Establishing the value that people put on the goods and services they sell is one of the most difficult tasks for the business-to-business marketer. If they pitch their price too high relative to the perceived benefits, then quite clearly they will lose out to the competition. Equally, if the price is too low, the company is in danger of leaving money on the table for the customer. Of course, a low price may encourage extra demand and the company could increase its market share. This is where pricing strategy research comes in…

Pricing Research Establishes Value – A Job Not Well Done

For most business-to-business marketers, finding the right price is a judgement which many get badly wrong – usually charging too little because they don’t realise the value of their offerings.

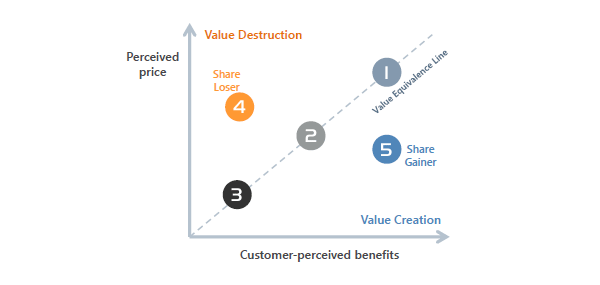

The concept of market equilibrium should, in theory, solve any pricing problems that are way out of line. Products that are priced too high relative to their benefits will lose out (product 4 in the diagram) while those that are attractively priced relative to their benefits gain share (product 5 in the diagram). This is illustrated in Figure 1 below.

A Common Problem – Leaving Money On The Table

However, the theory is very different from practice, and it may take too long for a supplier of goods and services to find out that their prices are out of line. In the main, the problem is not prices that are too high (because this becomes evident very quickly as sales of the product and services begin to stall); the biggest problem is under pricing. In the imperfect markets in which we operate, not all potential customers will be aware that there is a bargain to be had, and the supplier will not benefit from the increase in share that should by rights be his.

An increase in price of 10% can make a huge difference to a supplier’s bottom line, possibly doubling profits if the price increase is accompanied by only a small loss of customers. But this is the big question – what will be the loss of custom?

The reality is that in many business-to-business markets customers are extremely loyal to their suppliers. In part this is because buyers believe it is safer to stay with the devil they know. They fear moving for a small price advantage, reckoning that it isn’t worth incurring the problems associated with obtaining new supplier approvals or risking the new supplier putting up their prices in a few months’ time.

It may appear to be a clever move to extract more profit by simply putting up prices and pocketing the proceeds but this is crude marketing. If prices rise, buyers would hope that there is a commensurate improvement in the benefits. This makes it doubly important that we understand the value attached to the different elements of the offering so that these can be adjusted to make a more attractive proposition to the customer. Essentially, proper pricing research gives justification for any price hike.

Reminding Customers Of The Benefits They Receive

Let us think for a minute how customers value the goods and services that they buy. Too few companies remind their customers about the benefits of the products they purchase. If they promote anything it is typically the features, and customers are left to work out the benefits for themselves. This was brought home in a recent story told by a sales manager of a packaging material supplier. The sales manager was due to attend an annual review with a large customer and he sought the advice of the account salesman before making the visit. The salesman was extremely worried about the meeting, fearing they would lose the account as he had been told by the buyer that a price reduction was necessary if the company wanted to keep the account. The buyer threatened that there were many eager competitors baying at his door. The salesman could not think of any good reason for maintaining their current prices, let alone obtaining an increase.

On the day of reckoning the buyer met the sales team from the packaging materials company and walked them through the factory to his office. On their way, the sales manager of the packaging materials company made polite conversation, asking about a new production line which they walked past. It materialised that the new production line had been built in what used to be a warehouse for storing cardboard boxes which the packaging materials company supplied. Just-in-time deliveries from the packaging company had released this storage space which was now being put to more productive use. The sales manager was not slow in raising this issue in his presentation, pointing out that the reliable and speedy deliveries created valuable factory space. Without this simple reminder the buyer would have taken the benefit for granted, possibly not even thinking about it or giving the credit to the supplier. The packaging materials company was at least able to maintain their prices and was not forced into giving any further discounts. This short story illustrates the importance of constant vigilance in looking for benefits that are given to customers and attempting to put a monetary value on them.

Assessing The Value Of Benefits With A Simple Points Spend

Leaving the assessment of customer value to the sales team is risky and it may be safer to ask the help of market researchers to identify and measure the elements of a customer value proposition. A very simple approach is to present the buyer with a list of the benefits and ask him to indicate their relative importance by spending a number of points according to which are most valued. The points-spend gives a rough indication of how buyers see value in the products and services they buy.

This method of questioning has a number of limitations. When posed over the telephone it is difficult for a respondent to remember more than half-a-dozen issues, so the opportunity of exploring value benefits in detail is restricted. Furthermore, the idea of spending points in this way is not how most buyers make their decisions. They tend to think ‘in the round’ rather than putting a value on the different elements of the offering. In order to obtain a more detailed understanding of how people value the products and services, we have to turn to more sophisticated techniques.

Conjoint Analysis – The Appliance Of Science To Valuing Benefits

Conjoint analysis is a long-established technique used by market researchers for assessing the value of different elements of an offering. There are different types of conjoint analysis but, in essence, this is a trade-off model in which respondents compare different offerings and choose between them.

Imagine that we wanted to identify the value attached to different features of an envelope. The envelope could be brown or white, it could have a window or a plain front, and it could have a self-seal or a lick-seal flap. These different features present eight possible combinations which could be presented to a respondent to find out which they prefer.

| Concept | Method of sealing | Address facility | Colour |

|---|---|---|---|

| 1 | Self-seal | Window | White |

| 2 | Self-seal | Window | Brown |

| 3 | Self-seal | No window | White |

| 4 | Self-seal | No window | Brown |

| 5 | Glue | Window | White |

| 6 | Glue | Window | Brown |

| 7 | Glue | No window | White |

| 8 | Glue | No window | Brown |

In order to make a true judgment on which offerings they prefer, each should be given a price and it would be good to test people’s interest at different price levels – say one high price, one medium and one low. Applying three different levels of pricing to the eight combinations of product features gives a possible 24 options to put before respondents. These 24 options are called concepts, and in conjoint interviewing they are presented to respondents who are asked which they would be most likely to buy. The software that is used in the analysis calculates the values which are attributed to the different features of the envelope even though this was not specifically asked outright.

Conjoint analysis is potentially a useful tool for establishing how buyers value their products and services, but it has its limitations in business-to-business markets. It works best when the features of an offering are distinct and simple – as in the case of the envelope. In business-to-business markets, features of offerings are often less distinct as they include factors such as the knowledge of the salesperson, technical service or the reliability of delivery. Indeed, it is often difficult in b-to-b products and services to narrow the key features of the offering down to the eight permutations as was possible with the envelope example. Half-a-dozen features and three or four options for each, all with different pricing possibilities, gives thousands of possible concepts for respondents to consider. Statisticians can reduce this to a more manageable number but, in so doing, it can affect the accuracy of the result.

Even with relatively simple conjoint concepts it is necessary to interview a minimum of 200 respondents in order to obtain an accurate result, and most statisticians would look for at least twice this number. Conjoint analysis is not, therefore, without its problems for the business-to-business researcher undertaking pricing research.

SIMALTO Analysis – A Better Way To Assess Value For Business Researchers

An alternative to conjoint analysis, and more suited to business-to-business situations, is SIMALTO analysis. SIMALTO is an acronym for simultaneous multi-attribute level trade-off – a mouthful for the subconscious way the buying decisions are made. Presented with an offering, our brains look at the many features and attributes, weigh up how much we value each of them, and comes to an overall view on our likelihood to buy.

In SIMALTO analysis a list is made of the many attributes which are considered in an offering. This can include product features as well as service and delivery features. For each of these attributes different levels are described, showing basic levels to the left and improved and better levels to the right. These are put into a grid as shown in Figure 2 below.

The first task for respondents in SIMALTO interviewing is to choose which of the attributes (down the left-hand side of the grid) are important when making a purchasing decision. Respondents are then asked, for each of these chosen attributes, what level they are currently receiving (columns 1 to 4). Next they are asked what level they would like to receive; usually this is towards the right-hand side of the grid. The final part of the interview is to give respondents a number of points to spend to indicate how much they would like to receive the improvement that would move them from what they currently receive to their ideal. The grid has numbers in the bottom of each square from 0 to 15 which indicate the ‘cost’ of moving up a level. Each movement up a level costs the respondent 5 points. With only limited points to spend, respondents have to choose what improvements they really want. This trade-off gives a utility or value to the different levels of the attributes.

SIMALTO analysis has the benefit of being more appropriate for business-to-business marketers undertaking pricing strategy research where there are likely to be lots of attributes to consider – too many for conjoint to handle. Furthermore, SIMALTO is not as dependent on a large sample size as is conjoint. Indeed, the findings from just one respondent (for example, if it were a large and important customer) would be highly informative. Being able to work with small samples is a major advantage of SIMALTO in b-to-b markets.

Conclusion

This paper began by making the claim that most business-to-business products and services have a price tag which is based on judgement. Too often there is no objective assessment of how customers value the different components of the offering. As a result, many b-to-b companies undervalue the products and services that they sell and fail to capture sufficient value in their prices and their profits. It is the responsibility of the marketing team to understand how the offering is valued, and this paper has shown how this can be achieved through pricing strategy research, either by simple imaginative questions or by more complex techniques such as conjoint and SIMALTO. Unless the product is very simple, it is likely that SIMALTO will be the best option for investigating value in business-to-business situations.