyond the classical 4Ps (product, price, promotion, place) that have framed the discipline for so long.

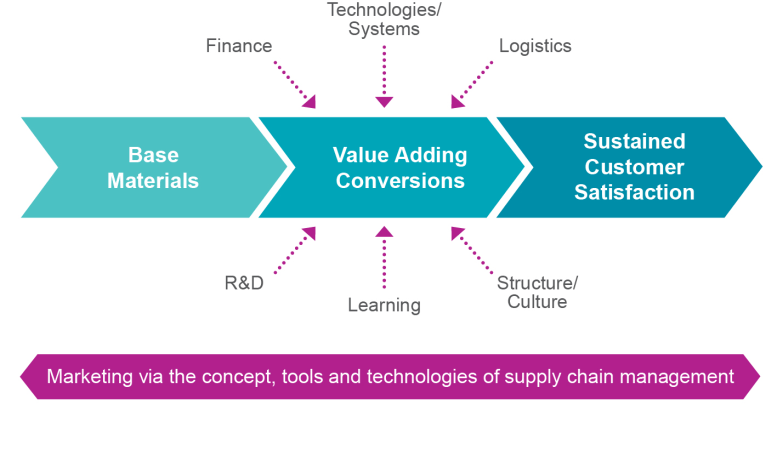

What is happening, quite simply, is that customer value can be derived from any element or combination of elements in the total supply chain, not just on the final product package. Marketing is about identifying (a) where value-adding conversions can take place and (b) how and why customers develop and change their views as to what constitutes value. This takes place against a background of increasingly collaborative relationships rather than the traditional arm’s length dealings. It can be usefully summarised as a holistic and integrated business process, as follows.

When the above concept of the full business process is considered it is not difficult to see how the decoupling of value creation from the country of location of the resources and activities that are restricted to the 4Ps necessitates a redefinition of the activity we term ‘marketing’. Globalisation accentuates this tendency.

Knowledge-Based Marketing

It follows from the two sub-sections above that global marketing is essentially rooted in knowledge acquisition, processing and application. The nature of market research and marketing is changing to take this into account. How we discover what brings a buyer (consumer or business/industrial) to a choice is increasingly complex. It is no longer sufficient to build a brand and promote it on the basis of techniques and propositions that made an impact twenty to thirty years ago in an American/European demand context.

The basis of a brand now involves commonality and consistency of key factors in the product package coupled with local details in final specification that appeal to the experience sought by the target buyer group(s).

Globalisation cannot remove the aspects of the marketing mix that are set to remain internationally heterogeneous. Therefore the question of managing the information supply chain is becoming more critical in marketing as business becomes increasingly global. Asymmetry of information is often the critical factor that gives rise to competitive advantage, at least over the short-term period.

We also bear in mind that “time compression” is a fact of marketing life – in terms of product life-cycle, innovation, time-to-market and other potential order qualifiers and order winners. The quantity and quality of information and the speed and creativity with which such information can be processed are central to 21st-century marketing. Market research is responding to this challenge by developing and refining cost-effective techniques of data mining and data manipulation – increasingly on a global basis.

What we are seeing is a new “currency” of marketing that is part of the essence of globalisation. The true differentiators are increasingly located in “intellectual” rather than “physical” capital. Thus high-value work gets done in locations where access to intellectual capital is most favourable (the high-cost developed world) and manufacturing/assembly gets done where raw materials, physical capital and labour are most favourably accessed (the low-cost developing world). Order winners are found in the former: order qualifiers are shifting increasingly to the latter. It is in the long run pointless to interfere in this rational economic process.

Cohesiveness and Consistency

If globalisation affects organisations, then it varies by function within a business. The final challenge is to maintain cohesiveness and consistency in presenting a company and its offerings to the world.

It is unlikely that markets will converge entirely because of differences in history, sociology, culture, physical and legal environments, and many other micro-aspects. This makes issues such as branding more, not less, important. But the concept and purpose of a brand is changing: it serves only to make a statement about a company’s core values and position. The ability of a customer to reach a “segment of one” (or realistically a “segment of few”) on the basis of a cohesive and consistent marketing platform will be the key to global success.

This is the true nature of Sony’s principle of “global localisation”.

Competencies in the New Market Environment

The new market environment is characterised by significantly greater organisational fluidity. All this gives rise to an additional set of challenges that are faced by business leaders generally, but especially in the marketing function. These translate readily into a comparison of core competences, as follows.

| Former Competence (Declining) | Contemporary Competence (Growing) |

|---|---|

|

|

The move towards globalisation requires marketing (and other) managers to abandon national allegiances and this can be come only when top company management modifies its own views and installs a set of processes and structures that relate to the emerging reality of the business and not to past practice. Globalisation extends choice – on both the supply and demand sides of business relationships. It not only opens up more markets to us, it simultaneously opens our markets to more competitors. This provides a more fluid marketing environment in which an organisation can “hedge” its markets and customers in order to increase returns and reduce risk and uncertainty.

As a response to this “empowerment” is not enough on its own: it must be accompanied by executive development. Periodic organisational reshuffles that find jobs for the existing hierarchy are no longer effective. As we move ahead in the 21st century we must acknowledge more than ever before that structure follows strategy, and this now means delayered, cross-border, multifunctional teams led by senior managers who do not spend their life travelling the world but who communicate electronically and interactively with an extended or “virtual” team.

This is why globalisation can never be about selling in each region of the world. It is why the global company will be distinguished by its capabilities not simply by the number of markets it serves or the number of countries from which it sources its inputs. Globalisation can be uncomfortable for ‘dirigiste’ governments, particularly those that prefer to influence economic forces for the narrow purposes of protectionism in the face of change. Properly managed at inter-governmental level, globalisation will level the playing field to a very significant extent and will change the nature of opportunity and competition. This constitutes the true and emerging essence of globalisation. It will challenge and alter our concepts and practices in marketing and more generally in strategic and operational management.

References

Coulson-Thomas, Colin “Creating the Global Company” London: McGraw Hill 1992. (Coulson-Thomas 1992)

Ohmae, Kenichi “The End of the Nation-State” New York: Simon & Shuster 1995. (Ohmae 1995)

Park, Daniel “Differentiation: Are Product, Brand and Service Still Enough?” B2B International Ltd White Paper, April 2003 (Park 2003)

Stiglitz, Joseph “Globalisation and its Discontents” New York: W W Norton 2002 (Stiglitz 2002)

Dr Daniel Park is an economist, specialising in business strategy and international marketing. He is an Associate of B2B International Ltd. He would like to thank Mike Dunckley, President (Europe and Americas), HBL-NIFE Inc and Paul Hague, Managing Director, B2B International for their critical comments in discussion.